The AI trade is often dominated by big names, so many compelling stories stay in the background just because of their small size. As the market prices in most of the AI developments among big names, investors and fund managers look towards hidden opportunities because that is what will define performance for them heading into the new year. Synnex Corp. (SNX) is one such stock, and according to Morgan Stanley, it is one of their top “Overweight” positions.

The firm’s bull thesis is quite simple. Memory cost will be a big issue in 2026, with memory cost inflation driving up costs for OEMs like HP (HPE) and Dell (DELL). SNX benefits from how well these OEMs do because it distributes their products. But it doesn't have to worry about shrinking margins due to the higher memory costs. This way, it benefits from the AI spending, minus the drawbacks. Additionally, OEMs prefer established distributors in times of price volatility. Smaller distributors fade away amid such industry crises, which eventually helps companies like SNX consolidate their market further.

About Synnex Corp. Stock

SNX is a global IT distributor that procures, deploys, and integrates various technologies. From data centers to personal computers and smartphones, SNX’s services and products ensure crucial functions of these industries operate smoothly. It was founded in 1980 and is present in over 100 countries, with its headquarters in California, United States.

The company’s stock is “only” up 32% in the last year, comfortably above the S&P 500 Industrials' 16.92% returns. However, these returns pale in comparison to the many AI trades that have become multibaggers during the same period. This is precisely what makes the stock so attractive now.

SNX trades at a forward P/E of 11.55x, nearly 14% above its five-year average but almost half the IT sector average forward P/E of 23.8x. Compared to the trending AI stocks, this valuation is dirt cheap. But investors often step back when they look at the company’s gross margins. At 6.91%, the gross margins are nothing special. However, for a distribution business model, this is completely normal. SNX is not a hardware maker. Rather, it distributes other companies’ hardware and therefore doesn’t need to have comparable margins to many of the AI stocks in the market.

The company also has a 1.16% dividend yield. This is consistent with the 5-year average dividend yield of 1.15%, showing how the company is still going under the radar and offering decent dividend safety to investors.

Synnex Corp. Reports Strong Earnings

SNX comfortably beat earnings estimates when it last reported its quarterly earnings on Sept. 25. It reported an EPS of $3.47 against estimates of $2.89. Similar results are expected when the company next announces its results on Jan. 8. The firm expects $23.5 billion in gross billings at the midpoint. The EPS is expected to be in the range of $3.45 to $3.95.

On the earnings call, Morgan Stanley inquired about the prospects of Hyve Dynamics in Q4 and beyond. Management responded that significant growth was witnessed across the board, so it was difficult to pinpoint one factor for the outperformance. The company continues to invest in all domains, including manufacturing, engineering skills, and capacity, among other things. Management is quite optimistic about the demand drivers staying strong in Q4, so Morgan Stanley’s bullishness on the stock is justified.

What Are Analysts Saying About SNX Stock

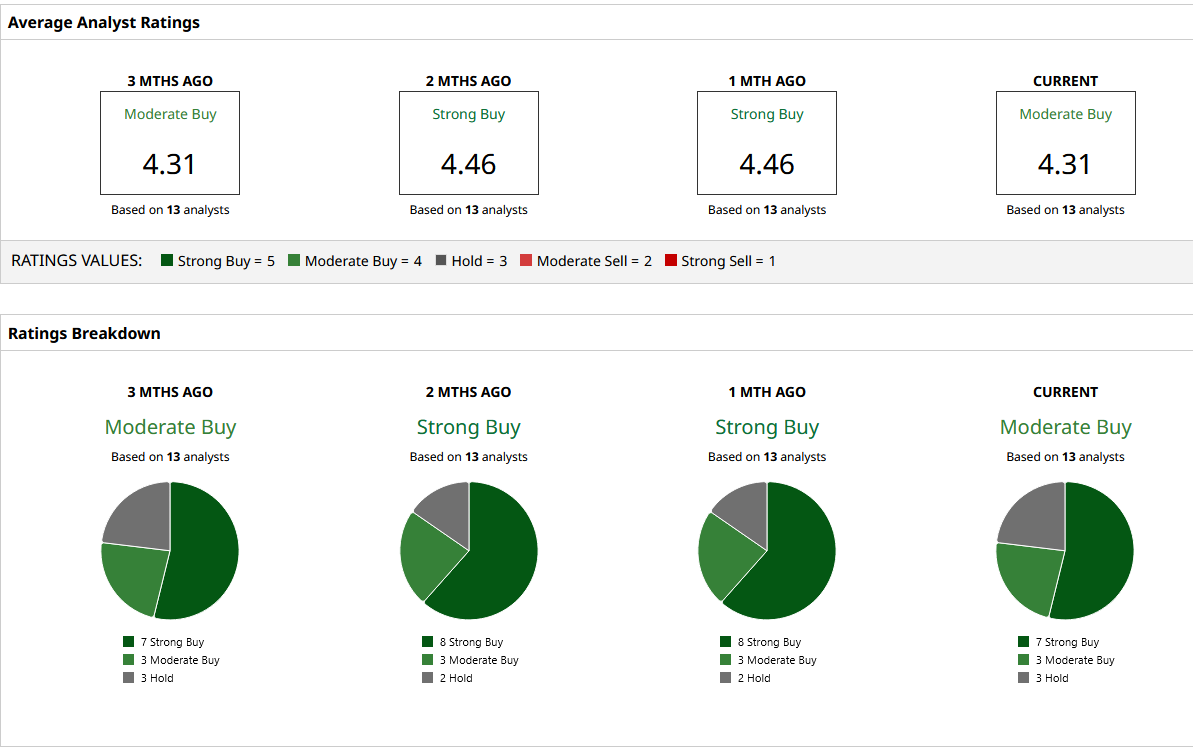

SNX stock is covered by 13 analysts on Wall Street, with just over half of them maintaining a “Strong Buy” rating. The most bullish analyst rating, with a price target of $200, suggests a 39% gain from here on. Even the mean price target of $178 offers 15% upside. After Morgan Stanley’s positive comments, investors and other Wall Street analysts may soon take notice of the stock. This would be beneficial for people who have already taken a position, especially in the first half of the year.

On the date of publication, Jabran Kundi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart