As the overall market trades near the high end of its 52-week range, various sectors, including the financial sector, have followed suit. To take it one step further, one stock in particular, within the financial sector, is trading at the high end of its 50-day range and looks poised for further upside.

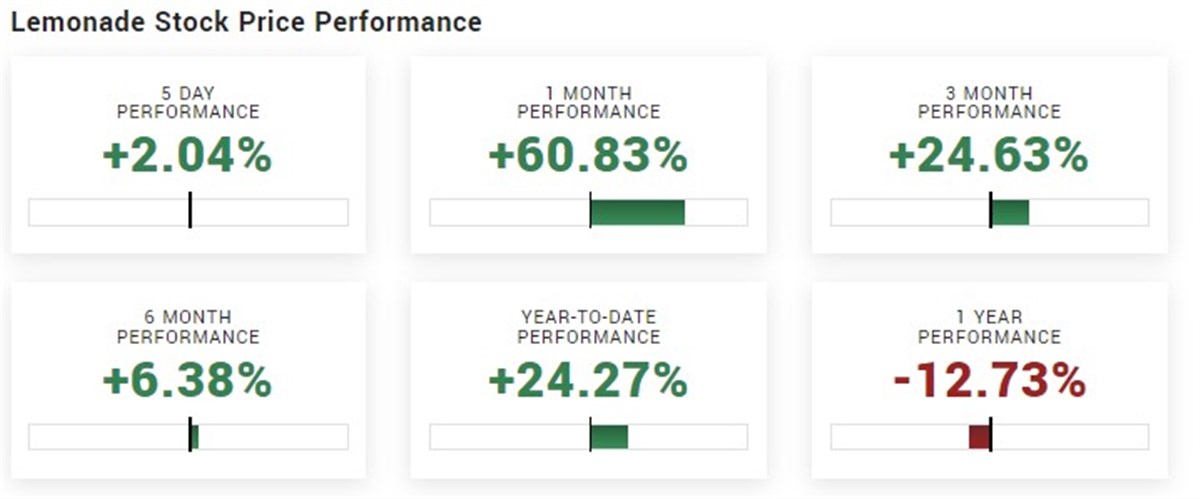

Lemonade (NYSE: LMND), the small-cap insurance provider, saw its share price rocket higher after the company announced its results for the third quarter on November 1. Over the past month, shares of Lemonade have soared over 60%.

Since reporting earnings just over three weeks ago, the stock has steadily consolidated near the high of its earnings move. And over the past week, the stock has seen its range contract and volume, signaling that a breakout might be nearing.

With the attractive bullish chart formation, LMND possesses an above-average short interest and bearish sentiment among analysts. All of these make the current setup in LMND unique and attractive for the bulls.

What is Lemonade (NYSE: LMND)?

Lemonade is an insurance provider operating in the United States and Europe. The company offers various insurance products such as property, personal liability, renters, homeowners, car, pet, and life insurance. Additionally, it provides landlord insurance policies and acts as an agent for other insurance companies.

Lemonade has consistently exceeded sales expectations set by analysts in recent years, showcasing steady revenue growth each quarter. Despite this upward trend in revenue, the company has yet to achieve a quarterly profit.

In its latest earnings report released on November 1, Lemonade reported an earnings per share (EPS) of ($0.88) for the quarter, surpassing the consensus estimate of ($0.93) by $0.05. The company generated $114.50 million in revenue during this period, outperforming the anticipated $104.52 million. This marks a significant 54.7% increase in revenue compared to the previous year.

Could the bearish sentiment fuel an up move?

As has often been the case in recent years, the overwhelming bearish sentiment fueled by a high short interest and negative analyst sentiment might be the catalyst for significant upside.

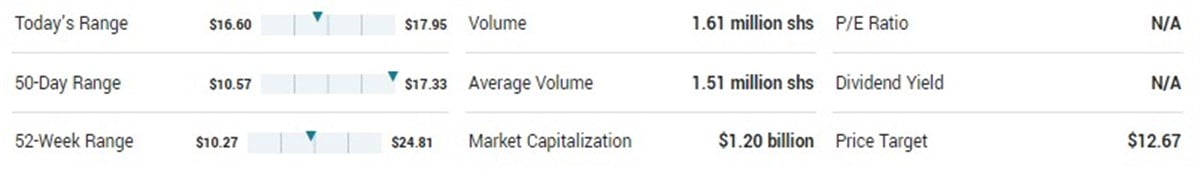

Analysts are far from bullish on the stock with a price target that predicts over 26% over downsite. LMND has a Sell rating based on five analyst ratings, with three ratings a Sell and two a Hold.

Additionally, many participants believe the stock is overvalued based on the abnormally sizeable short interest. The stock has 16.6 million shares sold short, or a 31.67% short interest. As the stock is trading near a potential breakout level, that short interest might work in the favor of the bulls.

The setup in LMND

As the stock forms a bullish wedge pattern, attention is drawn to the pivotal $18 level, a critical point for a potential breakout. Should the stock successfully trade above this level with a notable increase in trading volume, it could confirm a breakout and signal likely upward momentum. The substantial short interest in the stock might amplify this upward momentum should short sellers start closing their positions.