The artificial intelligence chip market is projected to reach $92.74 billion in 2025, with an estimated 29.11% compound annual growth rate through 2030 as demand for powerful computing permeates many sectors.

That growth path helps to explain why chipmakers that power AI workloads now sit at the center of many tech investment stories, with the broader AI market expected to surpass $254 billion in 2025 and head toward $1.68 trillion by 2031.

Nvidia (NVDA) reported fiscal third‑quarter earnings on Nov. 19, which seemed to back up every bullish view on AI infrastructure. Despite this, shares are down more than 13% over the past five trading days.

The picture became even more unusual when Wedbush analyst Dan Ives kept a very positive stance on the name, calling the quarter exceptional and comparing this phase to 1996, the early internet buildout, rather than 1999, the bubble peak before the dot‑com crash. So if Nvidia just delivered what analysts are calling a “mic drop” performance with demand for its AI chips showing no signs of slowing, why did investors send the stock lower, and what should be done with NVDA now? Let’s take a closer look.

Inside Nvidia’s Latest Numbers

Nvidia is, at its core, a chip designer that focuses on high‑performance GPUs, systems, and software used in data centers, AI workloads, gaming, and professional visualization, while running a fabless model and leaning on deep manufacturing and ecosystem partnerships to scale.

Over the past 52 weeks, NVDA has gained about 30%, and year-to-date (YTD), it is up 31%. This strong move helps explain why even a “mic drop” earnings report can lead to investors taking profits instead of pushing the stock straight higher.

Also, that strength is evident in the stock pricing. Shares trade at a forward price-earnings ratio of 41.99x, compared with roughly 22.46x for the broader technology sector. Consequently, investors are paying close to twice the sector multiple for Nvidia’s growth and cash‑generation profile.

The latest financial report offers an explanation. Nvidia posted record quarterly revenue of $57.0 billion dollars for Q3 ending Oct. 26, up 22% from the prior quarter and 62% from a year earlier, with data center revenue alone reaching a record $51.2 billion, up 25% quarter-over-quarter (QOQ) and 66% year-over-year (YOY), which shows how central AI infrastructure has become to the business. GAAP and non‑GAAP gross margins were 73.4% and 73.6%, pointing to sturdy pricing power and operating leverage, while GAAP and non‑GAAP earnings-per-diluted-share were both $1.30, turning that revenue growth into equally solid profit growth.

Why Nvidia’s AI Story Still Compels

AWS and HUMAIN’s expanded deal around Nvidia AI infrastructure clearly signals that the “mic drop” quarter is built on long‑term demand, not short‑lived excitement. They plan to deploy and run up to 150,000 AI accelerators in a dedicated “AI Zone” in Riyadh, with AWS as HUMAIN’s preferred AI partner and Nvidia GB300 infrastructure running alongside AWS Trainium chips for large‑scale training and inference. The aim is to let customers move from idea to live deployment on Nvidia infrastructure and AI software that sit tightly inside AWS services, putting Nvidia at the center of a global AI cloud setup.

On the enterprise side, Dell Technologies (DELL) is pushing its “Dell AI Factory with NVIDIA” offering, building Nvidia into storage (ObjectScale, PowerScale), networking, servers, and automation so full‑stack AI projects are easier to deploy and manage. Its broader automation tools and professional services pull Nvidia acceleration into a ready‑to‑use package for traditional, generative, and agentic AI workloads, giving CIOs a practical way to prepare data centers for heavier compute needs.

Digital Realty (DLR) provides the physical backbone. It is working with Nvidia on next‑generation AI infrastructure at its Manassas, Virginia campus, home to Nvidia’s AI Factory Research Center. There, both companies are developing Omniverse DSX blueprints for AI factories and digital twins of gigascale sites, while testing advanced liquid cooling, power management, and energy‑efficiency methods that make very dense Nvidia deployments easier to run and maintain at scale.

How Wall Street Sees the Next Act for NVDA

For the fourth quarter of fiscal 2026, the company is guiding for revenue of $65.0 billion, plus or minus 2%, with GAAP and non‑GAAP gross margins of 74.8% and 75.0%, respectively, plus or minus 50 basis points. For the current quarter, consensus sits at $1.42 versus $0.85 a year ago, implying year‑over‑year (YOY) growth of about 67.06%, while the next quarter (04/2026) is pegged at $1.48 versus $0.77, or roughly 92.21% growth.

The single‑name commentary from big brokerages points in the same direction. Susquehanna lifted its price target from $210 to $230 ahead of the Nov. 19 report, highlighting expectations that the GB300 chip will ramp strongly in the second half of fiscal 2026 and arguing that Nvidia has “one of the largest opportunity sets ahead.” Loop Capital went even further, setting what was then a Street‑high $350 target, which implies an $8.5 trillion market cap, built on strong expected demand for the company’s GB200 NVL72 racks over the next 12 to 15 months.

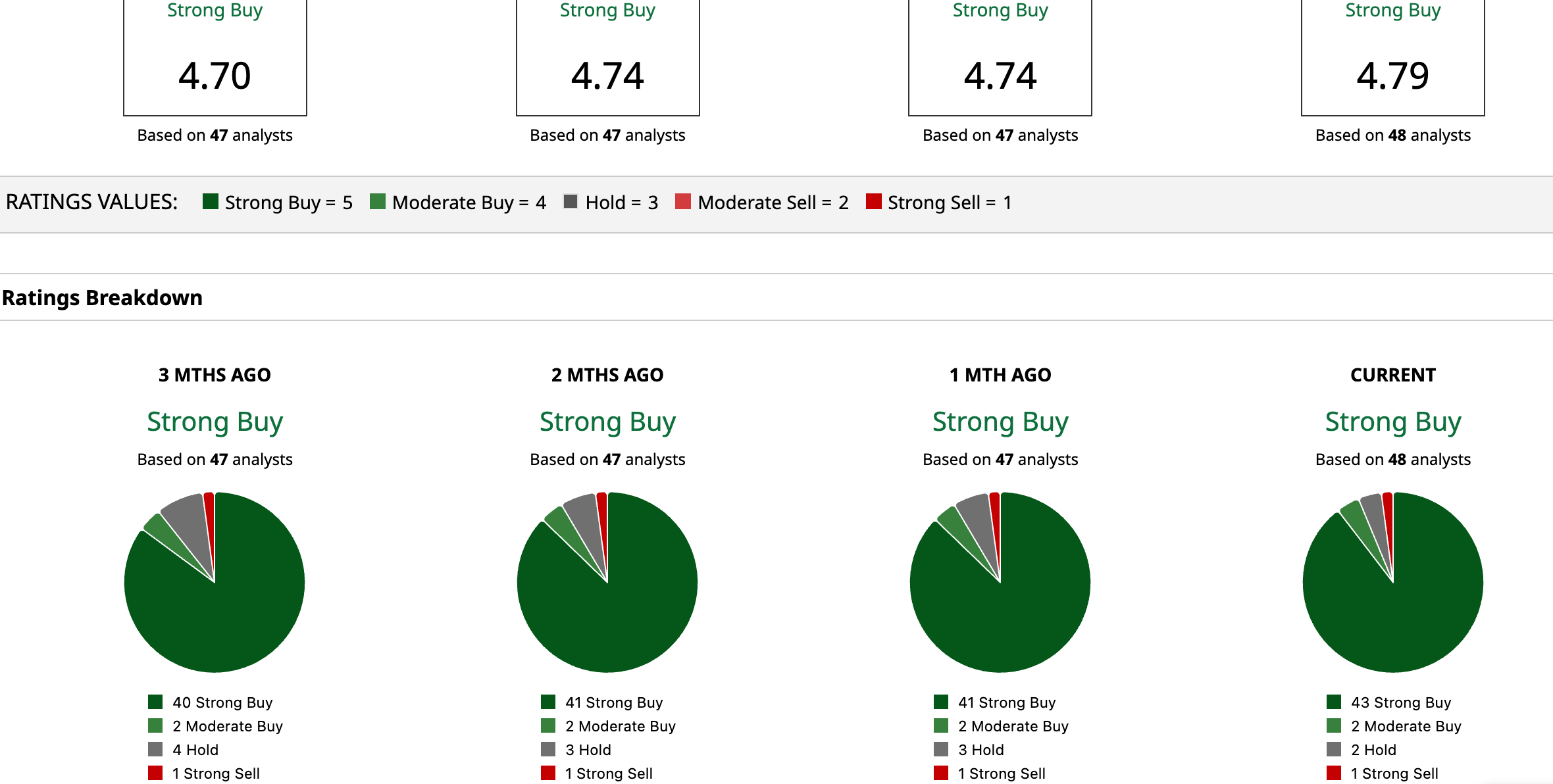

Stepping back, the broader analyst view is just as strong. Of 48 analysts surveyed, 43 rate the stock a consensus “Strong Buy,” two as a “Moderate Buy,” two with “Hold,” and only one as a “Strong Sell,” with an average price target of $252.91. Compared with the current price, that works out to roughly 45% upside.

Conclusion

For all the drama around the post‑earnings selloff, Nvidia still looks like a name you buy on weakness, not bail on. The fundamentals, pipeline, and multi‑year AI capex tied to GB200 and GB300 point-to-earnings power that can grow into a rich multiple, and a 45% implied upside to consensus targets suggest the Street agrees. In the near term, the stock probably chops higher with plenty of volatility as positioning and macro jitters wash through. But over the next 12-24 months, the risk/reward still skews toward materially higher prices for investors who can sit through the noise.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Down 66% From Its All-Time High, Should You Buy the Dip in Bullish Stock? Cathie Wood Is.

- As Microsoft Partners Up with Nvidia and Anthropic, Should You Buy, Sell, or Hold MSFT Stock?

- Nvidia Stock Is Selling Off on Google-Meta Deal. Should You Buy the NVDA Dip Today?

- Nvidia Just ‘Dropped the Mic’ But Its Stock Dropped Too. How Should You Play NVDA Here?