Headquartered in Minneapolis, Minnesota, Target Corporation (TGT), a leading U.S. retailer renowned for its big-box stores, operates nearly 2,000 locations nationwide and offers groceries, apparel, household essentials, and more. With a focus on value, innovation, and guest experience, Target drives efficient operations as an S&P 500 component and one of America’s top retailers. The company has a market capitalization of $41.18 billion, which classifies it as a “large-cap” stock.

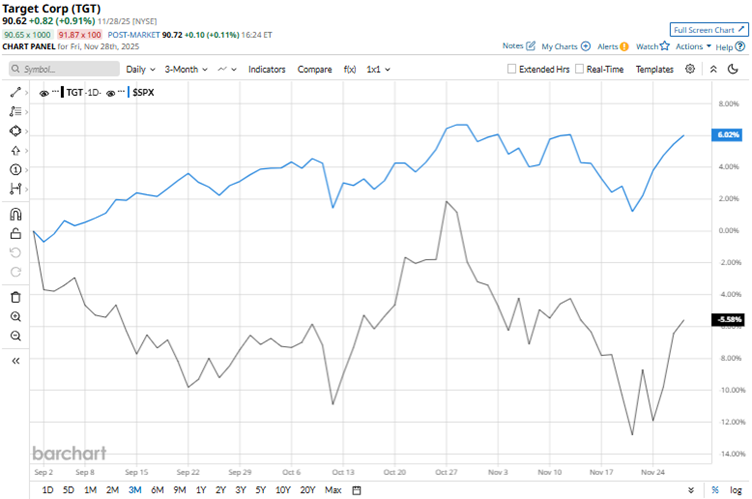

Target’s stock reached a 52-week low of $83.44 on Nov. 20, but is up 8.6% from that level. Multiple factors, including weak comparable sales, economic pressures, and an impending leadership transition, have weighed on the stock. Over the past three months, the stock has declined by 6.4%. On the other hand, the broader S&P 500 Index ($SPX) has gained 5.3% over the same period.

Over the longer term, this underperformance persists. Target’s stock has declined 30.3% over the past 52 weeks and 5.6% over the past six months. Contrarily, the S&P 500 index has gained 14.2% and 16.3% over the same periods, respectively. The stock has been trading consistently below its 200-day moving average over the past year, but is currently hovering near its 50-day moving average.

On Nov. 19, Target reported its third-quarter results for fiscal 2025 (the quarter ended Nov. 1). The company’s tepid results led to a 2.8% intraday drop in the stock on Nov. 20 and to a 52-week low. The company’s comparable sales fell 2.7%, weighed down by a 3.8% decline in comparable store sales. On the other hand, its digital channels performed well, as comparable digital sales grew 2.4%.

Target’s net sales decreased by 1.5% year-over-year (YOY) to $25.27 billion, missing the $25.36 billion figure that Wall Street analysts had expected. The company’s adjusted EPS was $1.78, down 3.9% from the prior year’s period but exceeding the $1.76 figure that Street analysts expected. For the fourth quarter of fiscal 2025, the company expects a low-single-digit decline in sales.

We compare Target’s performance with that of another discount store operator, Dollar General Corporation (DG), which has climbed 43.6% over the past 52 weeks and gained 12% over the past six months. Therefore, Target has underperformed Dollar General over these periods.

Wall Street analysts are tepid on Target’s stock. The stock has a consensus rating of “Hold” from the 36 analysts covering it. The mean price target of $100.47 indicates a 10.9% upside compared to current levels. Moreover, the Street-high price target of $135 indicates a 49% upside.

On the date of publication, Anushka Mukherjee did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart