Over the last six months, Euronet Worldwide’s shares have sunk to $89.14, producing a disappointing 17.9% loss - a stark contrast to the S&P 500’s 15.6% gain. This was partly driven by its softer quarterly results and may have investors wondering how to approach the situation.

Following the pullback, is now an opportune time to buy EEFT? Find out in our full research report, it’s free.

Why Do Investors Watch Euronet Worldwide?

Operating a global network of over 47,000 ATMs and 821,000 point-of-sale terminals across more than 60 countries, Euronet Worldwide (NASDAQ: EEFT) provides electronic payment solutions including ATM services, prepaid product processing, and international money transfer services.

Three Positive Attributes:

1. Long-Term Revenue Growth Shows Momentum

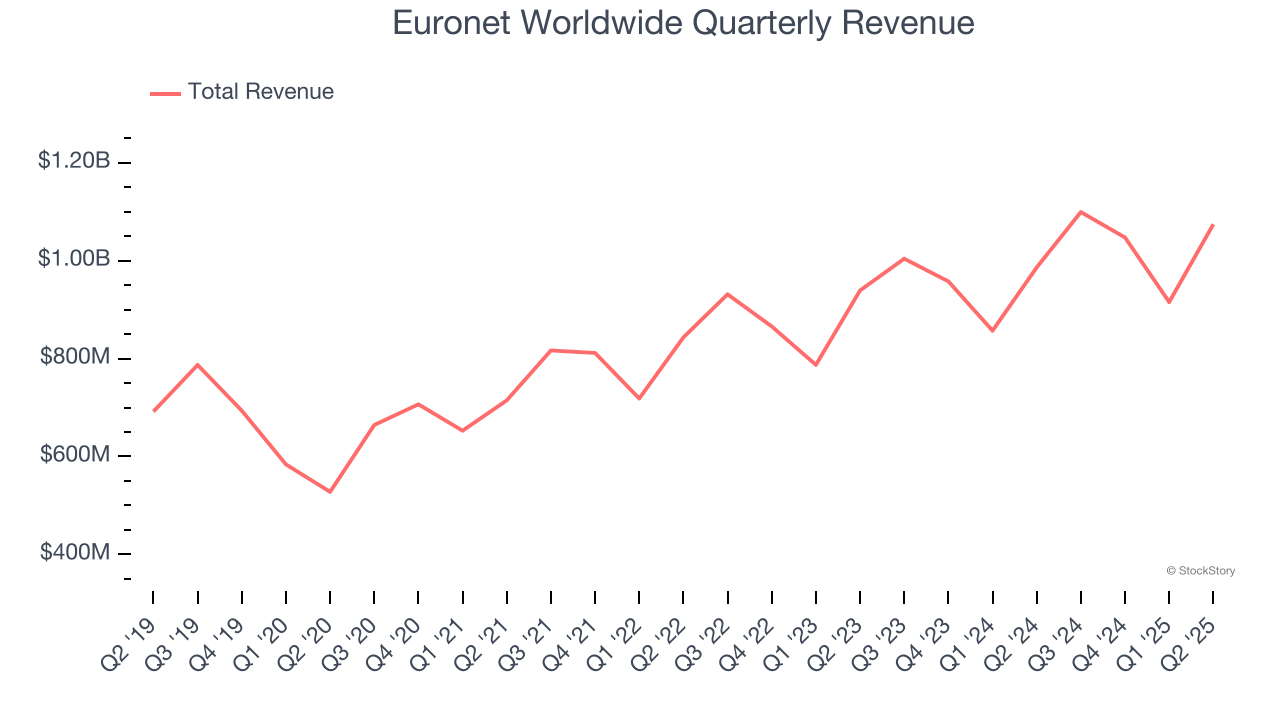

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

Thankfully, Euronet Worldwide’s 9.8% annualized revenue growth over the last five years was decent. Its growth was slightly above the average financials company and shows its offerings resonate with customers.

2. EPS Moving Up Steadily

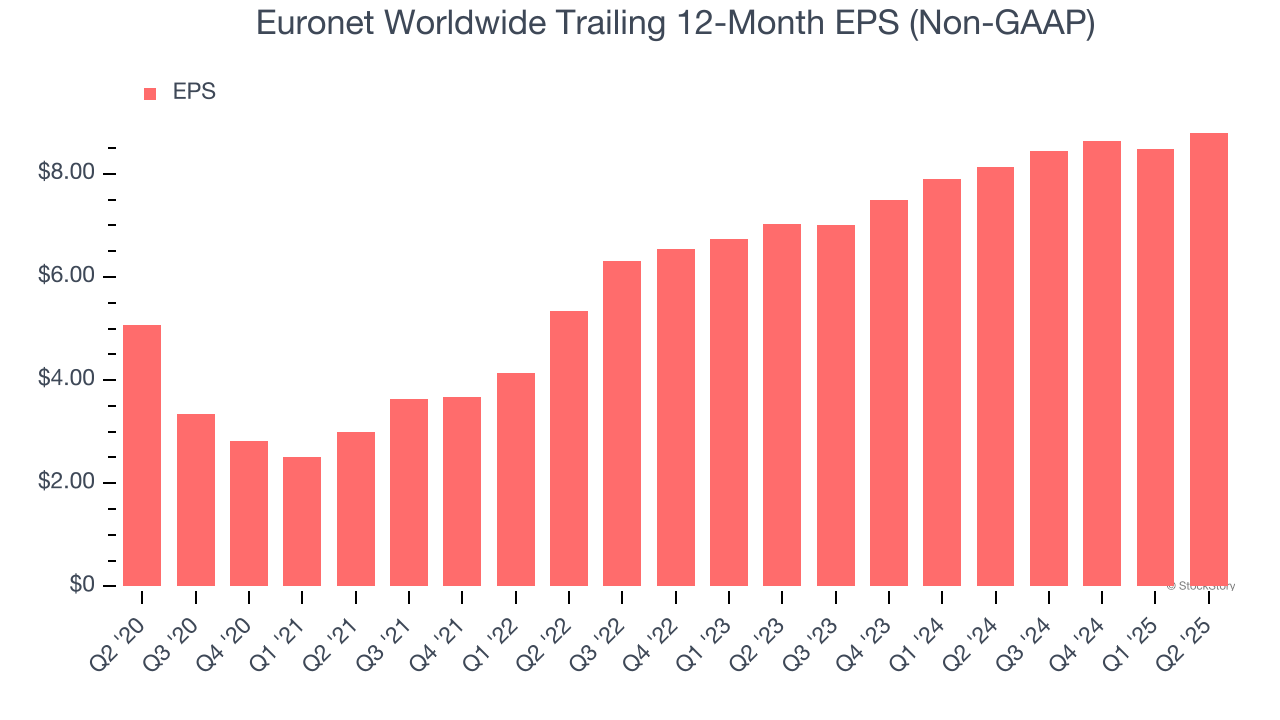

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Euronet Worldwide’s decent 11.7% annual EPS growth over the last five years aligns with its revenue performance. This tells us its incremental sales were profitable.

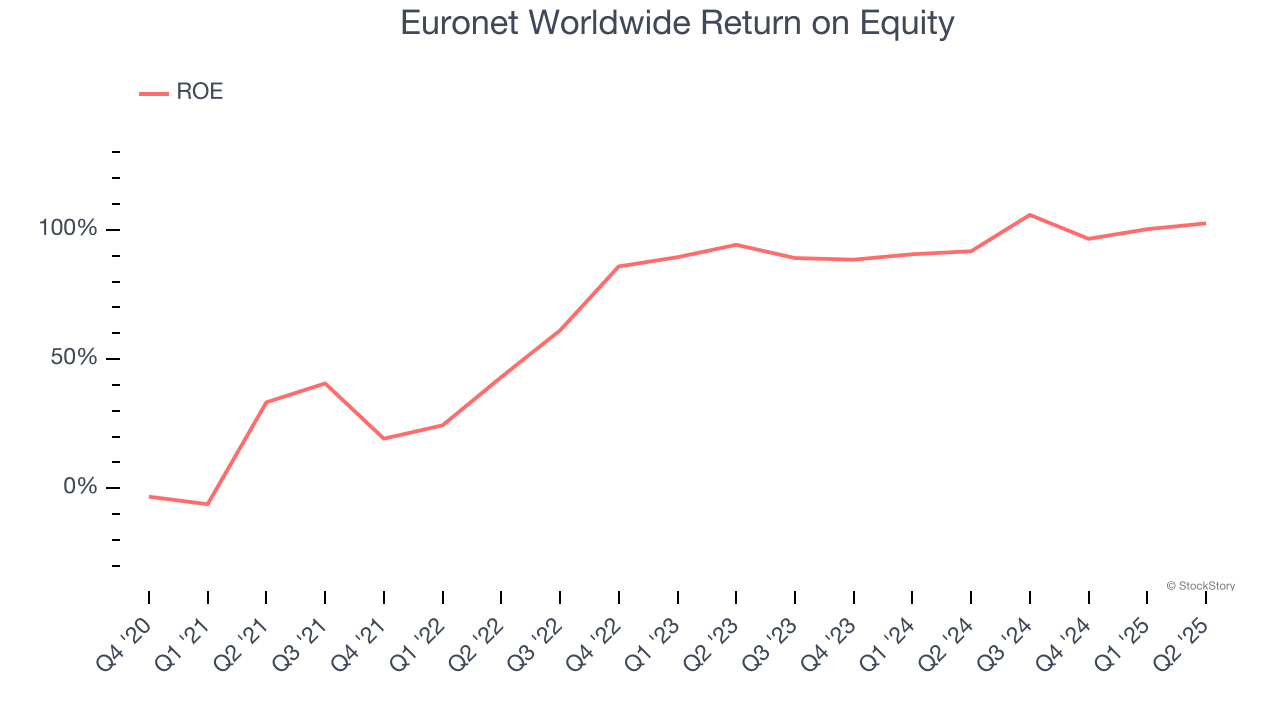

3. Stellar ROE Showcases Lucrative Growth Opportunities

Return on equity, or ROE, quantifies bank profitability relative to shareholder equity - an essential capital source for these institutions. Over extended periods, superior ROE performance drives faster shareholder wealth compounding through reinvestment, share repurchases, and dividend growth.

Over the last five years, Euronet Worldwide has averaged an ROE of 18.2%, impressive for a company operating in a sector where the average shakes out around 10% and those putting up 25%+ are greatly admired. This shows Euronet Worldwide has a strong competitive moat.

Final Judgment

There are definitely things to like about Euronet Worldwide. After the recent drawdown, the stock trades at 8.5× forward P/E (or $89.14 per share). Is now the right time to buy? See for yourself in our full research report, it’s free.

High-Quality Stocks for All Market Conditions

When Trump unveiled his aggressive tariff plan in April 2025, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.