Since June 2025, FirstSun Capital Bancorp has been in a holding pattern, posting a small loss of 0.7% while floating around $34.65. The stock also fell short of the S&P 500’s 14.4% gain during that period.

Is there a buying opportunity in FirstSun Capital Bancorp, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free for active Edge members.

Why Is FirstSun Capital Bancorp Not Exciting?

We're sitting this one out for now. Here are three reasons we avoid FSUN and a stock we'd rather own.

1. Long-Term Revenue Growth Disappoints

From lending activities to service fees, most banks build their revenue model around two income sources. Interest rate spreads between loans and deposits create the first stream, with the second coming from charges on everything from basic bank accounts to complex investment banking transactions.

Regrettably, FirstSun Capital Bancorp’s revenue grew at a mediocre 9.9% compounded annual growth rate over the last five years. This was below our standard for the banking sector.

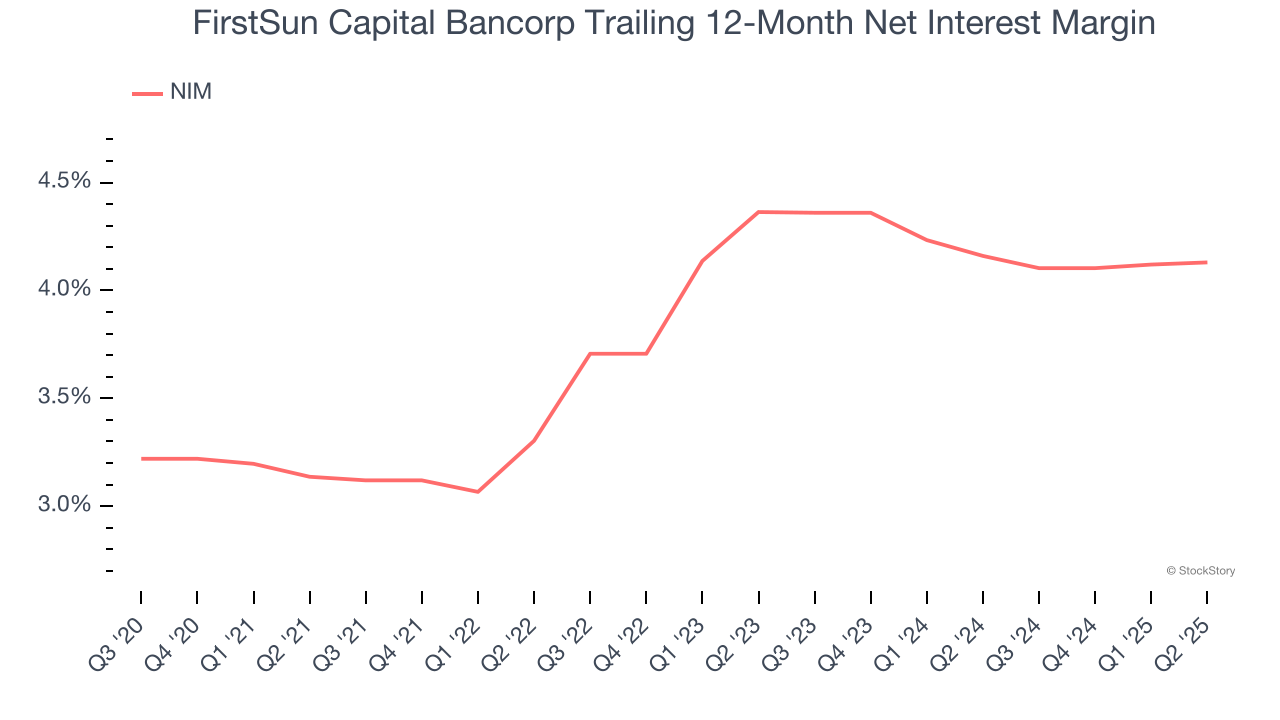

2. Net Interest Margin Dropping

Net interest margin (NIM) represents how much a bank earns in relation to its outstanding loans. It's one of the most important metrics to track because it shows how a bank's loans are performing and whether it has the ability to command higher premiums for its services.

Over the past two years, FirstSun Capital Bancorp’s net interest margin averaged 4.1%. However, its margin contracted by 23.3 basis points (100 basis points = 1 percentage point) over that period.

This decline was a headwind for its net interest income. While prevailing rates are a major determinant of net interest margin changes over time, the decline could mean FirstSun Capital Bancorp either faced competition for loans and deposits or experienced a negative mix shift in its balance sheet composition.

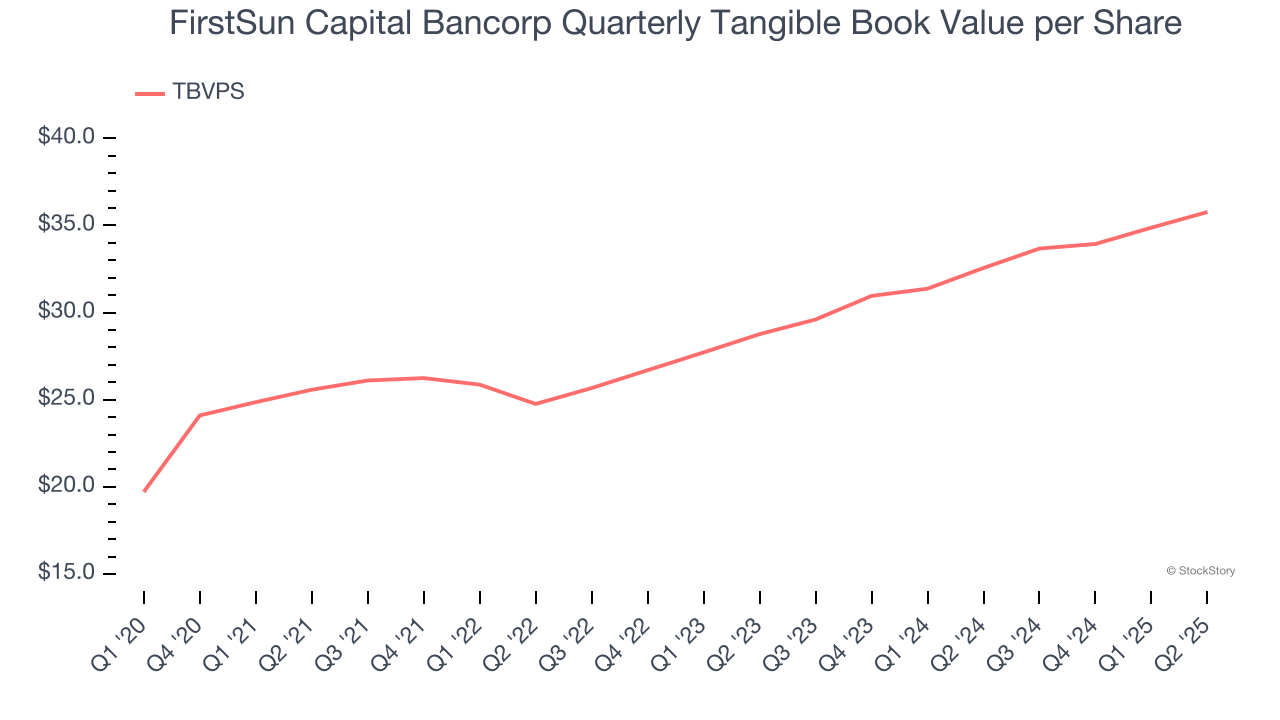

3. TBVPS Projections Show Stormy Skies Ahead

Tangible book value per share (TBVPS) growth comes from a bank’s ability to profitably lend while maintaining prudent risk management and efficient operations.

Over the next 12 months, Consensus estimates call for FirstSun Capital Bancorp’s TBVPS to shrink by 2.9% to $34.73, a sour projection.

Final Judgment

FirstSun Capital Bancorp isn’t a terrible business, but it doesn’t pass our bar. With its shares trailing the market in recent months, the stock trades at 0.8× forward P/B (or $34.65 per share). While this valuation is fair, the upside isn’t great compared to the potential downside. We're fairly confident there are better investments elsewhere. Let us point you toward a top digital advertising platform riding the creator economy.

Stocks We Like More Than FirstSun Capital Bancorp

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.