Apple (AAPL) has just dropped a game-changing artificial intelligence (AI) model that’s got Wall Street buzzing. The tech titan is racing to gain ground in the AI revolution, unveiling a breakthrough called SHARP that can instantly turn ordinary 2D photos into lifelike 3D images. The stock’s allure is shifting from phones and wearables to intelligent software and machine learning innovation.

SHARP uses a neural network to generate a 3D Gaussian representation in under a second on a standard GPU, enabling real-time, high-resolution rendering at over 100 frames per second. The model supports accurate, metric camera movements and demonstrates strong zero-shot generalization across datasets, highlighting Apple’s advancing capabilities in AI-driven 3D visualization.

While this breakthrough can meaningfully strengthen Apple’s long-term growth story, is the stock a buy at current levels?

About Apple Stock

California-based Apple continues to stand as a forward-looking company and a worldwide leader in hardware, software, and services. Its portfolio spans iconic devices like the iPhone, iPad, Mac, and Apple Watch, alongside widely used platforms such as the App Store, iCloud, Apple Music, and Apple TV+. The company currently boasts a market cap of $4.1 trillion and Magnificent Seven (MAGS) status.

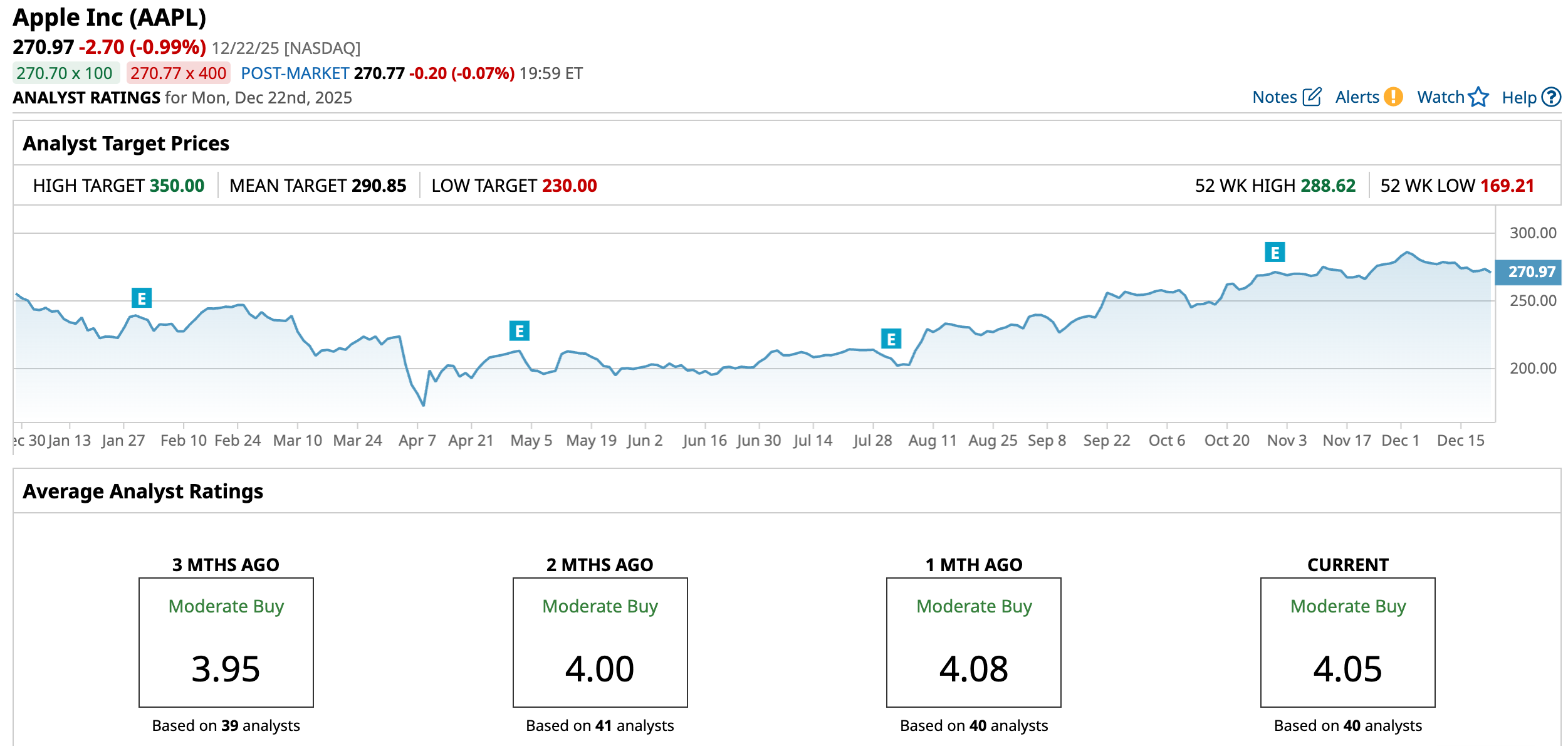

Apple’s stock has delivered a notable performance over the past year, but it remains somewhat muted compared to the highest-growth tech peers. The stock has gained 6.48% over the past 52 weeks and 8.2% year-to-date (YTD).

Additionally, it reached a fresh 52-week high of $288.62 on Dec. 3, propelled by optimism around solid iPhone sales momentum, aggressive advancements in AI integration, and robust financial forecasts for the holiday season.

The stock is trading at a premium at 33.73 times forward earnings, compared to the sector median and its historical average.

Steady Q4 Results

Apple released its fiscal Q4 2025 results on Oct. 30, for the quarter ended Sept. 27. The company reported total revenue of $102.5 billion, representing an 8% year-over-year (YOY) increase. Its earnings per share (EPS) came to $1.85, up 13% on an adjusted basis from the prior year and ahead of expectations. AAPL reported total revenue of $416.2 billion for the full year, representing 6.4% growth YOY.

In terms of business segments, the iPhone division generated approximately $49 billion in revenue for the quarter, marking a 6.1% increase and accounting for nearly half of the company’s quarterly sales. Mac revenue rose about 12.7% to $8.7 billion, while iPad revenue was essentially flat at about $7 billion. The Wearables, Home & Accessories segment also saw flat performance, around $9 billion.

Meanwhile, the Services segment achieved an all-time high of $28.8 billion, growing about 15.1% YOY.

Apple now projects revenue growth of 10% to 12% in the holiday quarter (December quarter), driven by an anticipated double-digit increase in iPhone revenue. It expects December revenue to be “best ever” for iPhone. Gross margin for the period is expected to range between 47% to 48%, while Apple also noted ongoing investments in AI and product development, highlighting that while hardware continues to anchor the business, services and ecosystem strength remain a central focus.

What Do Analysts Expect for Apple Stock?

Analysts covering Apple predict its EPS to rise by 10.4% YOY to $2.65 in the first quarter. Further, the consensus estimate of $8.11 for fiscal 2026 indicates an increase of 8.7% YOY, before improving by around 12.5% annually to $9.12 in fiscal 2027.

Recently, Jefferies raised its price target on Apple to $283.36 from $246.99 while maintaining a “Hold” rating, citing the company’s ability to withstand rising memory costs due to its high pricing power. The firm expects some volume and margin pressure in 2026 but believes a higher iPhone 18 average selling price (ASP) will help offset the impact.

Meanwhile, Morgan Stanley raised its price target on Apple to $315 from $305 and maintained an “Overweight” rating. The firm also pointed to improved iPhone shipment assumptions and continued AI investment, maintaining a favorable risk-reward outlook.

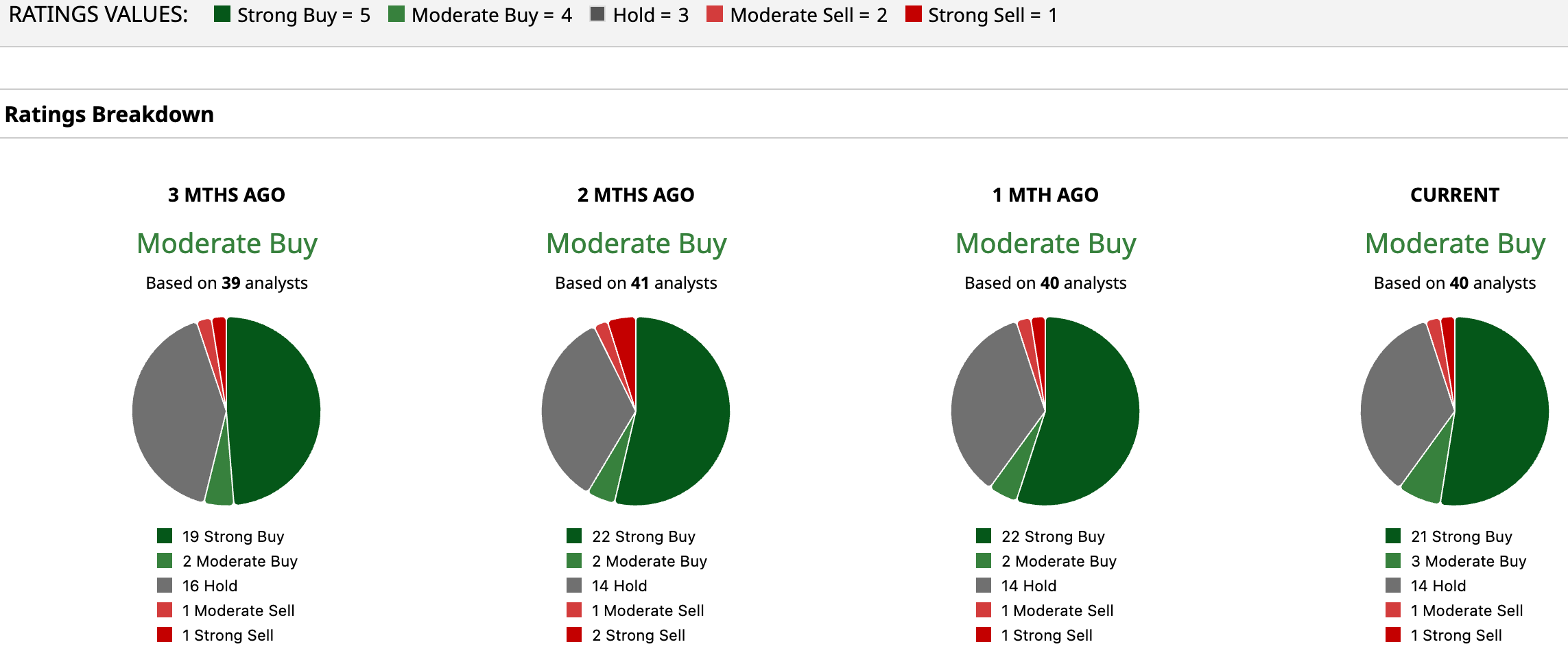

Apple stock has a consensus “Moderate Buy” rating overall. Out of 40 analysts covering the tech giant, 21 recommend a “Strong Buy,” three give a “Moderate Buy,” 14 analysts stay cautious with a “Hold” rating, one “Moderate Sell,” and one has a “Strong Sell” rating.

While the average analyst price target of $290.85 suggests an upside of 7.34%, its Street-high target price of $350 suggests as much as 29.17% upside ahead.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Wall Street Did the Math, and January 2026 Could Be a Prime Time to Buy Nvidia Stock

- This Software Stock Looks ‘Washed Out’ but Analysts Think 2026 Could Be Its Turnaround Year. Why?

- This Dividend Stock Just Scored an FDA Win. Should You Buy Shares Now?

- Top 100 Stocks to Buy: AMC Entertainment Partially Exited Hycroft Mining Earlier This Month. There’s Good News and Bad News for AMC Shareholders.