Mayville Engineering has been treading water for the past six months, recording a small return of 1.5% while holding steady at $14.15. The stock also fell short of the S&P 500’s 16.2% gain during that period.

Is there a buying opportunity in Mayville Engineering, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Why Is Mayville Engineering Not Exciting?

We're swiping left on Mayville Engineering for now. Here are three reasons there are better opportunities than MEC and a stock we'd rather own.

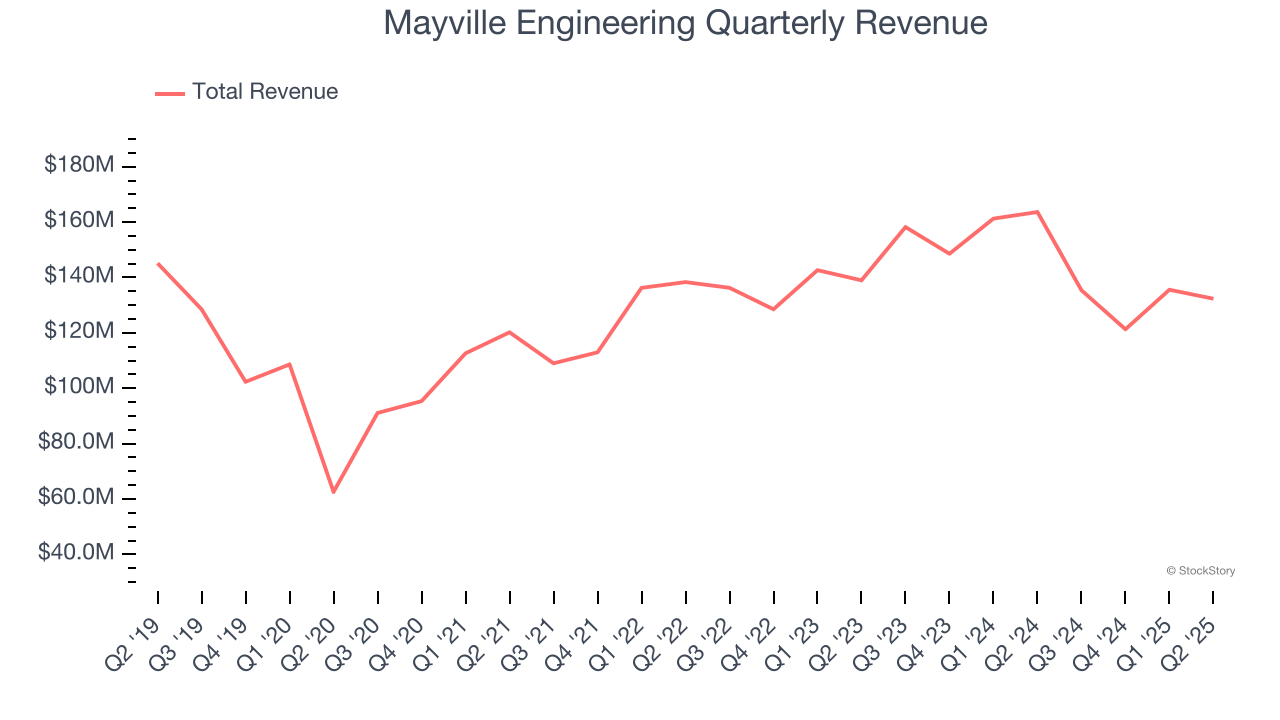

1. Long-Term Revenue Growth Disappoints

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Regrettably, Mayville Engineering’s sales grew at a tepid 5.5% compounded annual growth rate over the last five years. This fell short of our benchmark for the industrials sector.

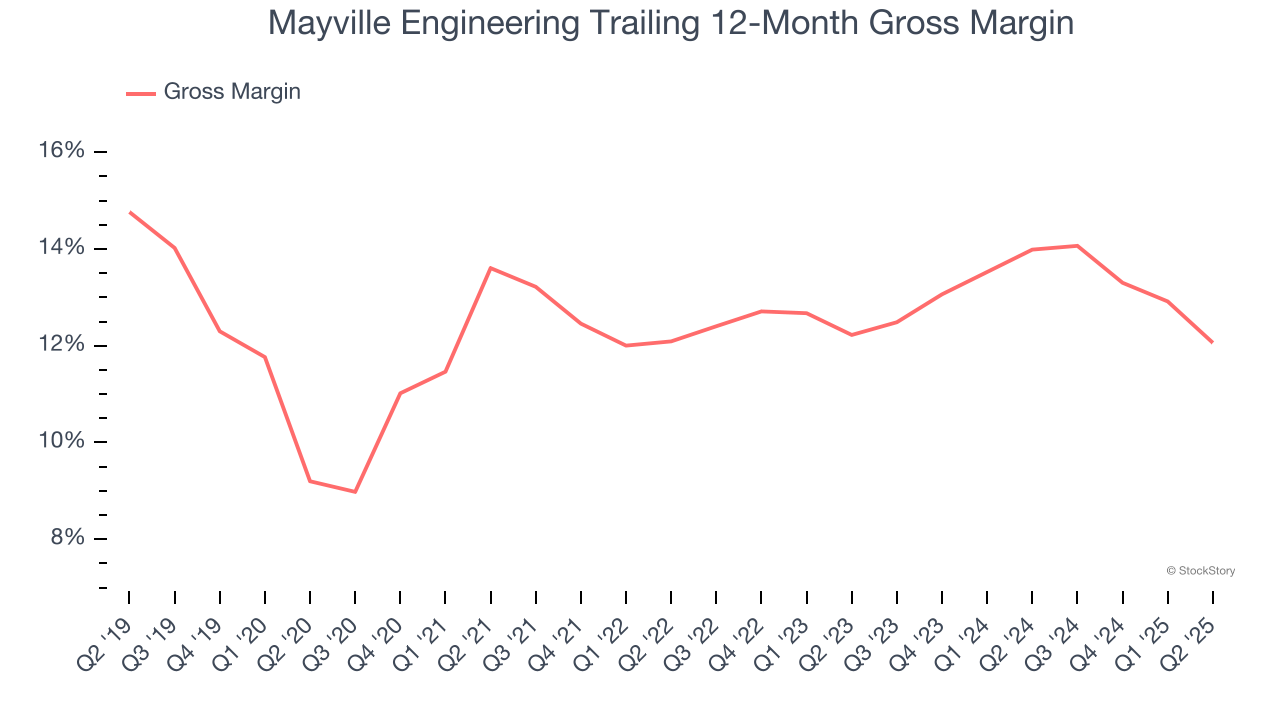

2. Low Gross Margin Reveals Weak Structural Profitability

All else equal, we prefer higher gross margins because they make it easier to generate more operating profits and indicate that a company commands pricing power by offering more differentiated products.

Mayville Engineering has bad unit economics for an industrials business, signaling it operates in a competitive market. As you can see below, it averaged a 12.8% gross margin over the last five years. Said differently, Mayville Engineering had to pay a chunky $87.19 to its suppliers for every $100 in revenue.

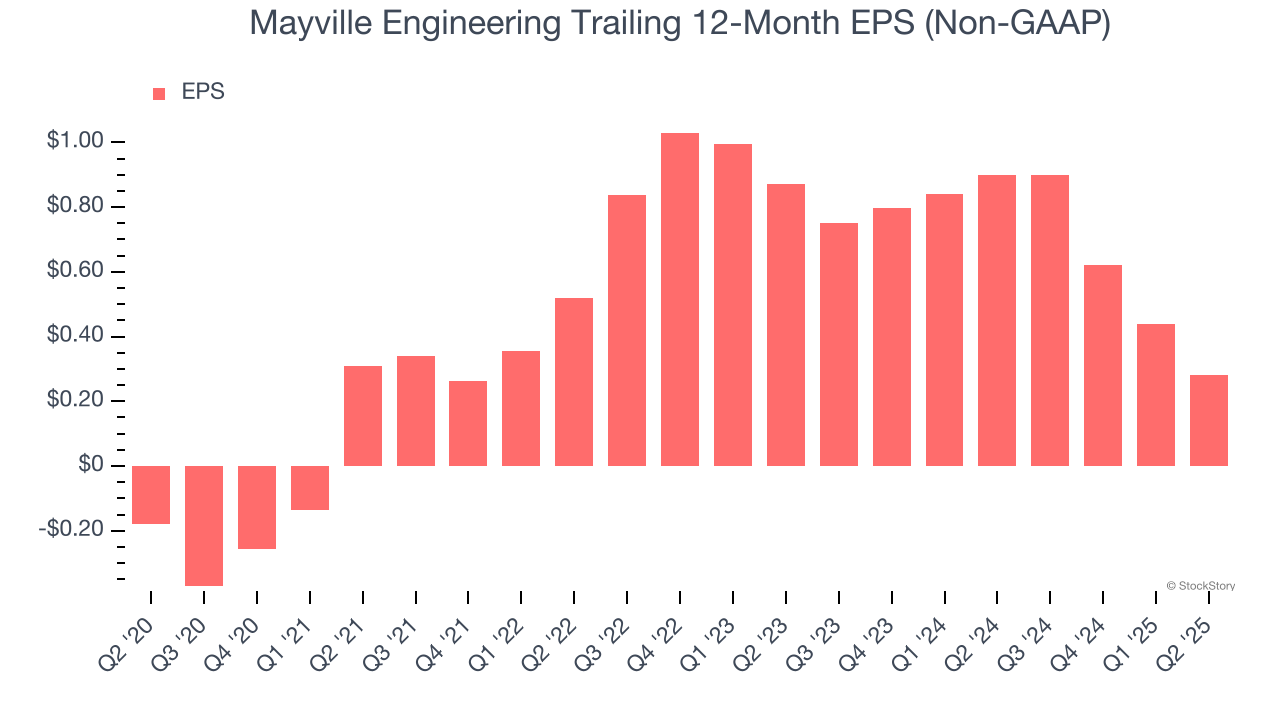

3. EPS Took a Dip Over the Last Two Years

While long-term earnings trends give us the big picture, we also track EPS over a shorter period because it can provide insight into an emerging theme or development for the business.

Sadly for Mayville Engineering, its EPS declined by more than its revenue over the last two years, dropping 43.3%. This tells us the company struggled to adjust to shrinking demand.

Final Judgment

Mayville Engineering isn’t a terrible business, but it isn’t one of our picks. With its shares underperforming the market lately, the stock trades at 14.8× forward P/E (or $14.15 per share). This valuation multiple is fair, but we don’t have much faith in the company. We're fairly confident there are better stocks to buy right now. Let us point you toward our favorite semiconductor picks and shovels play.

Stocks We Would Buy Instead of Mayville Engineering

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.