Moody’s Corporation (MCO) is a premier provider of financial intelligence worldwide, structured around Moody’s Investors Service and Moody’s Analytics. The company has a market capitalization of $87.56 billion, which classifies the company as a “large-cap” stock.

Moody’s Investors Service provides impartial credit evaluations, in-depth research, and tools to assess the creditworthiness of debt securities, governments, corporations, and institutions, helping investors evaluate credit reliability.

Moody’s Analytics supplies data analysis, software platforms, forecasting models, risk mitigation tools, and consulting to empower better financial strategies. Revenue from ratings, subscriptions, and advisory fees bolsters efficient markets.

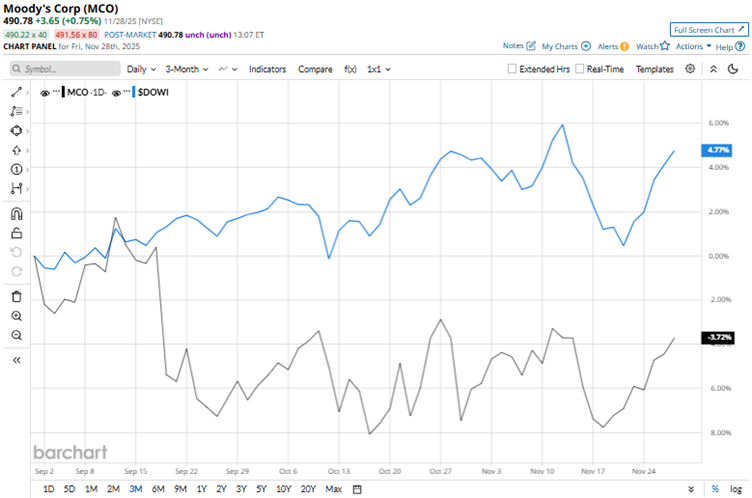

The company’s shares had reached a 52-week high of $531.93 back in February and a 52-week low of $378.71 in April. Reflecting broader market volatility and sector-specific concerns, Moody’s stock has declined by 3.7% over the past three months. On the other hand, the broader Dow Jones Industrial Average ($DOWI) is up 4.6% over the same period. Therefore, the stock has underperformed during this period.

Over the longer term, this underperformance persists. The stock has declined 2% over the past 52 weeks but gained 2.6% over the past six months. Contrarily, the Dow Jones Industrial Average has gained 6.7% and 13.3% over the same periods, respectively. The stock has been trading above its 50-day and 200-day moving averages since late November.

On Oct. 22, Moody’s reported its third-quarter results for fiscal 2025, which surpassed analyst estimates. The company’s revenue increased 10.7% year-over-year (YOY) to a record $2.01 billion. This was higher than the $1.96 billion that Wall Street analysts had expected. Its adjusted EPS was $3.92, up 22.1% annually and higher than the $3.70 that Street analysts expected.

Moody’s also raised its guidance for the current year. Now, it expects revenue to grow in the high single-digit percent range, up from its previous mid-single-digit percent guidance. The adjusted EPS guidance was raised from a range of $13.50 - $14 to $14.50 - $14.75. The stock dropped 2.5% intraday on Oct. 22, but gained 1.4% the next day.

We compare MCO’s performance with that of another credit rating firm, S&P Global Inc. (SPGI), which has dropped 4.6% over the past 52 weeks and 2.5% over the past six months. Therefore, Moody’s has outperformed S&P Global over these periods.

Wall Street analysts are moderately bullish on Moody’s stock. The stock has a consensus rating of “Moderate Buy” from the 23 analysts covering it. The mean price target of $537 indicates a 9.4% upside compared to current levels. Moreover, the Street-high price target of $620 indicates a 26.3% upside.

On the date of publication, Anushka Mukherjee did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart