With a market cap of $9.1 billion, Bio-Techne Corporation (TECH) is a global life sciences company that develops, manufactures, and sells reagents, instruments, and services for research, diagnostics, and bioprocessing markets. The company operates through two segments: Protein Sciences and Diagnostics and Spatial Biology.

Companies valued less than $10 billion are generally classified as “mid-cap” stocks, and Bio-Techne fits this criterion perfectly. The company’s offerings support applications ranging from protein analysis and molecular diagnostics to oncology and genetic research.

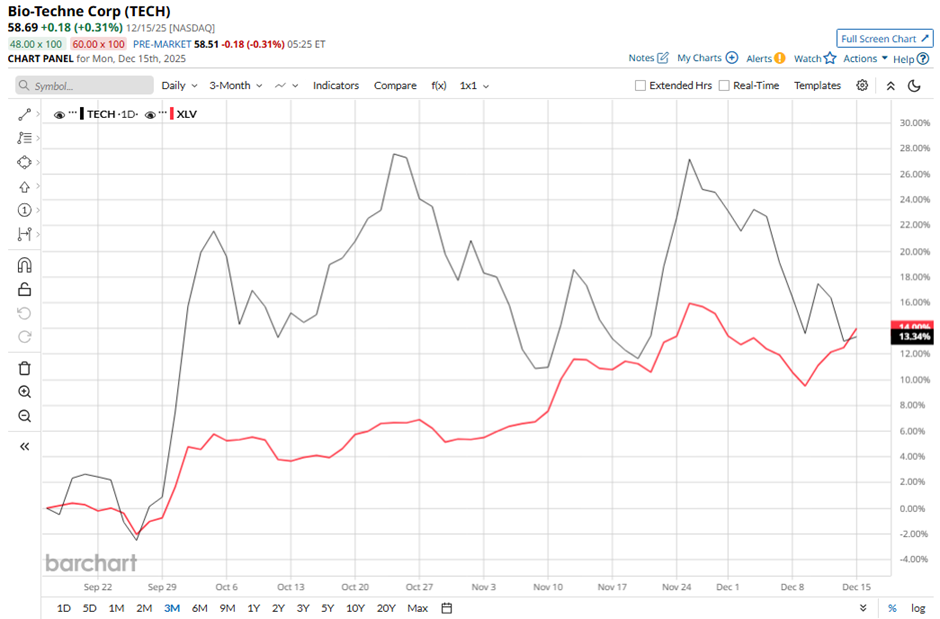

Shares of the Minneapolis, Minnesota-based company have decreased nearly 26% from its 52-week high of $79.28. TECH stock has increased 13.7% over the past three months, slightly lagging behind the Health Care Select Sector SPDR Fund’s (XLV) 14% gain over the same time frame.

Longer term, TECH stock is down 18.5% on a YTD basis, underperforming XLV’s 13.5% rise. Moreover, shares of the company have declined 22.5% over the past 52 weeks, compared to XLV’s 10.7% return over the same time frame.

Yet, the stock has been trading above its 200-day moving average since October.

Shares of Bio-Techne fell 1.9% on Nov. 5 after the company reported a 1% year-over-year revenue decline in Q1 2026 to $286.6 million, driven by a 3% organic decline in Protein Sciences and a 4% decline in Diagnostics and Spatial Biology. The decline reflected cell therapy timing headwinds that reduced growth by 200 basis points in Q1 and are expected to worsen to 400 basis points in Q2, along with continued biotech funding softness. Investor sentiment was further pressured by management maintaining low single-digit 2026 growth guidance.

In comparison, rival Quest Diagnostics Incorporated (DGX) has outpaced TECH stock. DGX stock has returned 22% on a YTD basis and 18.8% over the past 52 weeks.

Despite the stock’s underperformance, analysts remain bullish about its prospects. TECH stock has a consensus rating of “Strong Buy” from 15 analysts in coverage, and the mean price target of $68.58 is a premium of 16.9% to current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart