P10 trades at $9.83 and has moved in lockstep with the market. Its shares have returned 9.1% over the last six months while the S&P 500 has gained 13.6%.

Is there a buying opportunity in P10, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free for active Edge members.

Why Is P10 Not Exciting?

We're cautious about P10. Here are two reasons there are better opportunities than PX and a stock we'd rather own.

1. Recent EPS Growth Below Our Standards

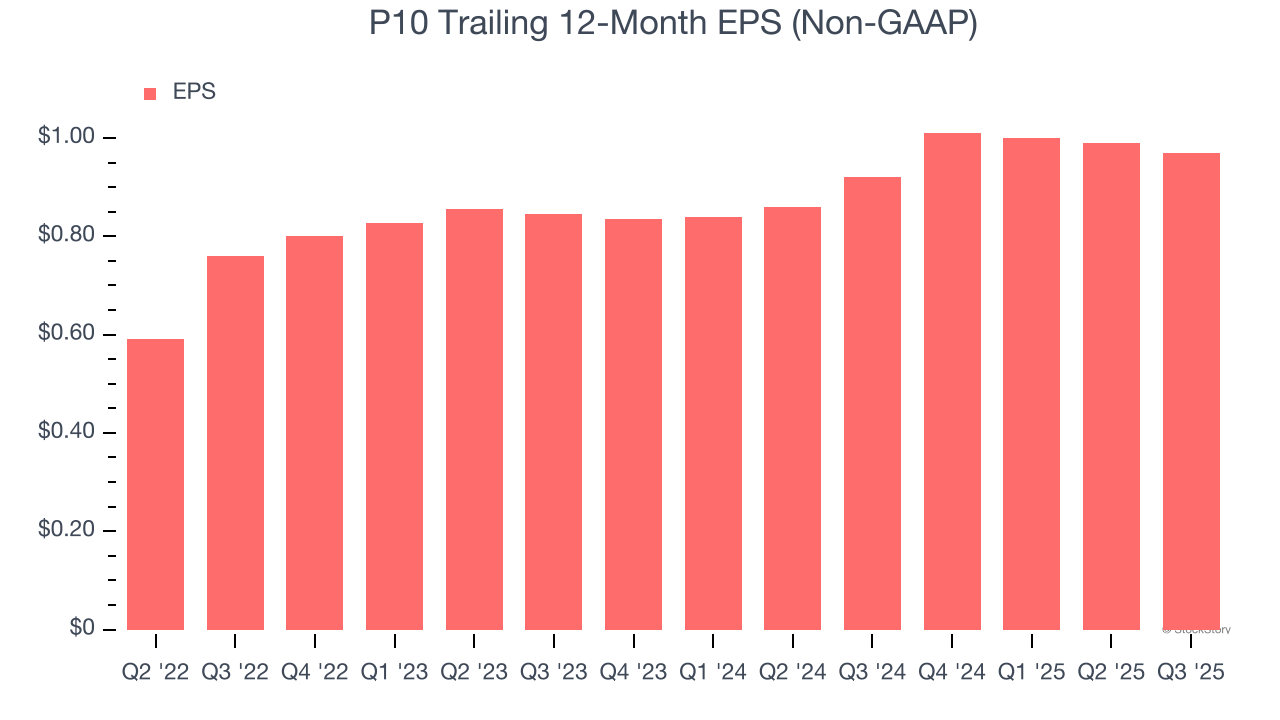

Although long-term earnings trends give us the big picture, we like to analyze EPS over a shorter period to see if we are missing a change in the business.

P10’s EPS grew at an unimpressive 7.1% compounded annual growth rate over the last two years, lower than its 12.8% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

2. Previous Growth Initiatives Haven’t Impressed

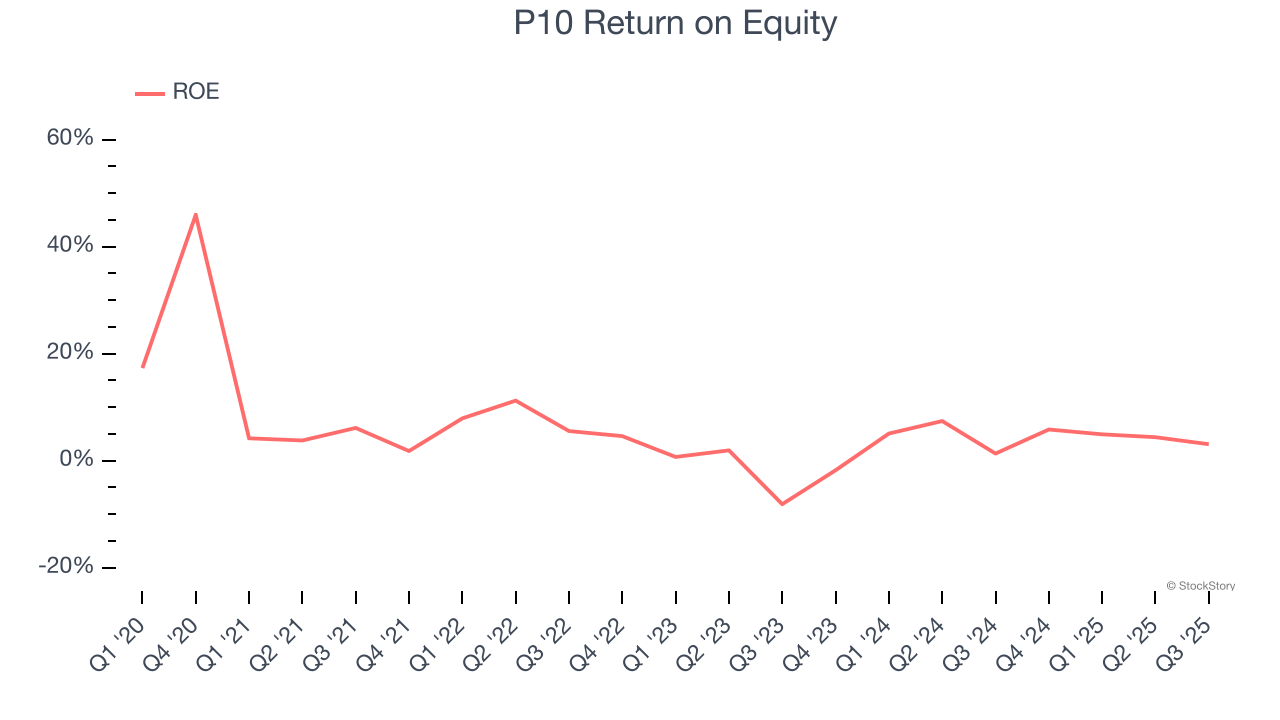

Return on equity, or ROE, tells us how much profit a company generates for each dollar of shareholder equity, a key funding source for banks. Over a long period, banks with high ROE tend to compound shareholder wealth faster through retained earnings, buybacks, and dividends.

Over the last five years, P10 has averaged an ROE of 5.8%, uninspiring for a company operating in a sector where the average shakes out around 10%.

Final Judgment

P10 isn’t a terrible business, but it isn’t one of our picks. That said, the stock currently trades at 9.8× forward P/E (or $9.83 per share). While this valuation is optically cheap, the potential downside is big given its shaky fundamentals. We're fairly confident there are better stocks to buy right now. Let us point you toward the Amazon and PayPal of Latin America.

High-Quality Stocks for All Market Conditions

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.