Popular tech analyst from Wedbush, Dan Ives's optimism about the world's largest automaker, Tesla (TSLA), is seen to be believed. Not deterred even after being publicly called out by the company's mercurial CEO ("Shut up, Dan") earlier this year, Ives continues to shout from the rooftops that the company will be the undisputed winner in the autonomous AI and robotics battle in the coming years.

In a recent note, Ives made his bullish case clearer, stating, "We expect an accelerated Robotaxi launch across the U.S., with, importantly, volume production of Cybercabs starting in the April/May timeframe. In a nutshell, we believe Tesla is taking major steps in advancing its AI Revolution path with autonomous and robotics front and center heading into 2026 that will be a game changer and define Tesla's future."

Ives went on to say that a $2 trillion, even a $3 trillion market cap, is on the anvil for Tesla in 2026.

But should Ives's perception about Tesla be enough to nudge investors to add Tesla to their portfolios? Or, is there more to consider before taking the plunge on a stock that has had a topsy-turvy year so far and is up just 18% on a year-to-date (YTD) basis? Let's find out.

Not Sorted, But Financials Still Strong

Tesla may have been going through a rough patch due to intense competition from Chinese upstarts, domestic players, and regulatory tangles, yet the EV leader has continued to maintain a stable financial position.

Tesla's most recent quarter came in with the familiar two-sided report. The top line topped what analysts had on their sheets, but the bottom line shrank for the third year-over-year (YoY) stretch running. Sales grew 12% to $28.1 billion, and the push came mostly from the pieces outside of straight vehicle deliveries. Energy storage and generation shot up 44% to $3.4 billion, and services added 25% to hit $3.5 billion. The automotive side, still the biggest revenue contributor, only rose 6% to $21.2 billion, helped by a rush of orders right as the $7,500 federal credit disappeared.

Meanwhile, EPS landed at $0.50, down 31% and under the $0.56 the Street wanted. Cash from operations kept coming in strong at $6.2 billion, and the company had a $41.6 billion cash balance, with just $1.9 billion in short-term debt, signifying a strong liquidity position.

Finally, deliveries were 497,099 vehicles, 7% above last year's quarter, but production came down 5% to 447,450 units. That extra space between what gets built and what gets sold shows demand isn't running smoothly, and the company is holding some stock on purpose as more players crowd the EV field.

Musk Remains Convinced; Should You?

Some call him a visionary, while some label him too volatile to run a trillion-dollar market cap company. But the reality is that the Elon Musk cult is real. However, unlike many cults, Musk has proven his credentials. He became CEO of the company in 2008, and the stock IPOed in 2010. Since then, from a market cap of around $2 billion, Musk has grown Tesla to a company having a market cap of $1.53 trillion currently. That is a rise of 750 times, making Tesla one of the greatest wealth generators of this century. Unsurprisingly, Musk was rewarded with a $1 trillion pay package to take the company to new heights recently.

And the maverick remains convinced about robotaxis and humanoid robots, i.e., Cybercabs and Optimus, respectively. Notably, Cybercab production is slated to kick off in April 2026, and Elon Musk has laid out ambitions for an annualized run rate reaching 3 million vehicles over the following 24 months. At a projected build cost of around $30,000 per unit and operating expenses of $0.20 to $0.40 per mile, the vehicle should undercut rivals like Waymo from Alphabet (GOOG) (GOOGL) and Zoox, backed by Amazon (AMZN), on total ownership economics. Those savings stem largely from a lighter sensor suite, trimming reliance on expensive LiDAR and radar arrays, while leaning more heavily on Tesla's AI hardware, including the next-generation inference chips produced by Samsung (SMSN.L.EB) and TSMC (TSM) alongside onboard computing systems.

Turning to Optimus, Musk has gone on record suggesting the humanoid program could eventually account for as much as 80% of Tesla's enterprise value, premised on shipping 10 billion units long-term. The near-term roadmap calls for scaling to 1 million robots per year by late 2026, targeting factory costs near $20,000 and retail pricing in the $20,000–$30,000 band.

However, irrespective of Musk's track record, there is also the truth about timeline misses from the company. Further, these are all projections for the moment, and Tesla must deliver something of substance in the near future so that the company can convince shareholders again that it can achieve its lofty ambitions.

Further, sky-high valuations also do not help. Tesla is trading at a bubble-like forward P/E, P/S, and P/CF of 356.21, 16.08, and 115.25, significantly higher than the sector medians of 17.76, 0.98, and 11.88, respectively. Even the forward PEG of 8.55 is considerably higher than the sector median of 1.82, implying that Tesla's strong growth forecasts don't justify its present valuation.

Analyst Opinion on TSLA Stock

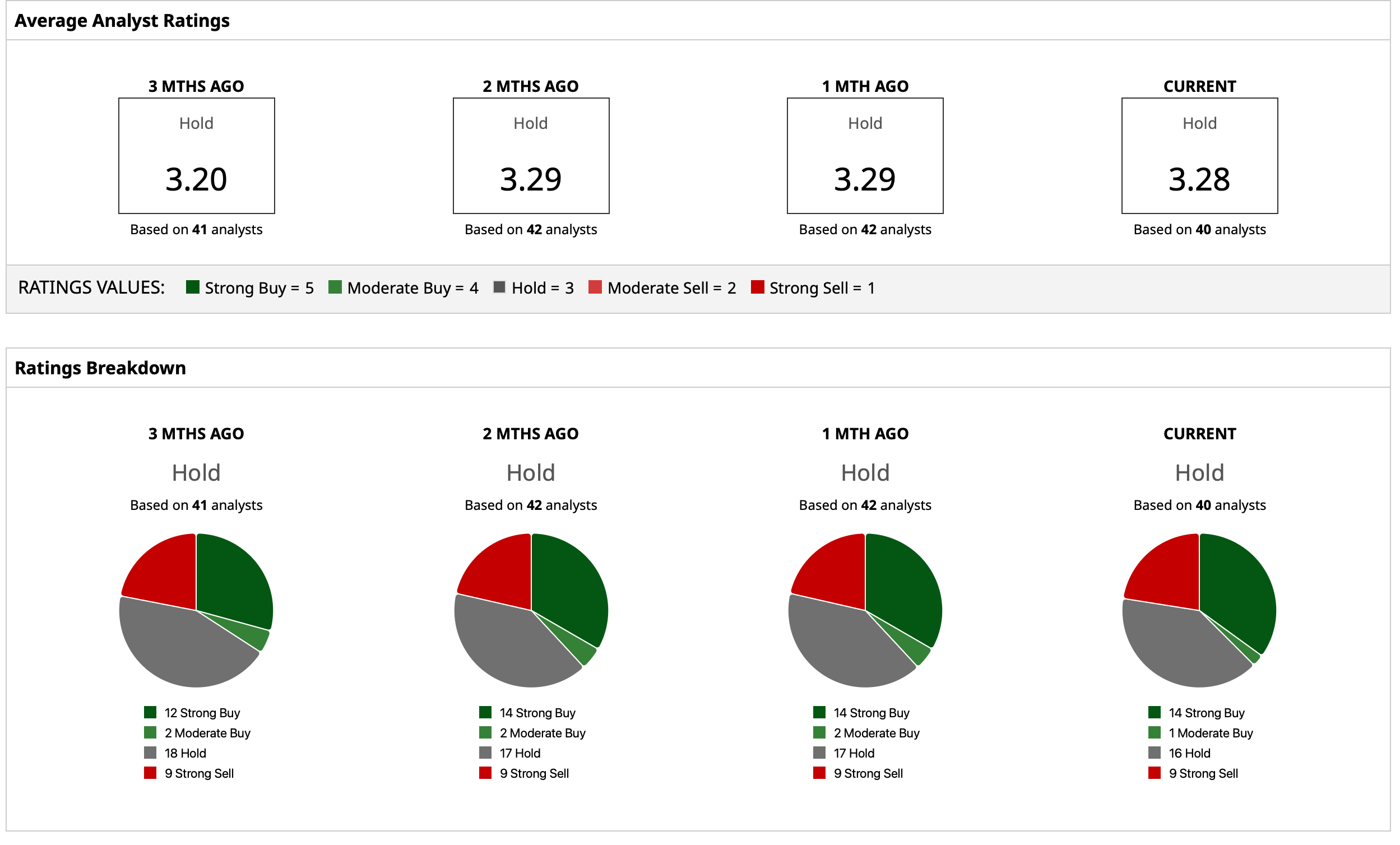

All this has led to the analysts earmarking an overall rating of “Hold” for the stock, with a mean target price that has already been surpassed. The high target price of $600 denotes upside potential of about 26% from current levels. Out of 40 analysts covering the stock, 14 have a “Strong Buy” rating, one has a “Moderate Buy” rating, 16 have a “Hold” rating, and nine have a “Strong Sell” rating.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart