The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how RE/MAX (NYSE: RMAX) and the rest of the real estate services stocks fared in Q2.

Technology has been a double-edged sword in real estate services. On the one hand, internet listings are effective at disseminating information far and wide, casting a wide net for buyers and sellers to increase the chances of transactions. On the other hand, digitization in the real estate market could potentially disintermediate key players like agents who use information asymmetries to their advantage.

The 12 real estate services stocks we track reported a satisfactory Q2. As a group, revenues beat analysts’ consensus estimates by 2.6% while next quarter’s revenue guidance was 0.9% above.

Luckily, real estate services stocks have performed well with share prices up 62.9% on average since the latest earnings results.

RE/MAX (NYSE: RMAX)

Short for Real Estate Maximums, RE/MAX (NYSE: RMAX) operates a real estate franchise network spanning over 100 countries and territories.

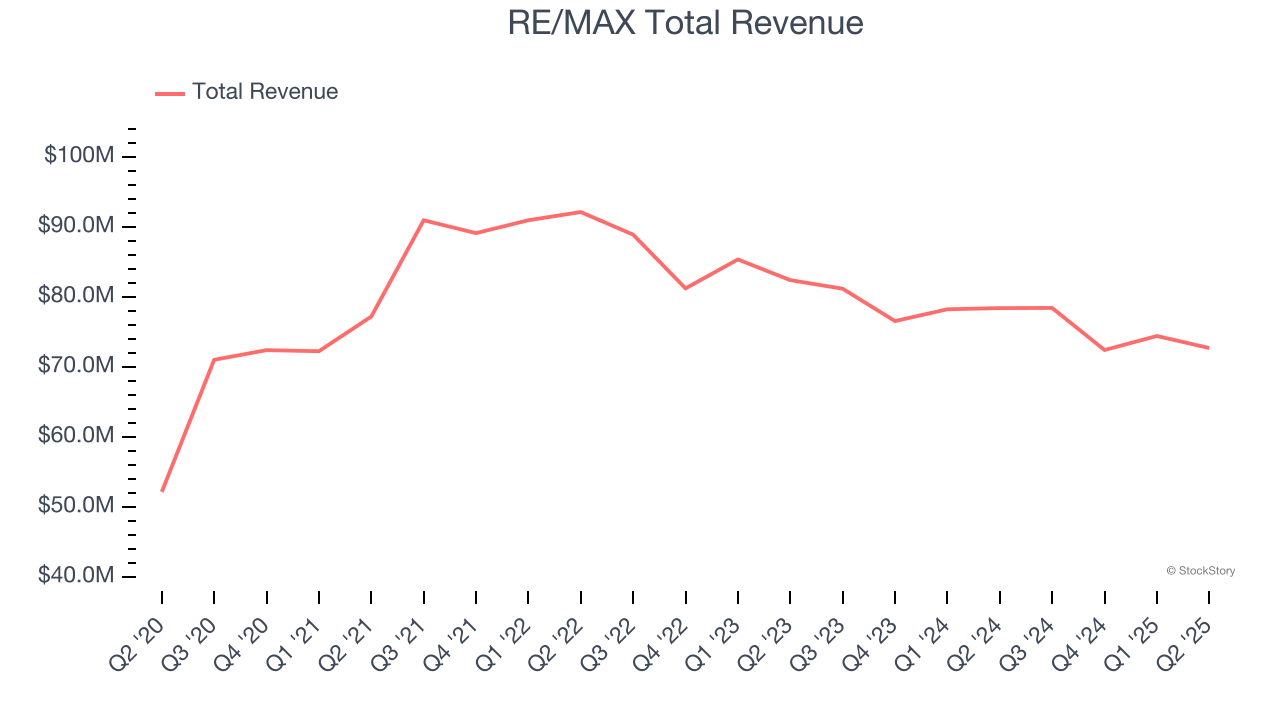

RE/MAX reported revenues of $72.75 million, down 7.3% year on year. This print fell short of analysts’ expectations by 1.1%. Overall, it was a mixed quarter for the company with a beat of analysts’ EPS estimates but EBITDA guidance for next quarter missing analysts’ expectations.

"Our total agent count was at an all-time high at the end of the second quarter, and we had our best quarter of U.S. agent count performance since the second quarter of 2022, as agents recognize the power of our brand, scale, and continually improving value proposition," said Erik Carlson, RE/MAX Holdings Chief Executive Officer.

RE/MAX delivered the weakest full-year guidance update of the whole group. Interestingly, the stock is up 13.9% since reporting and currently trades at $9.77.

Read our full report on RE/MAX here, it’s free.

Best Q2: The Real Brokerage (NASDAQ: REAX)

Founded in Toronto, Canada in 2014, The Real Brokerage (NASDAQ: REAX) is a technology-driven real estate brokerage firm combining a tech-centric model with an agent-centric philosophy.

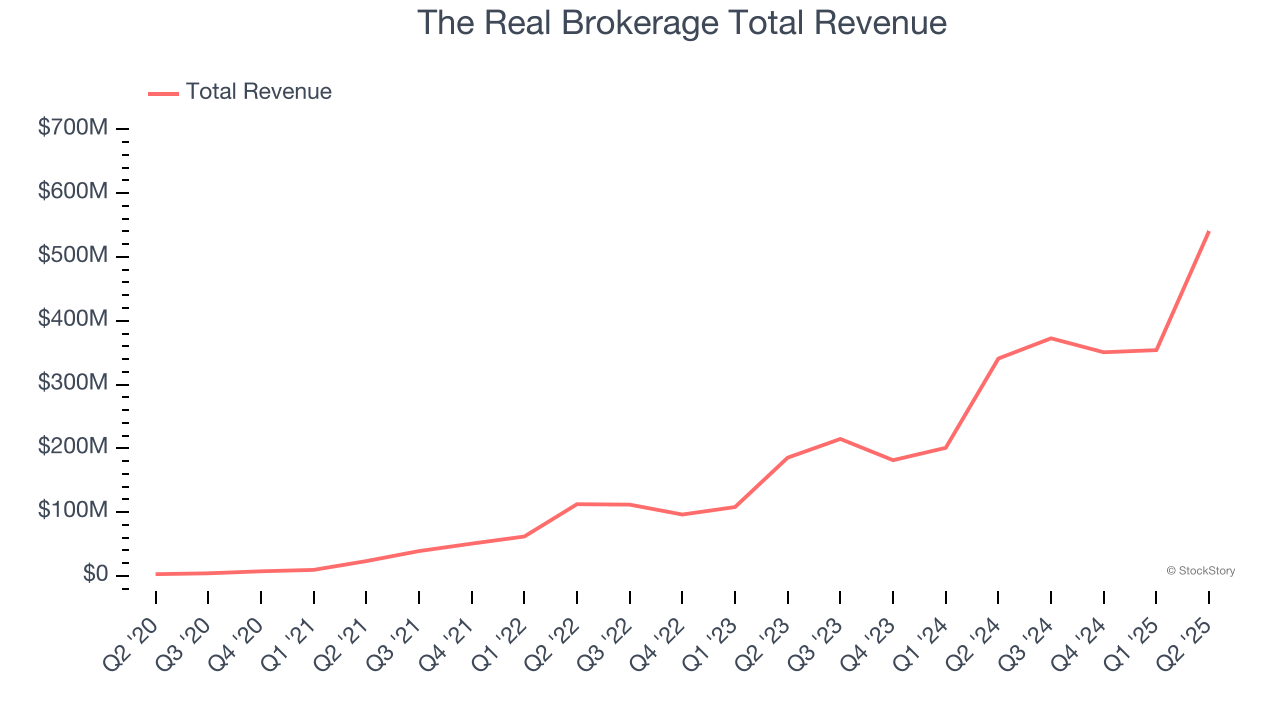

The Real Brokerage reported revenues of $540.7 million, up 58.7% year on year, outperforming analysts’ expectations by 12.1%. The business had a stunning quarter with EPS in line with analysts’ estimates and a solid beat of analysts’ EBITDA estimates.

The Real Brokerage scored the biggest analyst estimates beat and fastest revenue growth among its peers. The market seems happy with the results as the stock is up 20.1% since reporting. It currently trades at $4.93.

Is now the time to buy The Real Brokerage? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: eXp World (NASDAQ: EXPI)

Founded in 2009, eXp World (NASDAQ: EXPI) is a real estate company known for its virtual, cloud-based approach to real estate brokerage.

eXp World reported revenues of $1.31 billion, up 1.1% year on year, exceeding analysts’ expectations by 0.6%. Still, it was a disappointing quarter as it posted a significant miss of analysts’ adjusted operating income estimates.

Interestingly, the stock is up 3.7% since the results and currently trades at $11.24.

Read our full analysis of eXp World’s results here.

Newmark (NASDAQ: NMRK)

Founded in 1929, Newmark (NASDAQ: NMRK) provides commercial real estate services, including leasing advisory, global corporate services, investment sales and capital markets, property and facilities management, valuation and advisory, and consulting.

Newmark reported revenues of $759.1 million, up 19.9% year on year. This print beat analysts’ expectations by 10.7%. It was a very strong quarter as it also produced full-year revenue guidance exceeding analysts’ expectations and a beat of analysts’ EPS estimates.

Newmark pulled off the highest full-year guidance raise among its peers. The stock is up 35.9% since reporting and currently trades at $19.67.

Read our full, actionable report on Newmark here, it’s free.

Marcus & Millichap (NYSE: MMI)

Founded in 1971, Marcus & Millichap (NYSE: MMI) specializes in commercial real estate investment sales, financing, research, and advisory services.

Marcus & Millichap reported revenues of $172.3 million, up 8.8% year on year. This number surpassed analysts’ expectations by 5.3%. Overall, it was a strong quarter as it also put up a solid beat of analysts’ EBITDA estimates.

The stock is down 1.8% since reporting and currently trades at $31.60.

Read our full, actionable report on Marcus & Millichap here, it’s free.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.