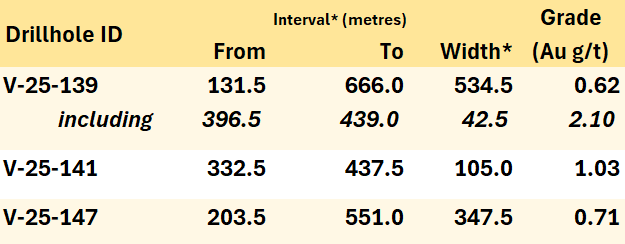

Open, consistent mineralization on Valley's margins, including V-25-139 with 534.5 m @ 0.62 g/t Au (incl. 42.5 m @ 2.10 g/t Au), and 10 of 12 reported holes ending in mineralization

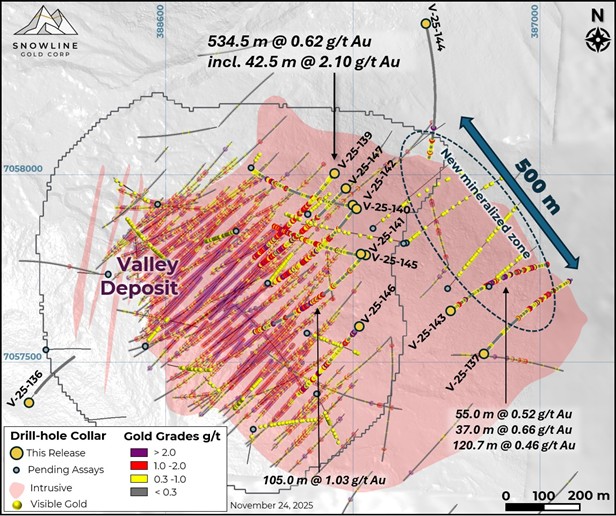

Broad mineralized intervals in a new Eastern zone at Valley located roughly 500 m northeast of current Mineral Resource Estimate ("MRE") boundary

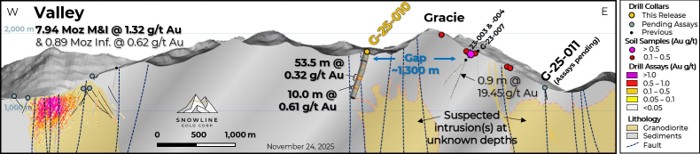

Gold intersection in initial drill results from multiple regional targets, with first intrusive units encountered in drilling and longest mineralized interval to date at Gracie target, 4 km east of Valley

Additional results pending for over 13,700 m of drilling, from Valley and five additional regional targets: Aurelius, Charlotte, Cujo, Gracie & Ramsey.

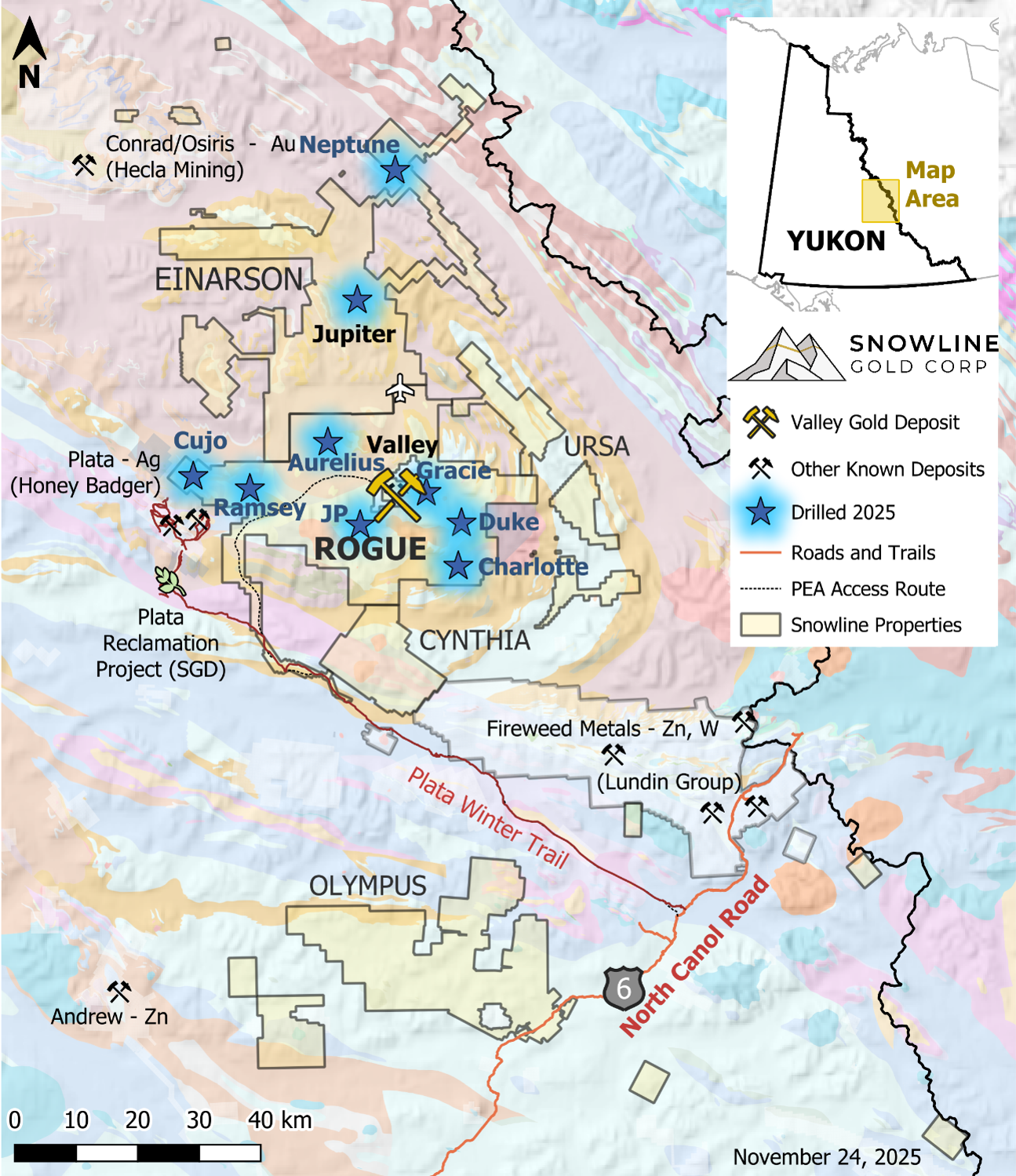

VANCOUVER, BC / ACCESS Newswire / November 24, 2025 / SNOWLINE GOLD CORP. (TSX-V:SGD)(OTCQB:SNWGF) (the "Company" or "Snowline") is pleased to announce additional drill results from its Rogue and Einarson projects in the eastern Yukon Territory. Drilling at Snowline's flagship Valley gold deposit ("Valley") on the Rogue Project continues to confirm and expand the scale of known mineralization, with initial assays from a new zone that is developing near the eastern margin of the Valley intrusion returning ling intersections of anomalous gold across a broad area (Figure 1). At the Rogue Project's Gracie target ("Gracie"), two intervals of mineralization in G-25-010-along with intrusive rocks in G-25-011 (assays pending)-provide further evidence of the causative reduced intrusion-related gold system ("RIRGS") and its potential location. Initial drill results from additional regional targets demonstrate additional mineralized intersections. Assays are pending on additional holes, with approximately 13,700 m of drill results from Snowline's 2025 season still to be reported.

"We're encouraged to see strong consistency of mineralization around the edges of the Valley deposit as we continue to build on the scale of the open system," said Scott Berdahl, CEO & Director of Snowline. "Today's results will serve to upgrade and potentially to expand our resource at Valley. In addition, the persistence of mineralization well beyond the near-surface, higher grade core of the deposit highlights the possibility of additional such hot-spots of mineralization in other parts of the Valley intrusion, particularly near the new, gold-bearing zone towards the eastern margin, which we had previously thought to be barren.

"We are also excited by the pictures taking shape on several regional targets. At Gracie, for example, 4 km east of Valley, drill hole G-25-010 intersected a 53.5 m wide zone of RIRGS mineralization in silicified sediments along a northwest structural corridor - broadly similar to what we saw in V-21-004 on our very first drill program at Valley four years ago. This year's second hole at Gracie, G-25-011, hit large intersections of intrusive rock for the first time on the target: two intrusive phases similar to units at Valley which we interpret as important hosts to and drivers of gold emplacement. These are key developments in vectoring towards what we think could be a significant gold system near our flagship deposit."

VALLEY DEPOSIT DRILLING

Over 20,000 m of drilling has been completed within and near Valley in 2025. The objectives of this program are: 1) to test potential expansion of the current MRE for Valley; 2) to test for new zones of high-grade mineralization within the Valley intrusion; and 3) to prepare for a future Prefeasibility Study ("PFS") by upgrading Inferred Resources to higher categories and obtaining additional geotechnical information.

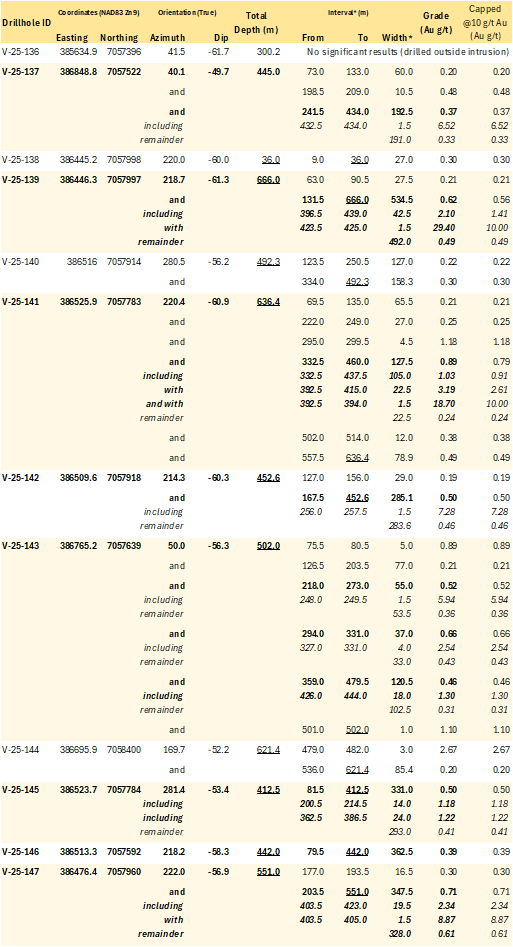

The Company has received results from twelve additional holes at Valley. These holes, V-25-136 through 147, continue to encounter broad zones of anomalous gold mineralization within and near the deposit (Figure 1 & Table 2). Hole V-25-139, for example, has 534.5 m at 0.62 g/t Au, including 42.5m at 2.10 g/t Au, primarily outside of the PEA mine plan. Collared 50 m to its southeast, V-25-147 has 347.5 m at 0.71 g/t Au, including 19.5 m at 2.34 g/t Au, demonstrating lateral consistency along this open edge of the Valley deposit. V-25-141 returned a 105.0 m interval averaging 1.03 g/t Au from 332.5 m downhole, entirely below the PEA pit shell. Results will serve to inform potential recategorization of Inferred Mineral Resources to higher categories and could potentially expand the overall resource.

Ten of the twelve holes reported end in mineralization within the Valley intrusive, highlighting the open nature of the known system at Valley. The two holes that did not end in mineralization ended outside of the intrusion.

New Eastern Zone: Roughly 500 m east of the main system, Snowline has discovered a large new zone of RIRGS mineralization near the eastern edge of the Valley intrusion (Figure 1). Holes V-25-137, V-25-143 and V-25-144 pierce various parts of this zone, with each hole returning broad intervals of tens to hundreds of metres of anomalous gold (Table 2). Hole V-25-143 hosts the highest overall grades seen thus far from this new zone, with intervals of 0.52 g/t Au over 55.0 m from 218.0 m downhole, 0.66 g/t Au over 37.0 m from 294.0 m downhole, and 0.46 g/t Au over 120.5 m from 359.0 m downhole, including 18.0 m at 1.3 g/t Au. The entire hole averages 0.30 g/t Au over 491.3 m from bedrock surface at 10.7 m downhole, with the first mineralized result (0.49 g/t Au over 1.5 m) at 14.5 m downhole and the final result averaging 1.1 g/t Au over 1.0 m at the bottom of the hole (502.0 m). Results from four additional holes in this zone are pending.

Broad intervals of mineralization above the Valley MRE cut-off grade of 0.3 g/t Au are present in this large new zone. The Company interprets this mineralization - distal to the Valley's main high-grade zone - as a potential indicator of additional centres of higher-grade mineralization within the Valley intrusion.

Roughly 10,800 m in additional results from 32 holes are pending overall from Valley, including results from geotechnical, condemnation and metallurgical holes and excluding sonic drill holes.

REGIONAL DRILLING

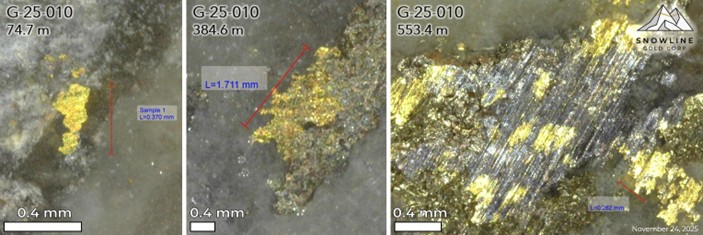

Roughly 10,000 m of drilling has been completed in 2025 outside of Valley on the Rogue and Einarson Projects, on nine additional targets across a 40 x 80 km region (Figure 7). Visible gold has been encountered in drilling in seven of these nine targets, demonstrating district-scale gold fertility. Results from four targets (Duke, Gracie, JP, Neptune) are presented herein, with additional results pending from five targets (Aurelius, Charlotte, Cujo, Gracie, Ramsey).

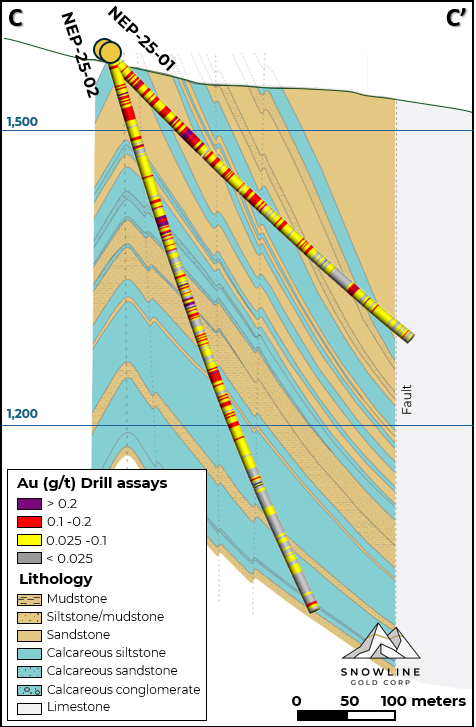

Gracie Target: Gracie is a RIRGS located roughly 4 km east of Valley (Figure 3). Unlike Valley, where the mineralized intrusion is exposed on surface, the causative intrusion at Gracie does not daylight. An intact RIRGS presents an attractive exploration target, as the highest gold grades in RIRGS systems are often found near the top of a given intrusion.

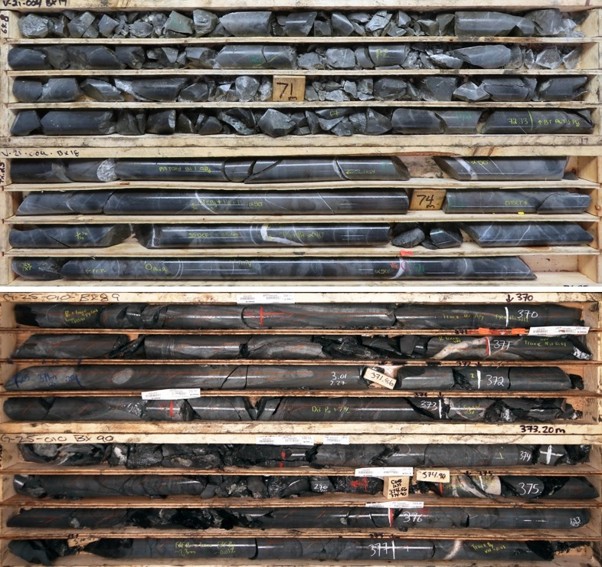

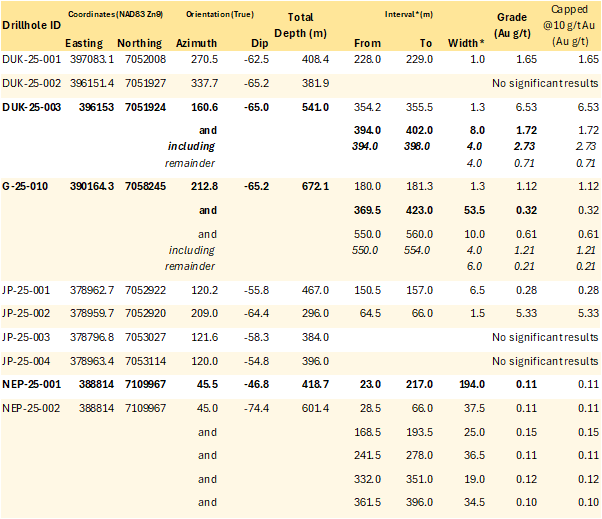

At Gracie, two holes total 826 m. G-25-010, drilled to the northwest of previous drilling, intersected two intervals of RIRGS style mineralization (Table 3), including one interval (53.5 m @ 0.32 g/t Au from 369.5 m downhole) associated with a northwest-trending fault zone in silicified sedimentary rocks. This fault zone is interpreted as a possible fluid conduit extending from an intrusion, similar to northwest-trending faults that extend lower grade mineralization into similar sedimentary rocks surrounding the intrusion at Valley (Figure 4). The final meter of drill core hosts a cm-scale dikelet of intrusive material.

G-25-011 is collared roughly 1,900 m east of G-25-010 and 600 m east of previous drilling at Gracie, towards the Company's Reid target. Notably, the hole intersected 55 m of medium-grained granodiorite as well as five dikes of fine-grained porphyritic granodiorite, analogous units to those that host and are thought to drive higher grade mineralization, respectively, at the Valley deposit. Assays for G-25-011 are pending, though vein densities in the hole are low-the significance of the hole is thought to be the presence of the intrusive units themselves at a significant distance from the Valley deposit and on the far side of Gracie.

Duke Target: Duke is an RIRGS target on the Rogue Project roughly 11 km southeast of Valley (Figure 7). The system is centered on a 1.4 x 1.3 km multi-phase intrusive complex, comprising porphyritic to equigranular granodiorite, diorite stocks, and late-stage syenite dykes.

Multiple magmatic to hydrothermal breccia centers crosscut the intrusion, ranging from monomictic to polymictic. Mineralization is hosted in hydrothermally altered breccias with sulphide-quartz-biotite-tourmaline cement, consisting of pyrrhotite, arsenopyrite, bismuthinite, boulangerite, and chalcopyrite.

Preliminary drilling of one such breccia returned 8.0 m averaging 1.72 g/t Au from 394.0 m downhole, including 4.0 m at 2.73 g/t Au, in hole DUK-25-003. Roughly 600 m northeast of the collar site, surface sampling of breccia units has yielded selective grab samples of up to 8.0 g/t Au.

Neptune Target, Einarson Project: The Neptune target is characterized by a 4 km talus fine gold anomaly with up to 0.349 ppm Au located along a NW-SE regional anticline and a steep regional fault, at the northwest end of a 30 km zone of consistently elevated to anomalous soils associated with this faulted anticlinal structure. In 2013, a historical 103.0 m continuous chip sample along the ridge returned an average of 0.10 g/t Au.

Two drillholes were collared 200 m to the southeast of the chip sample to target the gold anomaly located along the northeastern limb of the anticline. The drillholes intercepted interbedded siliciclastic and calcareous siltstone beds with mudstone, sandstone and conglomerate interbeds and returned several intervals greater than 0.1 g/t Au with up to 0.392 g/t Au in NEP-25-001 (Table 3). The mineralized intervals are characterized by disseminated pyrite with variable graphite content and quartz-carbonate veinlets with pyrite and graphite aggregates. These results extend the anomaly identified at Neptune by more than 200 m of strike length, demonstrate a vertical continuity greater than 500 m between the chip samples and drill core intercepts.

The Neptune target is interpreted to have potential to host multiple styles of mineralization, including Carlin style gold, epizonal orogenic gold and sediment-hosted gold similar in nature to that of Sukhoi Log. The extensive footprint of elevated gold at Neptune in drilling and in regional surface sampling may be indicative of a rich, gold-bearing source unit underlying the broader district, including the Rogue Project.

QA/QC

On receipt from the drill site NQ2-sized drill core was systematically logged for geological attributes, photographed and sampled at Snowline's Forks camp. Sample lengths as small as 0.5 m were used to isolate features of interest, but most samples within moderate to strong mineralization were 1.0 m in length; otherwise, a default 1.5 m downhole sample length was used. Core was cut in half lengthwise along a pre-determined line, with one half (same half, consistently, dictated by orientation line where present or by dominant vein orientation where absent) collected for analysis and one half stored as a record. Field duplicates were collected at regular intervals as ¼ core samples by splitting the ½ core sent for sampling, leaving a consistent record of half core material from duplicate and non-duplicate samples alike. Standard reference materials and blanks were inserted by Snowline personnel at regular intervals into the sample stream. Bagged samples were sealed with security tags to ensure integrity during transport. They were delivered by expeditor to Bureau Veritas' preparatory facility in Whitehorse, Yukon. Sample preparation was completed in Whitehorse, with analyses completed in Vancouver.

Bureau Veritas is accredited to ISO/IEC 17025 and ISO9001 for quality management. Samples were crushed by BV to >85% passing below 2 mm and split using a riffle splitter. 250 g splits were pulverized to >85% passing below 75 microns. A four-acid digest with an inductively coupled plasma mass spectroscopy (ICP-MS) finish was used for 59-element analysis on 0.25 g sample pulps (BV code: MA250). All samples were analysed for gold content by fire assay with an atomic absorption spectroscopy (AAS) finish on 30 g samples (BV code: FA430). Any sample returning >10 g/t Au was reanalysed by fire assay with a gravimetric finish on a 30 g sample (BV code: FA530).

ABOUT SNOWLINE GOLD CORP.

Snowline Gold Corp. is a Yukon Territory focused gold exploration and development company with mineral claim portfolio covering roughly 360,000 ha (3,600 km2). The Company is advancing its Valley gold deposit - a large, low-strip, near surface, >1 g/t Au bulk tonnage gold system located in the eastern Yukon - while continuing regional exploration of surrounding targets on the Rogue Project and the broader district in the highly prospective yet underexplored Selwyn Basin.

Valley hosts an open MRE of 7.94 million ounces gold at 1.21 g/t Au Measured & Indicated (in 204.0 million tonnes) and an additional 0.89 million ounces gold Inferred at 0.62 g/t Au (in 44.5 million tonnes)1, with a cut-off grade of 0.3 g/t Au. Results of a Preliminary Economic Assessment ("PEA") of Valley suggest the potential for the deposit to support a long-life mining operation with a strong production profile and low production costs. The MRE and PEA are supported by the recent technical report for Rogue, prepared in accordance with NI 43-101 standards, entitled "Independent Preliminary Economic Assessment for the Rogue Project Yukon, Canada," dated August 27, 2025, with an effective date of March 1, 2025, and available on SEDAR+ and the Company's website.

Snowline's project portfolio sits within the prolific Tintina Gold Province, host to multiple million-ounce-plus gold mines and deposits across the central Yukon and Alaska. The Company's comprehensive first-mover position and extensive exploration database provide a distinct competitive advantage and a unique opportunity for investors to be part of multiple discoveries, the advancement of a significant gold deposit, and the creation of a new gold district.

QUALIFIED PERSON

Information in this release has been prepared under supervision of and approved by Thomas Branson, M.Sc., P. Geo., Vice President of Exploration for Snowline Gold Corp, as Qualified Person for the purposes of National Instrument 43-101.

ON BEHALF OF THE BOARD

Scott Berdahl

CEO & Director

For further information, please contact:

Snowline Gold Corp.

+1 778 650 5485

info@snowlinegold.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This news release contains certain forward-looking statements, including statements about the Company's work programs, results, surface work, advancement of studies and permitting, the completion of a potential PFS, the significance of visible gold in drill core, the presence of a mineralized intrusion at Gracie, potential styles of mineralization, expansion and upgrading of mineral resource estimates, projected mining plans, continued exploration, and the creation of a new gold district. Wherever possible, words such as "may", "will", "should", "could", "expect", "plan", "intend", "anticipate", "believe", "estimate", "predict" or "potential" or the negative or other variations of these words, or similar words or phrases, have been used to identify these forward-looking statements. These statements reflect management's current beliefs and are based on information currently available to management as at the date hereof.

Forward-looking statements involve significant risk, uncertainties and assumptions. Many factors could cause actual results, performance or achievements to differ materially from the results discussed or implied in the forward-looking statements. Such factors include, among other things: risks related to uncertainties inherent in drill results and the estimation of mineral resources; and risks associated with executing the Company's plans and intentions. These factors should be considered carefully, and readers should not place undue reliance on the forward-looking statements. Although the forward-looking statements contained in this news release are based upon what management believes to be reasonable assumptions, the Company cannot assure readers that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this news release, and the Company assumes no obligation to update or revise them to reflect new events or circumstances, except as required by law.

1Mineral resources are not mineral reserves and do not have demonstrated economic viability. The estimate of mineral resources may be materially affected by metal prices, economic factors, environmental, permitting, legal, title, or other relevant issues.

SOURCE: Snowline Gold Corp.

View the original press release on ACCESS Newswire