Since June 2024, Sonos has been in a holding pattern, posting a small return of 2.1% while floating around $14.81. The stock also fell short of the S&P 500’s 9.9% gain during that period.

Is there a buying opportunity in Sonos, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.We're sitting this one out for now. Here are three reasons why SONO doesn't excite us and a stock we'd rather own.

Why Do We Think Sonos Will Underperform?

A pioneer in connected home audio systems, Sonos (NASDAQ:SONO) offers a range of premium wireless speakers and sound systems.

1. Long-Term Revenue Growth Disappoints

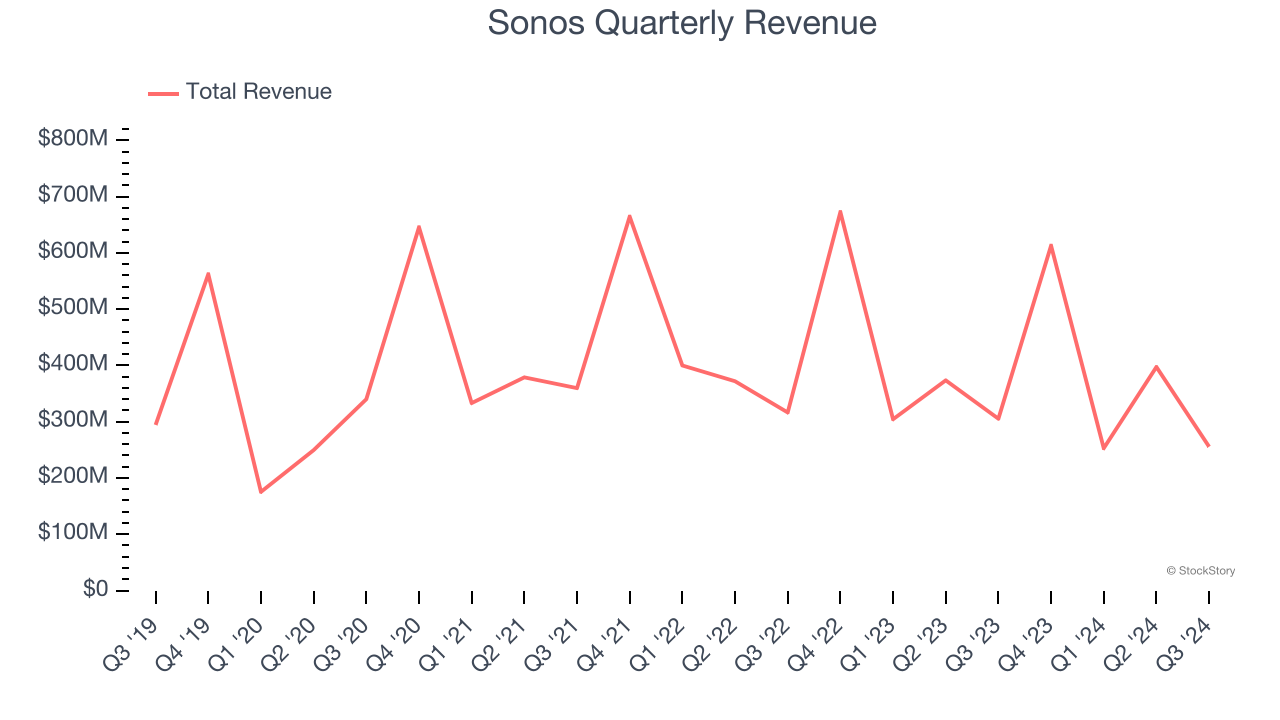

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Sonos grew its sales at a sluggish 3.8% compounded annual growth rate. This was below our standard for the consumer discretionary sector.

2. Operating Losses Sound the Alarms

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Sonos’s operating margin has shrunk over the last 12 months and averaged negative 2.2% over the last two years. Unprofitable consumer discretionary companies with falling margins deserve extra scrutiny because they’re spending loads of money to stay relevant, an unsustainable practice.

3. Revenue Projections Show Stormy Skies Ahead

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Sonos’s revenue to drop by 5.1%. Although this projection is better than its two-year trend, it's tough to feel optimistic about a company facing demand difficulties.

Final Judgment

We cheer for all companies serving everyday consumers, but in the case of Sonos, we’ll be cheering from the sidelines. With its shares underperforming the market lately, the stock trades at 26.2× forward price-to-earnings (or $14.81 per share). This valuation tells us a lot of optimism is priced in - we think there are better opportunities elsewhere. We’d suggest looking at The Trade Desk, the nucleus of digital advertising.

Stocks We Would Buy Instead of Sonos

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.