With cryptocurrency gaining traction in 2024 and early 2025, many companies pivoted to the “Bitcoin treasury” strategy, where they use proceeds from stock issuances to accumulate Bitcoin and rely on appreciation to increase the company’s value.

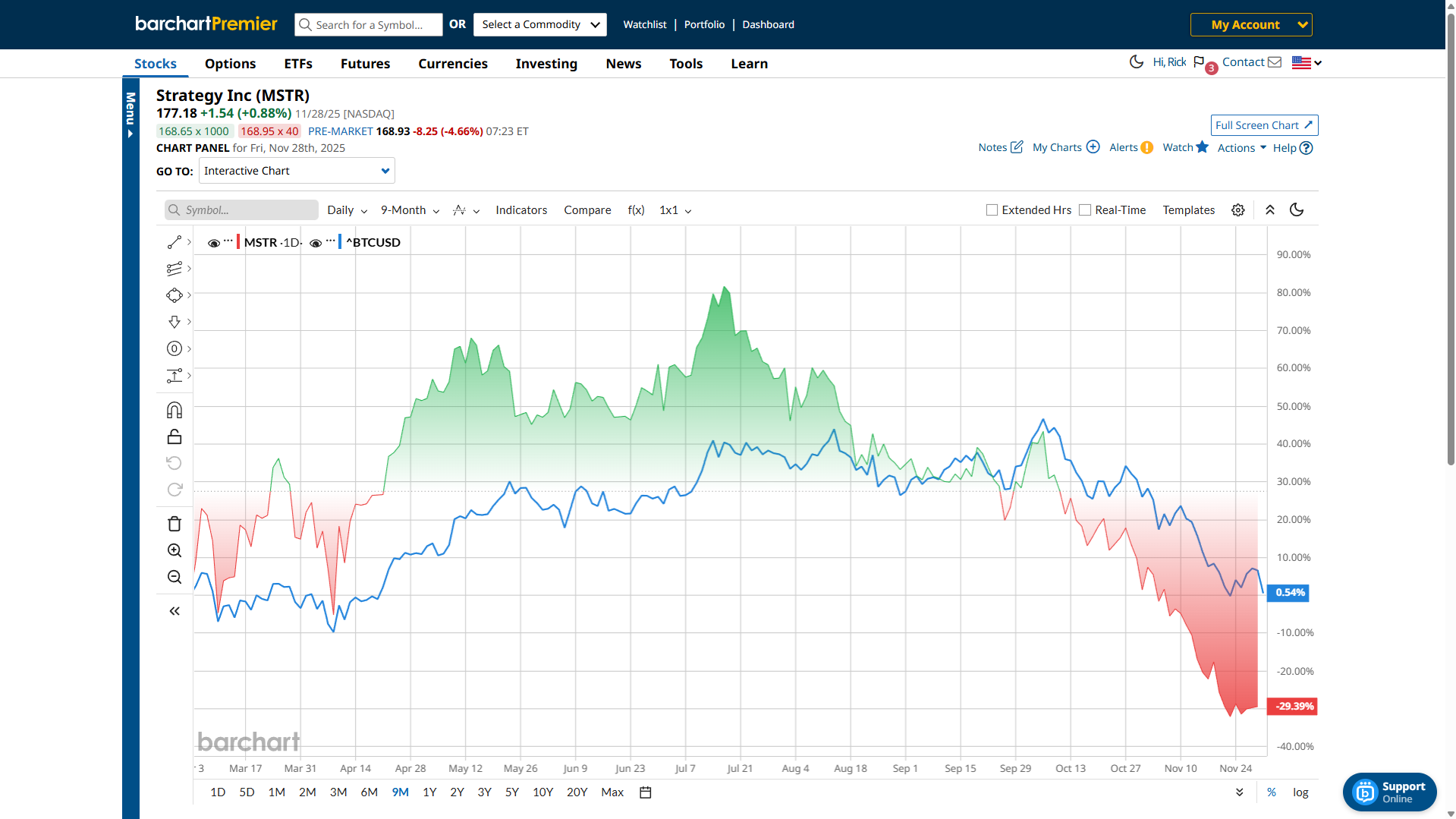

But here’s a big catch: the strategy requires Bitcoin to go up. And after reaching an all-time high of $126,184.05 on Oct. 6, Bitcoin’s price plummeted nearly 28% to $91,436.97.

As a result, these Bitcoin treasury companies saw significant sell-offs. And with Strategy Inc. being considered the de facto Bitcoin treasury stock, its price took a massive 38% dive in the last month.

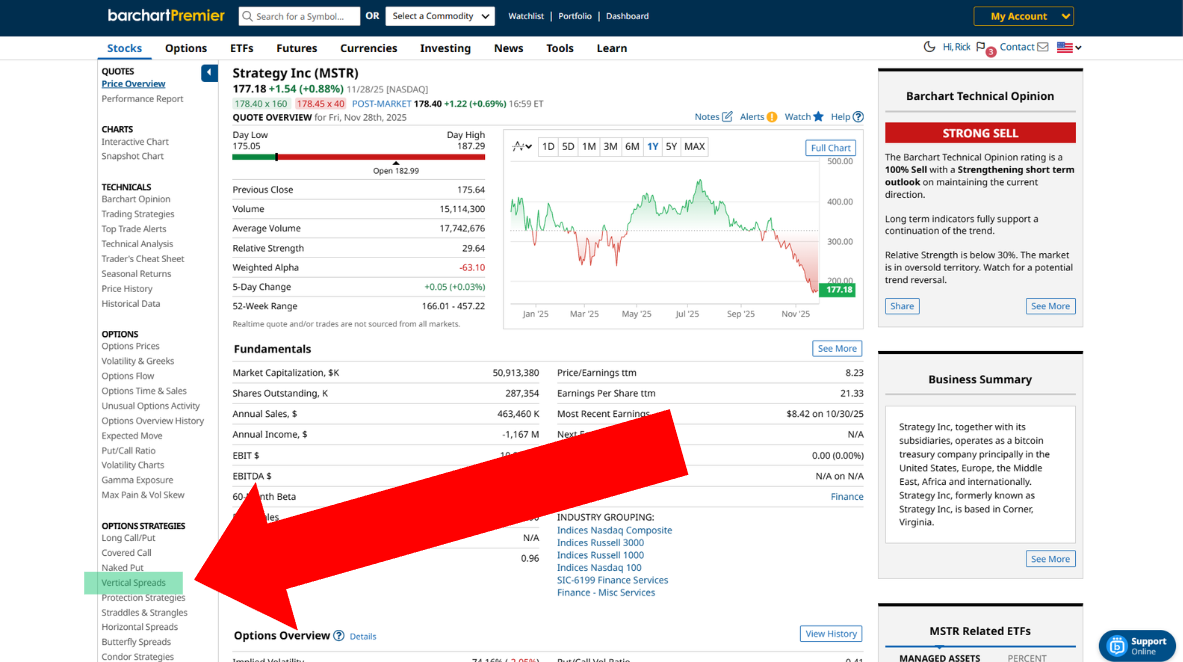

Another issue: despite its market cap, Strategy remains excluded from the S&P 500, again due to its investment fund-type operations.

It also doesn’t help that MSCI is considering removing Strategy from its index for the same reason. The deliberations are expected to yield results by January 15.

Even worse, another selloff is underway in pre-market trading with MSTR set to open around $169, down from $177 at the last close.

So it’s fair to say that Strategy is firmly in bearish territory, primarily due to macro headwinds and its deep exposure to crypto.

Now, if you want to take advantage of that setup that doesn’t carry the absurd risk of shorting a stock, then the bear call spread is your way to go.

Bear Call Explained

A bear call, also known as a short call spread or call credit spread, is a strategy that involves buying a call option at a higher strike price than selling another call at a lower strike price. The setup produces an immediate net credit at the start of the trade, and the aim is for the underlying asset to stay below the short strike price at expiration.

The trade forms a defined spread that caps both your potential profit at the net credit and your maximum loss.

The net credit is calculated by subtracting the premium paid from the premium received. The maximum loss is calculated by subtracting the net credit from the difference between the strike prices, and this occurs if the stock trades above the long call at expiration.

As noted, a bear call tends to work best in a moderately bearish market.

Finding MSTR Bear Call Trades

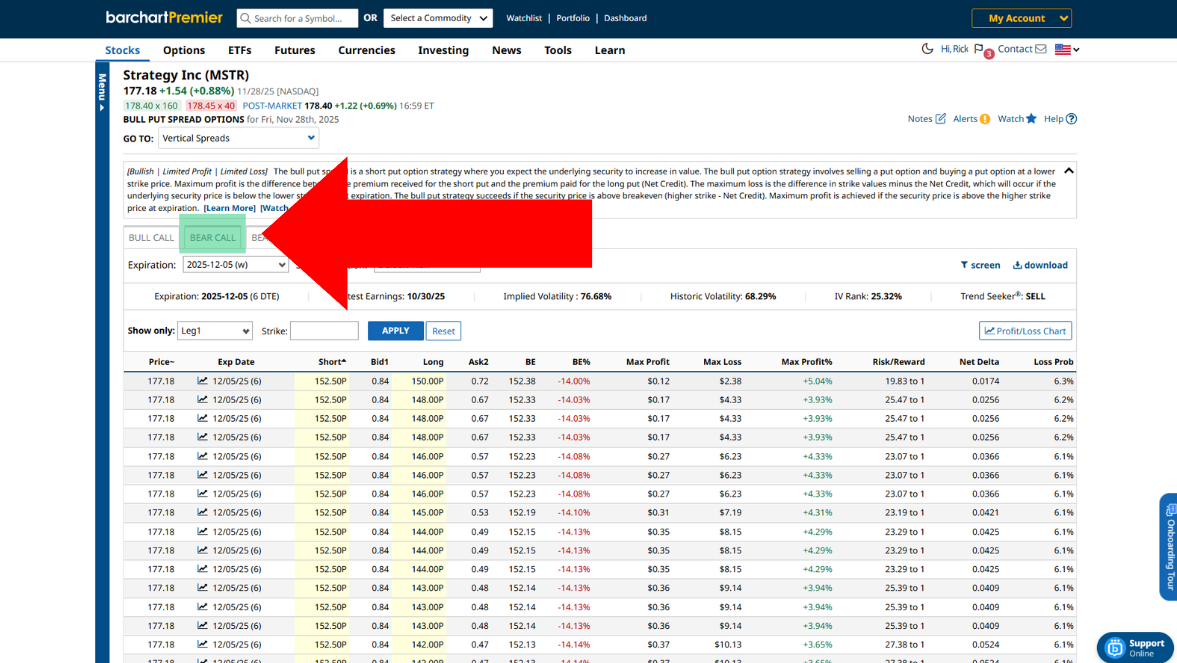

To find bear call trades, go to MSTR’s - or any stock’s or ETF’s - profile page and click Vertical Spreads, then click the Bear Call tab.

After that, you can pick and choose your preferred expiration date. When selling spreads, I’ve found that 30 to 45 days to expiration (DTE) is the optimal DTE. This gives you plenty of extrinsic value, which means richer premiums.

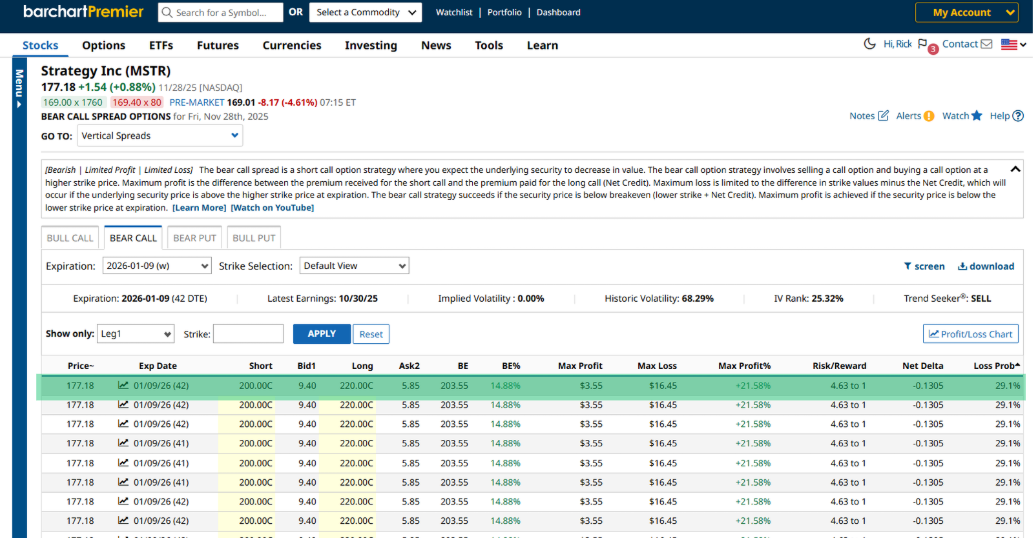

So, let’s set the expiration date to January 9, 2026, 42 days from now.

One of the best things about bear call spreads is that you sell them out of the money, i.e., with a higher long strike price than the current trading price right out the gate. That reduces the risk of losses at the end of the trade.

And on that topic, I typically choose trades with favorable risk/reward ratios and lower loss probabilities, around 30% max.

This particular trade meets my criteria nicely:

Trade Breakdown

According to the screener, you can sell a 220-200-spread bear call on MSTR and receive $3.55 per share or $355 per contract. The trade has around a 5-to-1 risk/reward ratio, a 29% chance of expiring at a loss, and has a maximum loss of $16.45. This bear call expires 42 days from now, and you can write/sell as many trades as you are comfortable with.

If MSTR trades below $200 by January 9, 2026, you will keep the entire $355 net credit per contract. If it trades above $220, you lose $1,645 per contract.

Why Choose Bear Calls Over Long Calls?

So why would you choose to sell a bear call instead of buying a long put or shorting the stock, which gives you direct, leveraged exposure?

The first and most significant reason is the difference in risk and exposure. Shorting a stock carries unlimited risk if the price rises, and long puts require a strong and timely drop in the underlying. If the selloff takes longer than expected, or if the decline is mild rather than sharp, both approaches may fall short.

A bear call, on the other hand, does not need a dramatic downside move to be profitable. It only needs MSTR to stay below the short strike price.

Second, time decay works in your favor when you sell a bear call. The option spread loses value each day. Since you collect the net credit upfront, that daily decay supports you rather than hurts you.

By contrast, a long put costs money upfront and suffers from time decay. If the stock does not decline quickly enough, the option's value can steadily erode your potential gains.

Final Thoughts

A bear call spread presents an opportunity for bearish investors with a credit, as long as MSTR stays below $200 on January 9, 2026.

However, remember that options trading always carries risk, and crypto and crypto-adjacent securities tend to be more volatile than traditional stocks. So always do your due diligence and keep an eye on market developments.

On the date of publication, Rick Orford did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart