Cincinnati, Ohio-based Cintas Corporation (CTAS) provides corporate identity uniforms and related business services. With a market cap of $74.8 billion, the company sells uniforms and work apparel, as well as entrance mats, restroom supplies, promotional products, document management, fire protection, and first aid and safety services.

Companies worth $10 billion or more are generally described as “large-cap stocks,” and CTAS perfectly fits that description, with its market cap exceeding this mark, underscoring its size, influence, and dominance within the specialty business services industry. CTAS’ growth is fueled by its ability to expand its customer base and enhance its service offerings through strategic acquisitions. Its operational excellence is evident in the improved cost efficiency of uniform rental and facility services, driving profitability and enabling investment in further growth initiatives.

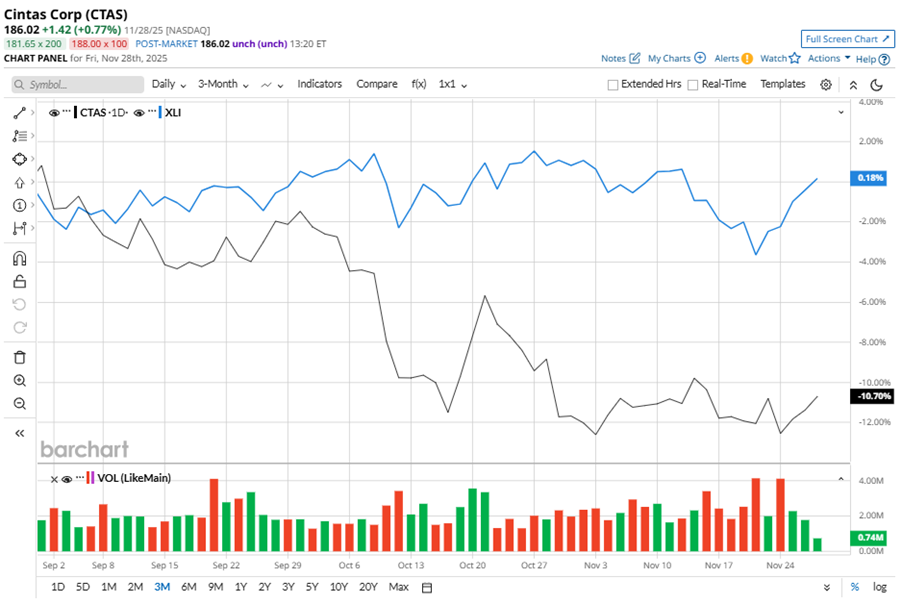

Despite its notable strength, CTAS slipped 18.9% from its 52-week high of $229.24, achieved on Jun. 6. Over the past three months, CTAS stock declined 10.7%, underperforming the Industrial Select Sector SPDR Fund’s (XLI) marginal gains during the same time frame.

In the longer term, shares of CTAS rose 1.8% on a YTD basis but dipped 17% over the past 52 weeks, underperforming XLI’s YTD gains of 16.6% and 7.3% returns over the last year.

To confirm the bearish trend, CTAS is trading below its 50-day moving average since mid-August. The stock has been trading below its 200-day moving average since late August.

On Sep. 24, CTAS shares closed down marginally after reporting its Q1 results. Its EPS of $1.20 surpassed Wall Street expectations of $1.19. The company’s revenue was $2.72 billion, beating Wall Street forecasts of $2.69 billion. Cintas expects full-year EPS to be $4.74 to $4.86, and revenue in the range of $11.1 billion to $11.2 billion.

In the competitive arena of specialty business services, UniFirst Corporation (UNF) has taken the lead over CTAS, showing resilience with a 14.9% loss over the past 52 weeks. However, UNF lagged behind the stock with a marginal uptick on a YTD basis.

Wall Street analysts are reasonably bullish on CTAS’ prospects. The stock has a consensus “Moderate Buy” rating from the 21 analysts covering it, and the mean price target of $218.18 suggests a potential upside of 17.3% from current price levels.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart