Root’s stock price has taken a beating over the past six months, shedding 30.2% of its value and falling to $89.76 per share. This may have investors wondering how to approach the situation.

Is now the time to buy Root, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free.

Why Is Root Not Exciting?

Even with the cheaper entry price, we don't have much confidence in Root. Here are two reasons why ROOT doesn't excite us and a stock we'd rather own.

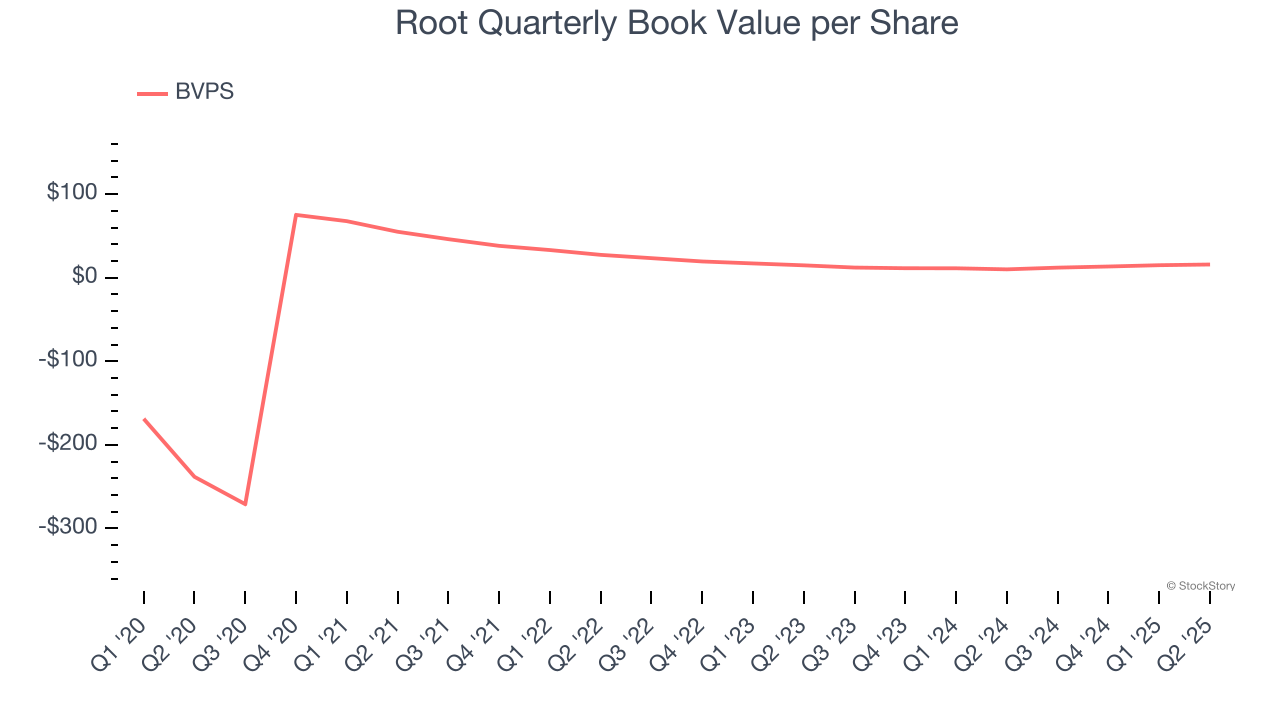

1. Substandard BVPS Growth Indicates Limited Asset Expansion

In the insurance industry, book value per share (BVPS) provides a clear picture of shareholder value, as it represents the total equity backing a company’s insurance operations and growth initiatives.

To the detriment of investors, Root’s BVPS grew at a sluggish 3.3% annual clip over the last two years.

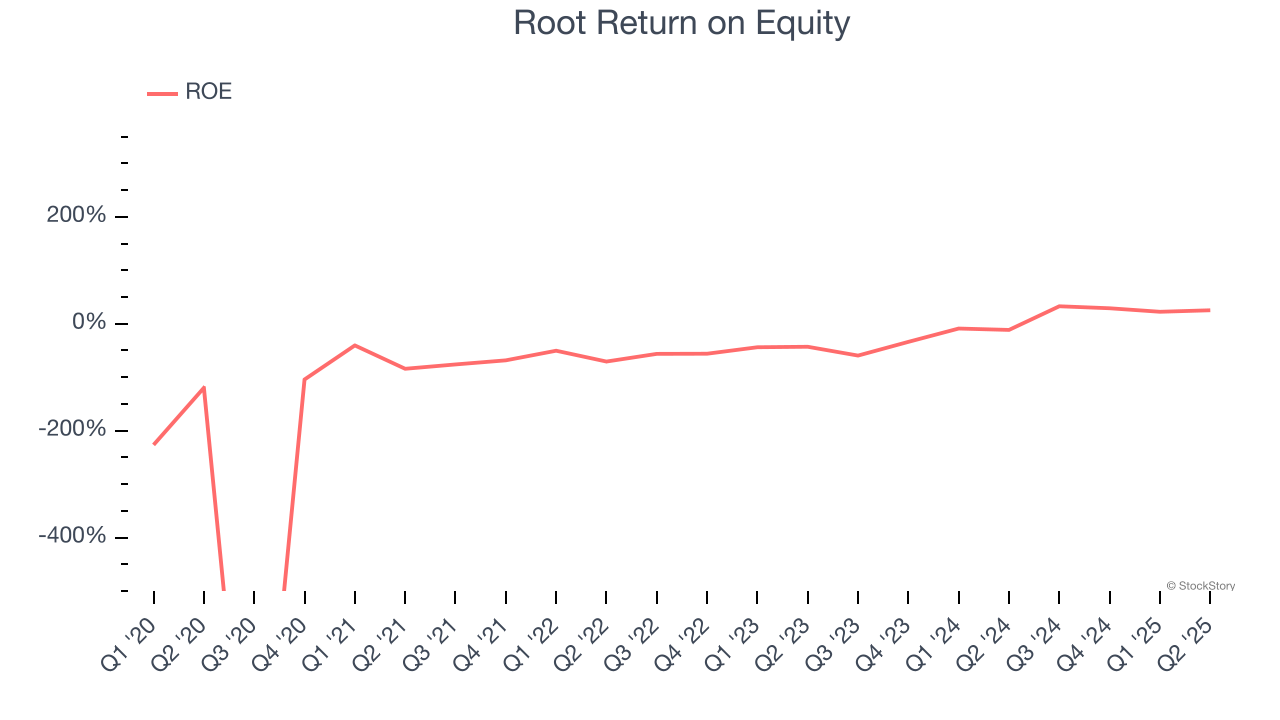

2. Previous Growth Initiatives Have Lost Money

Return on equity, or ROE, represents the ultimate measure of an insurer's effectiveness, quantifying how well it transforms shareholder investments into profits. Over the long term, insurance companies with robust ROE metrics typically deliver superior shareholder returns through a balanced approach to capital management.

Over the last five years, Root has averaged an ROE of negative 88.9%, a bad result not only in absolute terms but also relative to the majority of insurers putting up 20%+. It also shows that Root has little to no competitive moat.

Final Judgment

Root isn’t a terrible business, but it doesn’t pass our bar. After the recent drawdown, the stock trades at 4.3× forward P/B (or $89.76 per share). This valuation tells us it’s a bit of a market darling with a lot of good news priced in - you can find more timely opportunities elsewhere. We’d recommend looking at one of our all-time favorite software stocks.

High-Quality Stocks for All Market Conditions

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.