Finnish network infrastructure company Nokia Oyj (NOK) has announced that it will collaborate with the Trump administration to invest $4 billion to expand R&D and manufacturing in the U.S. This is in addition to Nokia’s $2.30 billion investment in U.S. manufacturing as part of its Infinera acquisition. The investment is expected to strengthen the company’s artificial intelligence (AI) optimized networking solutions in the country.

In light of this development, we take a deeper look at Nokia.

About Nokia Stock

Nokia Oyj specializes in network infrastructure, cloud services, and technology licensing. It provides mobile, fixed, and cloud-based network solutions globally, including 5G, optical, and IP routing networks. The firm also develops software for automation, security, and network management, while licensing patents and innovations to other tech companies.

Headquartered in Espoo, Finland, Nokia supports extensive research and development efforts worldwide, focusing on advancing telecommunications and network technologies. The company’s strategic efforts aim to lead in the AI-driven transformation of networks and 6G, ensuring sustainable growth and innovation. The company has a market capitalization of almost $34 billion.

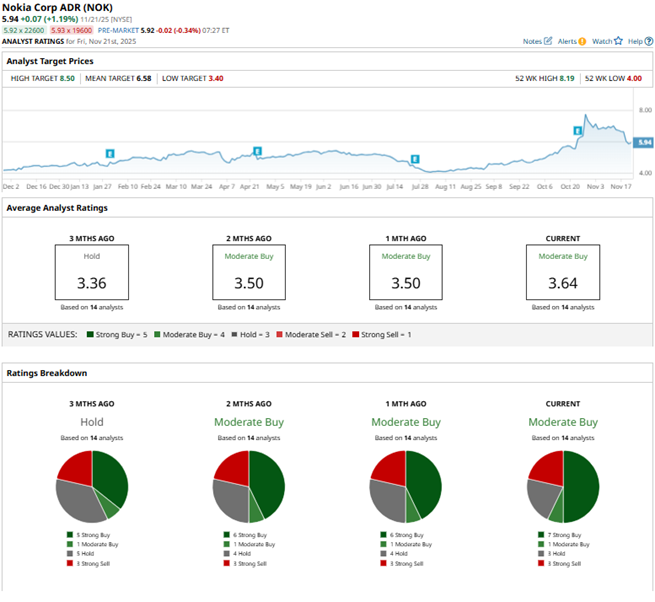

Positive market sentiment has driven Nokia’s stock performance on Wall Street. Over the past 52 weeks, the stock has gained 43.71%, while it is up 39.4% over the past three months. On Oct. 28, the stock reached a 52-week high of $8.19, but it is down 35.15% from that level.

The stock surged after NVIDIA (NVDA) took a $1 billion equity stake in the company. Alongside the capital infusion, NVIDIA and Nokia also partnered to integrate Nokia’s networking technologies with NVIDIA's robust chip architecture.

Also, Nokia is trading at a cheap valuation. Its price-to-sales ratio of 1.37x is lower than the industry average of 3.20x.

Nokia’s Third-Quarter Results Topped Estimates

For the third quarter of fiscal 2025, Nokia reported adjusted net sales of €4.83 billion ($5.56 billion), up 12% year-over-year (YOY). This was also higher than the €4.60 billion ($5.30 billion) net sales that a forecast had predicted.

The top line growth was primarily driven by Nokia’s network infrastructure revenue, which increased 28% from the year-ago value to €1.95 billion ($2.25 billion). On the other hand, the company’s net sales from mobile networks declined modestly by 1% YOY to €1.84 billion ($2.12 billion).

The profitability trajectory showed some weakness, as Nokia’s adjusted gross margin dropped by 150 basis points YOY to 44.2%. The company’s adjusted operating profit declined by 10% from the prior year’s period to €435 million ($500.76 million), but this was higher than the Bloomberg estimate of €324.20 million ($373.20 million). Adjusted EPS remained flat annually at €0.06.

Following a strategic review, Nokia decided to scale down its passive venture investments, as they do not align with the company’s strategy. As a result of this change, Nokia’s fiscal 2025 comparable operating profit guidance changed from a range of €1.60 billion ($1.84 billion) - €2.10 billion ($2.42 billion) to a range of €1.70 billion ($1.96 billion) - €2.20 billion ($2.53 billion).

Wall Street analysts have a mixed view about Nokia’s bottom-line trajectory. For the current fiscal year, its EPS is expected to drop by 25.6% YOY to $0.32. On the other hand, for fiscal 2026, the company’s EPS is projected to increase by 25% annually to $0.40.

What Do Analysts Think About Nokia’s Stock?

In October, analysts from Jefferies upgraded Nokia’s stock from “Hold” to “Buy,” citing the company’s heightened exposure to AI-driven data center demand. Jefferies analysts believe Nokia is transitioning from a predominantly radio-access-centric business to one with greater AI exposure. The brokerage also expects Nokia’s gross margin to grow to 45% in 2026 and 46% in 2027.

In the same month, JPMorgan analysts, led by Sandeep Deshpande, maintained an “Overweight” rating on Nokia’s stock and raised the price target from $6 to $7.10, reflecting continued confidence in the company’s stock.

Nokia has become quite popular on Wall Street, with analysts awarding it a consensus “Moderate Buy” rating overall. Of the 14 analysts rating the stock, seven analysts have given it a “Strong Buy” rating, one analyst rated it “Moderate Buy,” three analysts are playing it safe with a “Hold” rating, while three recommended “Strong Sell.” The consensus price target of $6.58 represents 8.58% upside from current levels. The Street-high price target of $8.50 indicates a 40.26% upside.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart