Covered call exchange-traded funds (ETFs) are not new. But the obsessive buying behavior and “can’t miss” attitude investors have developed around them is.

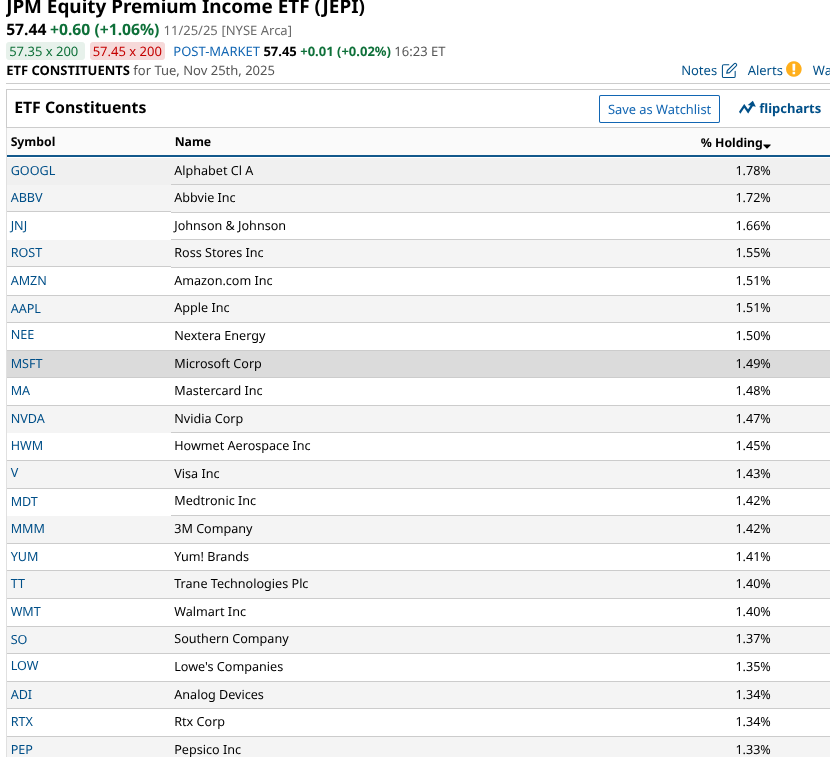

These ETFs have a simple premise.They buy a basket of stocks, either based on an index or active management. That gives them equity-like returns but also equity-like risk. And, since major stock indexes typically produce dividend yields of under 2% these days, a generation of investors seeking retirement income and or other cash flow have flocked to these products.

The question I’ve been asking for a few years now is why?

It’s not like I am unfamiliar with the space. Heck, I managed a few mutual funds earlier this century that used equity-option combination techniques.

But there’s one thing I never really considered about the investing public back then, a time when using options within an ETF or even a mutual fund was more like a zebra than a horse. Covered call funds have been around for decades, although many were in closed-end and mutual fund form. And they never caught on like the current crop of ETFs have. Not even close.

If there were a senator among covered call ETFs, one of their own that represents a covered call ETF nation, so to speak, it would be the JPM Equity Premium Income ETF (JEPI). It didn’t put JPMorgan’s asset management division on the map. But it has become one of its asset-gathering stars.

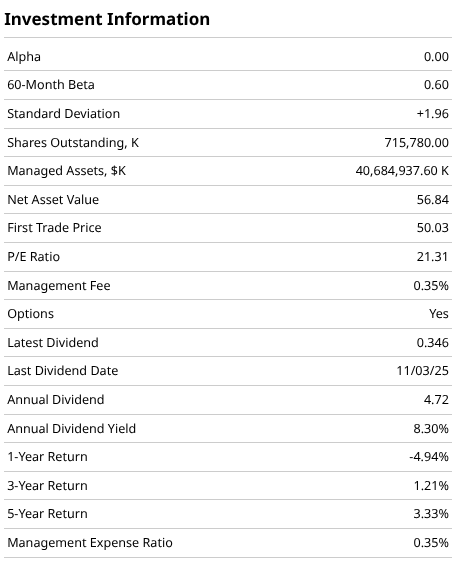

How did it get to around $50 billion in assets at one point, and still manage around $40 billion today? I point to three reasons, one of which might elicit some disparaging reactions. But that’s not what I am aiming for.

- JEPI had a great year in 2022, as its active stock selection added some value in a down market for stocks and bonds, the first of that kind in a long time. The ETF dropped only 3%, well ahead of the S&P 500 Index ($SPX). And while JEPI is an active ETF, its large-cap equity base makes that at least a distant peer. Investors love to run after what just did well, so 2022 was the start of a multi-year period in which JEPI raked in assets.

- That spawned interest in that sub-segment of the ETF space, and it led to a bevy of new entrants, and a rising tide lifted all covered call ETF boats. It also bolstered others. At another site where I provide market and ETF analysis, JEPI and its ilk are the favored sons. And daughters, nephews, and cousins. Retail investors seemingly can’t get enough of them.

- Marketing dollars. Because JPMorgan is as close to the pulse of what works on Wall Street as any firm, JEPI became something like a “Band Aid” to what is technically an adhesive bandage.

Is JEPI Still a Good ETF?

You’re probably already anticipating my usual boring response to this question. And you’re going to get it. It depends on what role you want it to play within your more complete portfolio.

JEPI has plenty going for it. Solid management that is highly experienced in the space, the JPMorgan brand and financial muscle behind it, a track record, and the attraction that leads so many to covered call ETFs. It takes an equity investment and uses its volatility to convert capital gains to regular monthly income.

Those dividends are not included in the price-only returns below. Which is a good way to identify just how vulnerable an ETF like JEPI could be if the stock price returns were much weaker, so as to trounce the income-return-generating portion.

Now, for the other side, and why I wrote this article.

There are a few things about covered call ETFs that make them so topical. Because what has worked for them so well for five years is at great risk of no longer working the same way. Namely:

- The yield on these ETFs is likely to be pressured downward. It already has been, but it could get worse. T-bill yields factor in, as they are collateral for many of these funds. Lower T-bill yields is what we appear to be getting, with the Fed on a gradual lowering path. And there’s added risk from the still-stagnant stock market beyond the biggest tech stocks. That’s where JEPI’s playground is. And it equally weights its holdings, so a big position in Magnificent 7 stocks is not likely. That could be helpful if those crash, and it would thus be an even bigger issue for covered call ETFs that track the Nasdaq-100 Index ($IUXX).

- The yield may be very lonely, with price returns fading. What many fail to realize is that funds like JEPI are really just giving up some upside in exchange for higher income yield. Covered call writing near the money will do that.

- And that’s the real rub here. There’s not much downside protection in these ETFs. Why? Because there’s not supposed to be! Sure, there’s a cushion to some extent from the option income. But when the stock market falls quickly and doesn’t get up quickly, these ETFs are writing call options well below where they were. And the upside is now capped. It is like a logistical trap.

Why Hasn’t This Been a Bigger Problem?

Very simply, if we think back over the AUM surge in covered call ETFs, we realize that while the market has dropped sharply, it got right back up every single time. That “covered” for the weakness of these funds, pun intended.

I am among a small minority of investment writers who are trying to scream about this potential risk. But frankly, it is not getting as much traction as it should. I did produce a study earlier this year that looked back at what happened to the forefathers of JEPI and the like. The closed-end covered call funds that existed during 2007-2009. That was the last time the aforementioned big risk was realized. So it is understandable that most investors today don’t think about it. Or if they do, they assign a low probability to it actually occurring.

This article is not about bashing any ETF. In fact, I have often written that covered call ETFs pair up nicely with inverse ETFs, which attack the direct risk of plunging stock prices.

It's an easy problem for risk management-driven investors to solve. But they have to want to solve it. And they have to recognize that the risk exists in the first place.

Hopefully, they will come to appreciate the risks as well as the rewards of covered call ETFs, in a way that allows them to be proactive in preventing great losses.

Rob Isbitts, founder of Sungarden Investment Publishing, is a semi-retired chief investment officer, whose current research is found here at Barchart, as well as at his ETF Yourself subscription service on Substack.

On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart