With a market cap of $22.5 billion, Ralph Lauren Corporation (RL) is a global lifestyle brand that designs, markets, and distributes premium apparel, accessories, home products, and fragrances worldwide. Its diverse portfolio includes well-known brands such as Polo Ralph Lauren, Ralph Lauren Collection, Purple Label, Double RL, Lauren Ralph Lauren, and Chaps, along with a wide range of men’s, women’s, and children’s products.

Companies valued over $10 billion are generally described as “large-cap” stocks, and Ralph Lauren fits right into that category. The company reaches consumers through department and specialty stores, directly operated retail locations, digital commerce platforms, and distinctive restaurant and hospitality concepts worldwide.

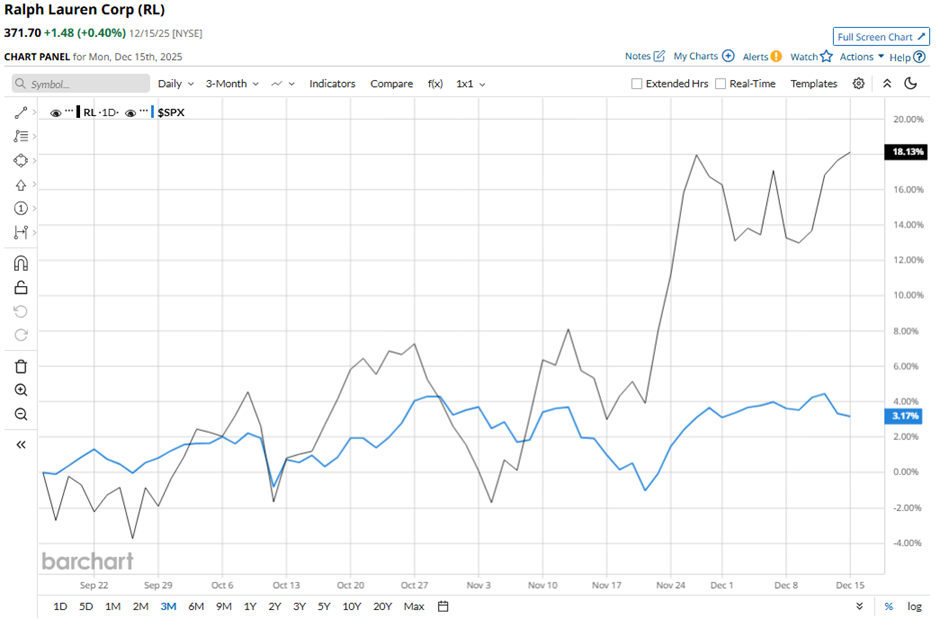

Shares of the New York-based company have fallen 1.6% from its 52-week high of $377.72. Ralph Lauren’s shares have increased 17.7% over the past three months, outpacing the broader S&P 500 Index’s ($SPX) 3% gain over the same time frame.

In the longer term, RL stock is up 60.9% on a YTD basis, surpassing SPX’s 15.9% rise. Moreover, shares of the company have climbed 63.4% over the past 52 weeks, compared to the 12.7% return of the SPX over the same time frame.

The stock has been trading above its 50-day and 200-day moving averages since last year.

Ralph Lauren posted better-than-expected Q2 2026 results on Nov. 6, with revenue up 17% reported to $2 billion and adjusted EPS rising 49% year-over-year to $3.79, well above prior-year levels. The management also raised its full-year fiscal 2026 outlook, forecasting 5% - 7% constant-currency revenue growth and 60 basis points - 80 basis points of operating margin expansion. However, the stock fell marginally on that day.

In comparison, rival Levi Strauss & Co. (LEVI) has lagged behind RL stock. LEVI stock has soared 26.8% on a YTD basis and 28.2% over the past 52 weeks.

Due to the stock’s strong performance over the past year, analysts remain bullish on RL. It has a consensus rating of “Strong Buy” from the 19 analysts in coverage, and the mean price target of $381.81 is a premium of 2.7% to current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart