With a market cap of $76.2 billion, Minneapolis, Minnesota-based U.S. Bancorp (USB) is a financial services holding company, providing a broad range of banking and investment services across the United States. The company offers traditional banking products, lending solutions, treasury management, capital markets services, and payment processing for individuals, businesses, and government entities.

Companies valued at $10 billion or more are generally considered “large-cap” stocks, and U.S. Bancorp fits this criterion. U.S. Bancorp has a strong presence in the Midwest and West regions, serving diverse clients through digital platforms, branch locations, and specialized financial services.

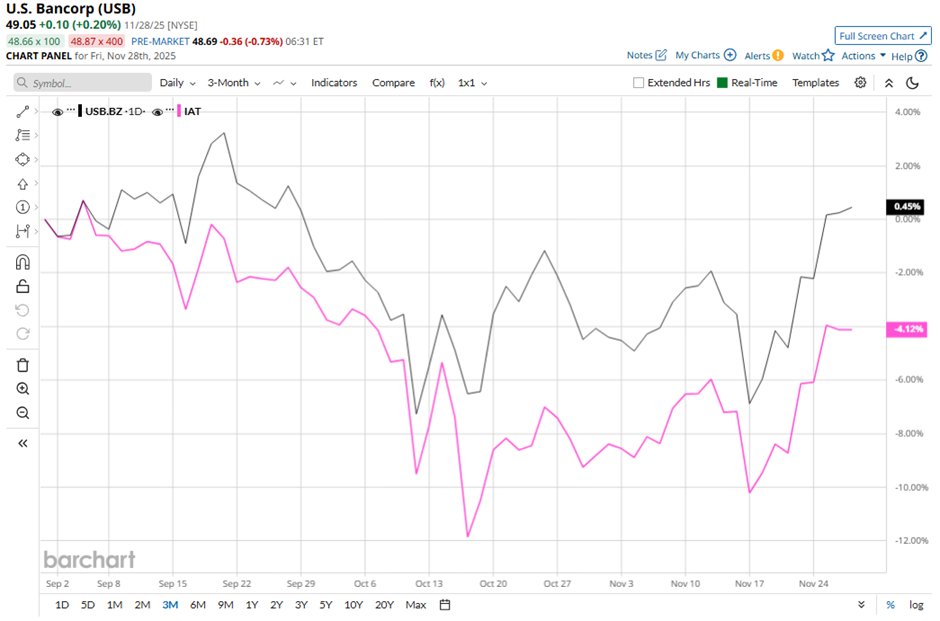

Shares of the regional banking leader are down 8.7% from its 52-week high of $53.75. USB stock has risen marginally over the past three months, outpacing the iShares U.S. Regional Banks ETF's (IAT) 3.9% drop over the same time frame.

Longer term, USB stock is up 2.6% on a YTD basis, lagging behind IAT's over 3% gain. Moreover, shares of U.S. Bancorp have dipped 8.3% over the past 52 weeks, matching the IAT's decrease over the same time frame.

Despite a few fluctuations, the stock has been trading above its 200-day moving average since July.

U.S. Bancorp reported a strong Q3 2025 profit jump of 18% on Oct. 16, with net income rising to $1.89 billion, or $1.22 per share. USB also posted robust fee income growth of 9.5%, including a 9.3% surge in capital markets fees and a 9.4% increase in trust and investment management fees. Additionally, net interest income rose 2.1% to $4.22 billion, beating management expectations. However, the stock fell 1.7% on that day.

In comparison, rival The PNC Financial Services Group, Inc. (PNC) has lagged behind USB stock. Shares of PNC Financial have fallen 1.1% on a YTD basis and 11.3% over the past 52 weeks.

Despite USB’s outperformance relative to its industry peers, analysts remain cautiously optimistic about its prospects. Among the 24 analysts covering the stock, there is a consensus rating of “Moderate Buy,” and the mean price target of $55.40 is a premium of 12.9% to current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart