Investors have been swamped with headlines comparing today’s market, particularly the artificial intelligence (AI) trade, to dot-com days. “Big Short” investor Michael Burry has also joined the “AI bubble” chorus, launching his Substack after deregistering Scion Asset Management. While comparing Nvidia’s (NVDA) price action over the last three years to that of Cisco (CSCO) in the late 1990s has been a pastime for many, the latest comparison has come in terms of dividend yield, with the S&P 500 Index’s ($SPX) dividend yield falling to lows last seen during the dot-com days.

To be sure, such comparisons are not totally out of place, and the frenzy toward AI is comparable to what we saw toward internet companies in the late 90s. There, however, is little denying that AI looks set to redefine numerous industries, just as the internet did. Another reality is that while the internet turned out to be perhaps bigger than what most thought, many companies of the dot-com era either went out of business or, as in the case of Intel (INTC) and Cisco, still trade below their all-time highs.

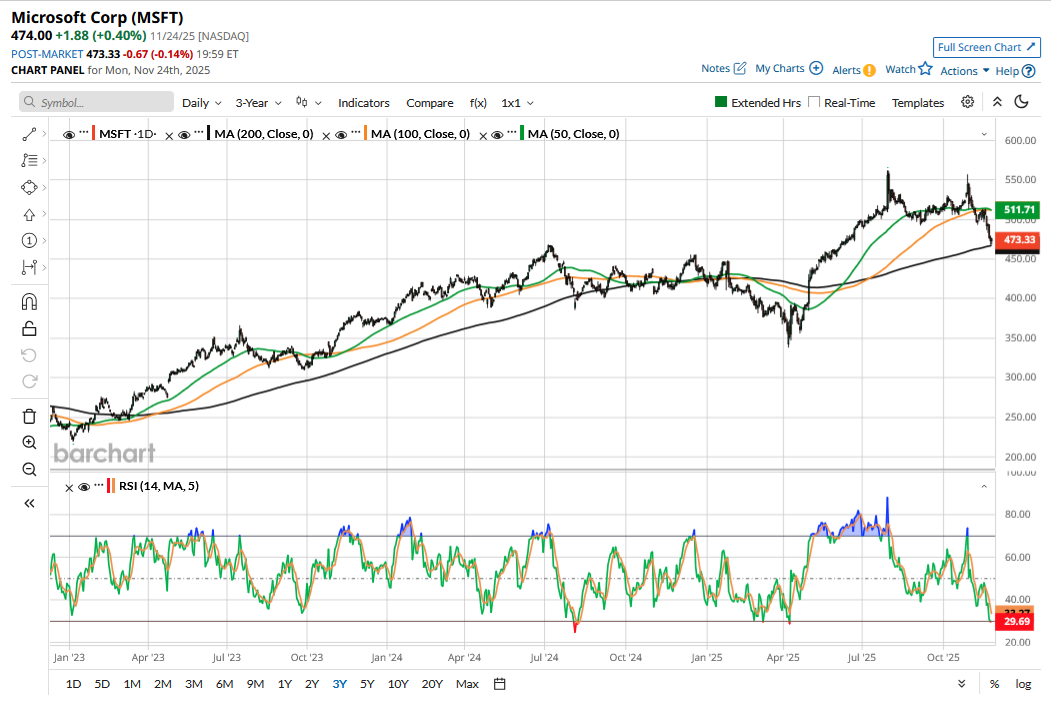

But several companies not only survived the dot-com bust, but thrived. Microsoft (MSFT), for instance, surpassed its 1999 peak in 2015 and has briefly jostled for the position of the world’s most valuable company. However, after a strong first half, Microsoft shares have looked weak and are down over 7% in the last three months, while the drawdown from the 2025 peak is just over 16%.

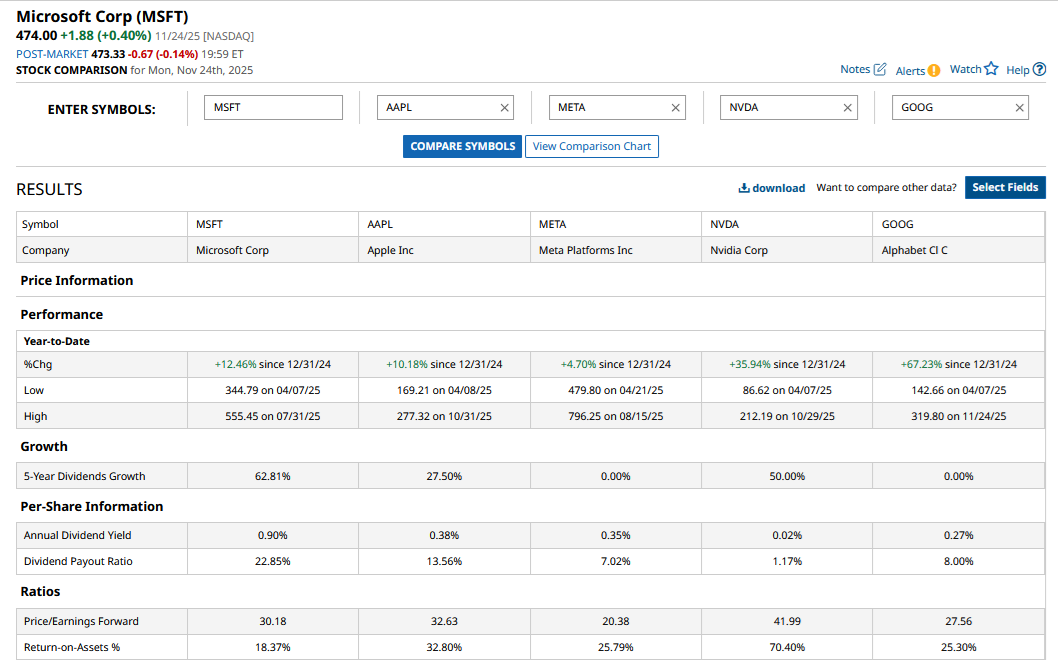

Microsoft’s Dividend Yield Is the Highest Among Magnificent 7 Peers

Microsoft’s dividend yield currently stands at 0.77%, which, although below historical averages, is the highest among its “Magnificent 7” peers. Notably, MSFT shouldn’t be singled out for having a dividend yield below historical averages, as the S&P 500’s dividend yield has also fallen and is inching toward 1%.

Here, it is worth noting that dividend yield is a function of both the dividend and the stock price. While Microsoft is on the verge of becoming a Dividend Aristocrat after raising its dividend every year since initiation in 2003, the growth in stock price has more than outpaced dividend growth, pulling down the yield.

That said, I find Microsoft stock to be a good buy after the recent underperformance, with its relatively healthy dividend yield compared to Big Tech peers being a cherry on top.

Why Has Microsoft Stock Dropped?

Before analyzing Microsoft’s outlook, let’s examine why the stock has come off its highs after closing at a record ahead of its fiscal Q1 2026 earnings release last month. The stock fell after that report despite a beat on both the top line and the bottom line as the company said that it expects the growth in the current fiscal year’s capex to be higher than the previous one.

Previously, Microsoft had said that it expects fiscal 2026 capex growth to be below fiscal 2025, and the company even rationalized its AI spending by canceling some data center leases. While rising AI capex is music to the ear of Nvidia investors, as much of it will land in the company’s coffers, investors in hyperscalers like Microsoft are fretting over the spending spree, questioning whether companies will be able to make enough return on these investments.

Notably, Microsoft is the biggest external investor in OpenAI, and in the most recent quarter, it booked a net loss of $3.1 billion as its share of losses in the company. The losses are taking a toll on Microsoft’s bottom line even as the investment has grown 10x, thanks to OpenAI’s soaring valuations.

MSFT Stock Looks Like a Buy

Apart from AI bubble fears, I don’t find anything particularly wrong with Microsoft’s business. The company’s revenue streams are quite diversified and spread across the core Windows and Office franchises, premium subscription products, advertising, cloud, gaming, and LinkedIn. I find it a good buy for 2026, as the company is literally firing on all cylinders. While strong demand for AI PCs is aiding Microsoft's Windows and Office business, AI is fueling demand for subscription and cloud business. The cloud business is particularly growing at a brisk pace, and Microsoft is closing the gap with market leader Amazon (AMZN).

I have been skeptical about Microsoft’s valuations in the past, but at these levels I find it attractive, as while the recent fall in MSFT’s stock has bumped up its dividend yield, its valuations have taken a beating, with the forward price-earnings (P/E) multiple falling to just under 30x. The multiples look reasonable to me, considering where the broader market valuations stand and Microsoft’s historical multiples over the last few years. Moreover, tech companies’ valuation multiples would look ugly over the next few quarters as the aggressive AI capex would eat into profits in the form of higher depreciation. Overall, I am betting on Microsoft stock and have added to my existing positions amid the market selloff.

On the date of publication, Mohit Oberoi had a position in: MSFT , AMZN , NVDA . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart