Canopy Growth (CGC) shares have been in a sharp uptrend this week following reports President Donald Trump will reclassify cannabis as a “Schedule III” drug within the next few days.

Additionally, the president is also considering announcing a Medicare pilot program that would let some seniors access cannabis products at a subsidized rate.

At the time of writing, CGC shares are up a remarkable 90% versus their low in late November.

Is Canopy Growth Stock Worth Owning for 2026?

The aforementioned federal initiatives are broadly expected to prove “transformative” for cannabis stocks next year since government support could help them finally secure institutional investments.

Easing tax burden and banking restrictions will likely unlock revenue upside for the likes of CGC, and help contract their overall timeline to sustainable profitability.

That said, Canopy Growth stock also warrants an investment for reasons that go well beyond policy tailwinds.

These include its recent acquisition of MTL Cannabis for about $179 million, a transaction that’s broadly expected to grow CGC’s domestic market share and add high-margin revenue to its profile.

Investors should also note that Canopy Growth is currently trading handily above its major moving averages (50-day, 100-day, 200-day), reinforcing that bulls are in control heading into 2026.

Financials Warrant Investing in CGC Shares

Canopy Growth shares are worth owning for the strength of the company’s financials as well.

In its latest reported quarter, the Nasdaq-listed firm narrowed its adjusted EBITDA loss further to just $3 million on rising momentum in the Canadian adult-use market.

As of writing, CGC has nearly $300 million in liquidity, signaling the company headquartered in Smiths Falls is strongly positioned to pursue growth initiatives without immediate financial strain.

What’s also worth mentioning is that CGC stock has a history of starting the new year with a bang.

Since 2015, it has rallied more than 12% on average in January, which further strengthens the case for keeping exposure to Canopy Growth heading into 2026.

How Wall Street Recommends Playing Canopy Growth

Wall Street analysts remain bullish as ever on CGC shares as well.

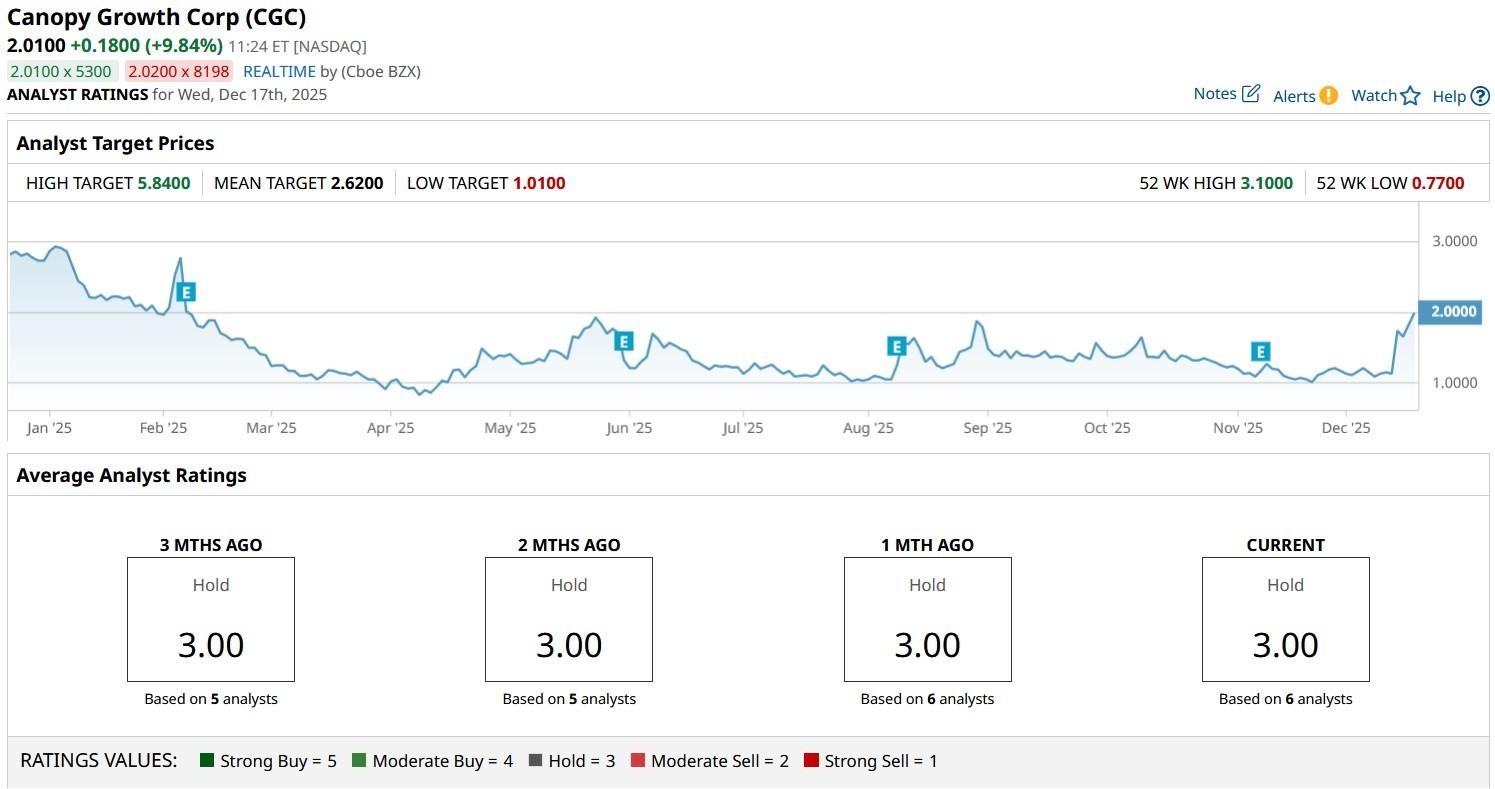

While the consensus rating on Canopy Growth stock currently sits at “Hold” only, the mean target of about $2.62 indicates potential upside of another 30% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- ‘You Didn’t Want to Be in Jamestown’: Elon Musk Warns Mars Won’t Be A Billionaire Vacation Spot; It Will Be ‘Very Dangerous’ and ‘You Might Die’

- Why You Need to Watch FedEx Stock This Week

- Dear BlackBerry Stock Fans, Mark Your Calendars for December 18

- Luminar Just Filed for Bankruptcy. This 1 Quantum Computing Stock Could Win on the News.