Microsoft (MSFT) became the second U.S. company to join the exclusive $4 trillion market cap club on Tuesday, riding a 4% surge after restructuring its OpenAI partnership. The software giant now values its stake in the AI startup at roughly $135 billion, representing about 27% ownership on a fully diluted basis.

The milestone comes as Microsoft and Apple (AAPL) raced toward the $4 trillion threshold, with Apple needing to close above $269.54 to claim its spot. Nvidia (NVDA) reached this valuation for the first time back in July and now trades above $5 trillion. The chipmaker moved much faster between trillion-dollar marks than its peers, taking just 66 trading days to jump from $2 trillion to $3 trillion.

The company's latest agreement with OpenAI brings significant changes. OpenAI is committed to purchasing an additional $250 billion in Azure services, though Microsoft loses its exclusive computing provider status.

The partnership maintains critical elements, including Microsoft's rights to frontier models and Azure API exclusivity, until general artificial intelligence is achieved. The restructured OpenAI deal provides clarity on a partnership that had raised investor concerns about growth sustainability and competition from cheaper alternatives.

Investors Concerned Over Microsoft’s AI Expenses

Microsoft delivered strong fiscal first-quarter results that topped Wall Street expectations. However, the tech stock has pulled back amid concerns about the company’s rising AI expenses.

In fiscal Q1 of 2026 (ended in September), Microsoft reported revenue of $77.67 billion and adjusted earnings of $3.72 per share, above estimates of $75.33 billion and $3.67 per share, respectively.

Azure cloud services drove the top line in Q1, with the segment growing 40%, above estimates of 38.2%. The Intelligent Cloud division reported revenue of $30.9 billion, up 28% year-over-year (YoY).

Microsoft disclosed that its OpenAI investment resulted in a $3.1 billion net income hit during the quarter, equivalent to $0.41 per share. Despite this impact, net income rose to $27.7 billion from $24.67 billion a year earlier.

Finance chief Amy Hood projected fiscal second-quarter revenue of $79.5 billion to $80.6 billion, with Azure growth of 37% in constant currency. However, remarks about capital expenditures sparked investor concerns.

The enterprise software behemoth spent $34.9 billion on infrastructure in the first quarter, and Hood indicated that capex growth will accelerate in fiscal 2026 rather than slow down as previously suggested.

Microsoft's Productivity and Business Processes segment, which houses Office and LinkedIn, generated $33 billion in sales. The More Personal Computing unit delivered $13.8 billion in revenue, representing 4% growth driven by Windows, search advertising, and gaming.

What Is the MSFT Stock Price Target?

Analysts tracking MSFT stock forecast revenue to rise from $281.7 billion in fiscal 2025 to $507 billion in 2030. Compared with adjusted earnings, adjusted earnings are forecast to expand from $13.64 per share to $27.17 per share. While revenue is forecast to grow by 12.5% annually, adjusted earnings growth is estimated at 14.8% through fiscal 2030.

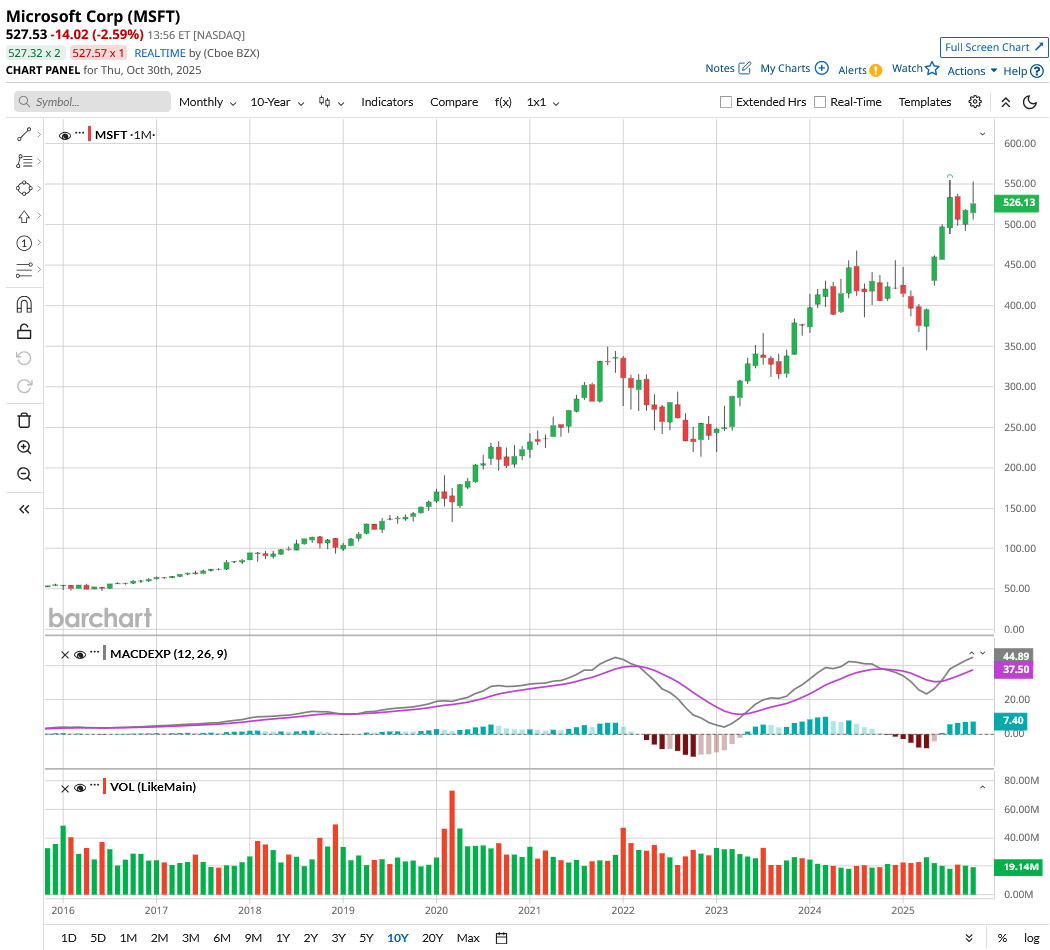

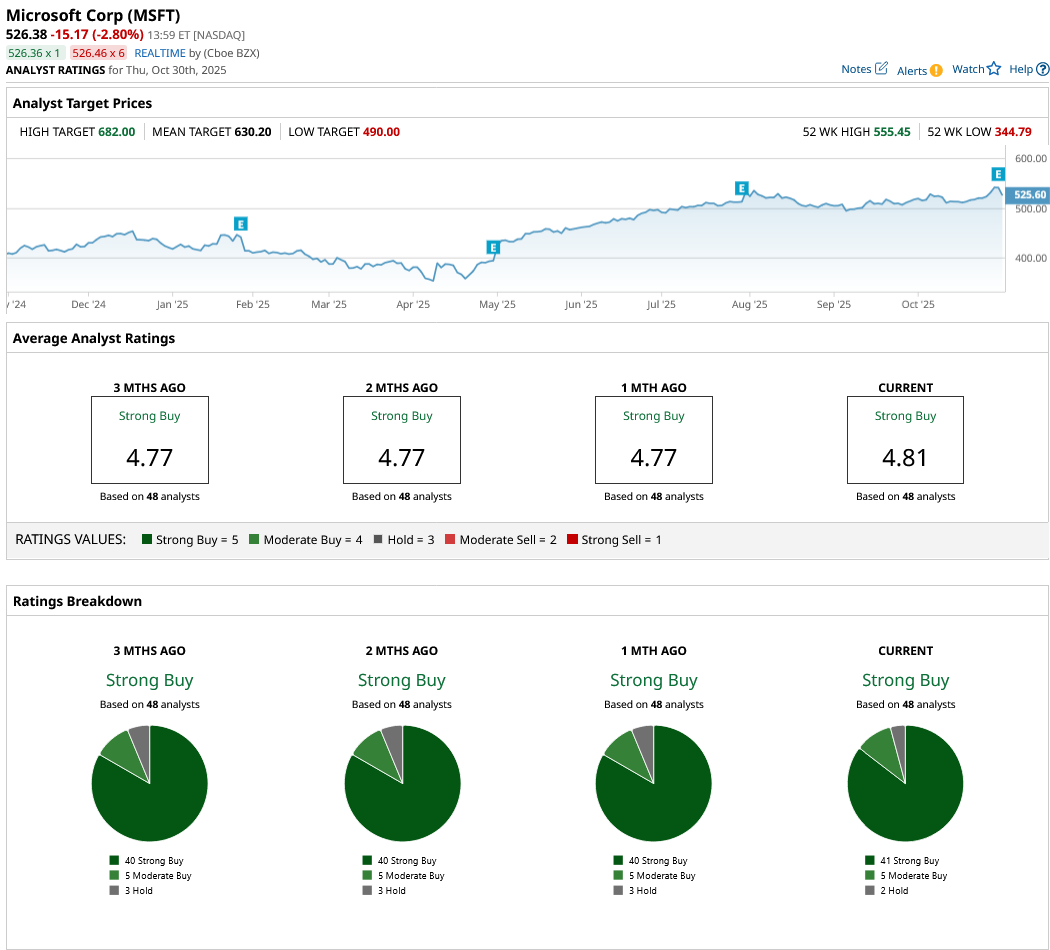

In the last 10 years, MSFT stock has returned over 900% to shareholders. Despite these outsized returns, analysts remain bullish on the tech giant. Out of the 48 analysts covering MSFT stock, 41 recommend “Strong Buy,” five recommend “Moderate Buy,” and two recommend “Hold.” The average MSFT stock price target is $630, above the current price of around $526.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Fiserv Stock’s 44% Single-Day Plunge Proves That Stop Orders Don’t Work, But This Option Strategy Could Have Prevented the Carnage

- 1 Fintech Stock Under $400 to Buy and Hold Forever

- 'Our GPUs Are Everywhere’ According to CEO Jensen Huang as Nvidia Doubles Down on AI, Quantum, and 6G

- Chipotle Stock Is Plunging. Should You Buy the Dip Today?