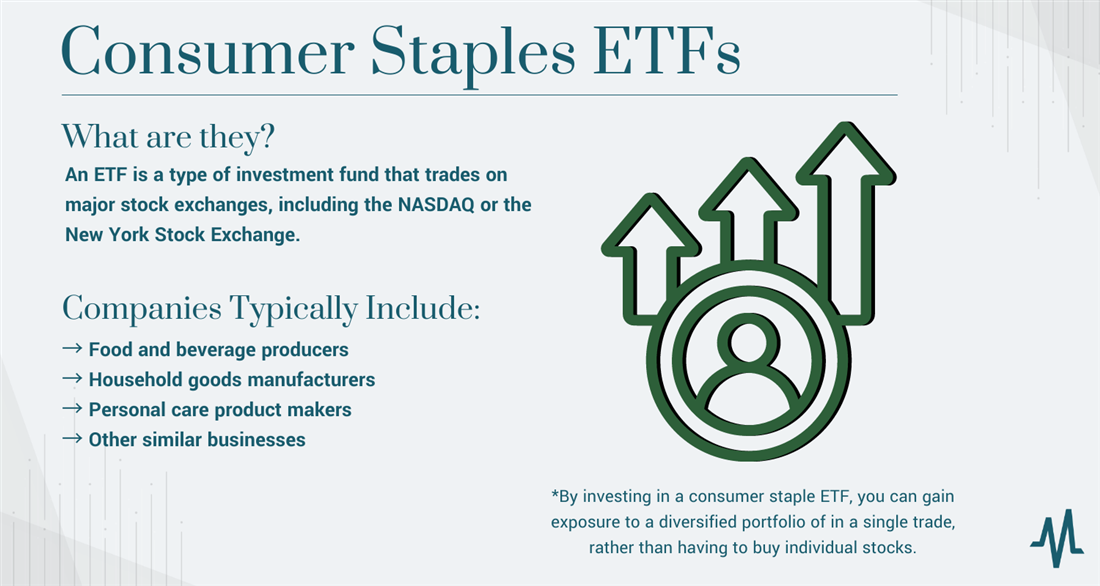

A consumer staple ETF (exchange-traded fund) is an investment fund that tracks a series of stocks in companies that produce essential goods and services. The definition of a "consumer staple" usually includes products that consumers typically purchase regardless of economic conditions. Companies that produce consumer staples are usually relatively stable, as their products are in constant demand. This may make an ETF for consumer staples an attractive investment during economic uncertainty.

Consumer staples companies typically include:

- Food and beverage producers

- Household goods manufacturers

- Personal care product makers

- Other similar businesses

By investing in a consumer staple ETF, you can gain exposure to a diversified portfolio of these types of companies in a single trade rather than buying individual stocks. Read on to learn more about the best consumer staples ETFs and how you can begin investing in them.

What Are Consumer Staples ETFs?

Before discussing the best monthly dividend stocks and ETFs, it's important to understand ETFs, how they work and how they vary from investing in common shares of stock. An ETF is an investment fund that trades on major stock exchanges, including the NASDAQ or the New York Stock Exchange.

ETFs are a grouping of stocks that trade together as a single unit. Investment companies create ETFs, typically holding a basket of securities that mirror the index or sector they are tracking. An ETF could mimic the performance of a specific index (like the S&P 500 or the Dow Jones Industrial average. The fund's shares are listed on a stock exchange, and investors can buy and sell them just like they would with individual stocks.

One of the advantages of ETFs is that they provide investors with diversification, as they hold many securities. When you divide your total investment funds between multiple stocks (like when you buy an ETF), you won't see as significant of a loss if one individual stock in the fund loses value. Additionally, ETFs generally have lower fees than mutual funds and other investment vehicles.

Many types of ETFs are available, including broad-based ETFs that track entire markets or indices and sector-specific ETFs that focus on particular industries or sectors. As the name suggests, a consumer staple ETF is an ETF that focuses on stocks issued by companies producing household goods. Some examples of stocks commonly included in consumer staple ETFs include:

- Procter & Gamble Co. (NYSE: P.G.)

- Coca-Cola Co. (NYSE: K.O.)

- PepsiCo Inc. (NASDAQ: PEP)

- Walmart Inc. (NYSE: WMT)

- Colgate-Palmolive Co. (NYSE: CL)

- Johnson and Johnson (NYSE: JNJ)

These companies are known for selling essential consumer goods and services, including household products like cleaning supplies, personal care items, food and beverages and tobacco. You can use tools like MarketBeat's ETF screener to identify other companies typically included in consumer staple ETFs.

8 Best Consumer Staples ETFs

Now that you understand what a consumer staple ETF is and how an investment service provider might put together a consumer-focused fund, you may feel ready to explore an ETF for consumer staples to add to your portfolio. Consider beginning your research with a few of the funds below.

Vanguard Consumer Staples ETF

The Vanguard Consumer Staples ETF (NYSE: VDC) aims to track the performance of the MSCI US Investable Market Consumer Staples 25/50 Index. Some of the top holdings in the Vanguard Consumer Staples ETF include Procter and Gamble Co., Coca-Cola Co. and PepsiCo Inc. As of March 2023, the ETF had a total net asset value of over $6 billion and a dividend yield of 2.41%.

First Trust Nasdaq Food & Beverage ETF

The First Trust Nasdaq Food & Beverage ETF (NASDAQ: FTXG) is an exchange-traded fund that aims to track the performance of the NASDAQ U.S. Smart Food and Beverage Index. This index includes U.S. companies that produce, distribute and sell food and beverage products. The ETF seeks to replicate the index's performance by investing in a diversified portfolio of stocks from the index.

Some top holdings in the First Trust Nasdaq Food & Beverage ETF include PepsiCo Inc., Coca-Cola Co., Keurig Dr. Pepper Inc. and Mondelez International Inc. The ETF's portfolio is diversified across various food and beverage sub-sectors, including soft drinks, packaged foods, dairy products, and meat products. As of March 2023, the fund had a little less than $1 billion in assets under management and paid out a dividend yield of 1.51%.

iShares Global Consumer Staples ETF

The iShares Global Consumer Staples ETF (NYSE: KXI) tracks the performance of the S&P Global 1200 Consumer Staples Sector Index. This consumer staples ETF offers investors exposure to companies across multiple countries, including the United States, Switzerland, Japan, and the United Kingdom. Some of the top holdings in the ETF include Nestle SA, Procter and Gamble Co. and the Coca-Cola Co. As of March 2023, the ETF had a total of $1.51 billion in assets under management, as well as an overall dividend yield of 1.98%.

iShares U.S. Consumer Staples ETF

The iShares U.S. Consumer Staples ETF (NYSE: IYK) tracks the performance of the Dow Jones U.S. Consumer Goods Index. The ETF invests in a diversified portfolio of U.S. companies and is similar to the iShares Global Consumer Staples fund without exposure to international consumer goods. Some of this ETF's largest holdings include Procter & Gamble Co., Coca-Cola Co., PepsiCo Inc. and Walmart. In March 2023, the fund had $1.83 billion in assets under management and a dividend yield of 2.25%.

First Trust Consumer Staples AlphaDEX Fund

The First Trust Consumer Staples AlphaDEX Fund (NYSE: FXG) is an exchange-traded fund (ETF) that seeks to track the performance of the StrataQuant Consumer Staples Index. As of March 2023, the fund had a total of $735 million in assets under management and a dividend yield of 1.86%. Some of the fund's top holdings are in Procter and Gamble, Coca-Cola, PepsiCo and Walmart Inc.

The FXG ETF uses a unique quantitative methodology called the AlphaDEX selection methodology to choose stocks and other assets to include in the portfolio. This methodology uses fundamental and technical factors to rank stocks based on their potential for outperformance relative to their peers. The top-ranked stocks are then selected for inclusion in the ETF's portfolio, while lower-ranked stocks are excluded.

Fidelity MSCI Consumer Staples Index ETF

The Fidelity MSCI Consumer Staples Index ETF (NYSE: FSTA) tracks the performance of the MSCI USA IMI Consumer Staples Index. This index includes large-, mid- and small-cap stocks from the consumer staples sector of the U.S. equity market. Some of the fund's largest holdings include Proctor and Gamble, Coca-Cola Co. and PepsiCo.

FSTA, like other mutual funds and ETFs from Fidelity, is known for its lower-than-average expense ratios. As of March 2023, the fund had an expense ratio of 0.084%, totaling $1.11 billion in assets under management. This fund also features a dividend yield of 2.29%.

Invesco S&P 500 Equal Weight Consumer Staples ETF

The Invesco S&P 500 Equal Weight Consumer Staples ETF (NYSE: RHS) tracks the performance of the S&P 500 Equal Weight Consumer Staples Index. This index includes consumer staple companies in the S&P 500 index. As of March 2023, the fund had more than $734 million in assets under management and a dividend yield of 2.35%.

Each company in the fund has an equal weighting in the index, which means larger companies with more influence in the overall economy are weighted less heavily when calculating fund inclusions, as is typically the case with other ETF consumer staples. By giving each company an equal weighting, the ETF provides more diversified exposure to the sector than traditional market-cap-weighted ETFs. Some of the fund's top holdings are in Estee Lauder, Clorox and Molson Coors.

Consumer Staples Select Sector SPDR Fund

The Consumer Staples Select Sector SPDR Fund (NYSE: XLP) aims to track the performance of the Consumer Staples Select Sector Index, composed of companies in the S&P 500 Index classified in the consumer staples sector. As of March 2023, the fund had more than $16 billion in assets under management and a dividend yield payout of 2.54%.

Investing in Consumer Staples

Investing in consumer staples can be a good idea for investors looking for stability and long-term growth potential. Consumer staples are essential for daily life and are in demand regardless of economic cycles. Familiarizing yourself with ETF strategies to beat the market and researching consumer staple ETFs may offer you a unique level of stability in your journey toward long-term investment goals. As with any other investment, it's a good idea to consult with a financial advisor familiar with your unique goals before making any major ETF investing decisions.

FAQs

The following are some of investors' most common questions before investing in a consumer staples ETF.

What are the top five rated ETFs to buy?

When ranked by market capitalization, the top five ETFs include the SPDR S&P 500 ETF Trust, iShares Core S&P 500 ETF, Vanguard Total Stock Market ETF, Vanguard S&P 500 ETF and the Invesco QQQ Trust. The best ETF to buy may vary depending on your investment goals, initial investment capital, and additional factors.

Does Vanguard have a consumer staples ETF?

Vanguard offers a consumer staples ETF called the Vanguard Consumer Staples ETF (NYSE: VDC). The VDC ETF seeks to track the performance of the MSCI US Investable Market Consumer Staples 25/50 Index, composed of U.S. companies in the consumer staples sector.

Is it better to buy consumer staples stocks or ETFs?

In most cases, buying consumer staple ETFs rather than individual stocks is a better idea due to a lower level of risk (though both assets have pros and cons). Buying a consumer staples ETF can expose investors to a diversified portfolio of consumer staples companies, reducing company-specific risks and potentially providing a more stable return.