Palo Alto Networks (PANW) landed a multibillion-dollar deal last week that could reshape its competitive moat in the AI security market. The cybersecurity giant announced an expansion of its Google Cloud partnership that goes far beyond a typical vendor agreement. Palo Alto has committed to migrating key internal workloads to Alphabet's (GOOG) (GOOGL) Google infrastructure while embedding its Prisma AIRS security platform directly into Google's AI development tools and cloud services.

The deal addresses a critical market requirement revealed in Palo Alto's recent State of Cloud Report: enterprises are racing to deploy AI applications while nearly every organization experienced at least one attack on its AI infrastructure over the past year. This timing positions Palo Alto to capture an outsized share of the AI security spending wave as companies scramble to protect increasingly valuable and vulnerable AI workloads.

The partnership delivers immediate commercial traction by building on an already successful relationship that generated over $2 billion in Google Cloud Marketplace sales and established more than 75 joint integrations.

Now Palo Alto gains native integration with Google's Vertex AI platform and Gemini language models, allowing it to embed security controls directly into where AI applications are being built rather than bolting on protection after deployment.

The multibillion-dollar commitment signals strategic conviction from both companies rather than a pilot program. This suggests the potential for material revenue contribution as enterprises standardize on combined Google-Palo Alto architectures for AI security.

Let’s see whether PANW stock is a good buy given its widening AI moat.

The Bull Case for Investing in Palo Alto Networks Stock

Palo Alto Networks ended fiscal Q1 with remaining performance obligations (RPO) of $15.5 billion, an increase of 24% year-over-year (YoY). Its next-generation security annual recurring revenue rose 29% to $5.85 billion.

The company's platformization strategy continues to gain traction as customers consolidate fragmented security architectures. Management highlighted a $100 million deal with a major telecom provider that included an $85 million XSIAM commitment. It was the largest security operations platform deal in the company's history. Another notable win was a $33 million SASE contract with a federal cabinet agency, in which PANW secured 60,000 seats by displacing an entrenched incumbent.

In fiscal Q1, Palo Alto Networks reported revenue of $2.47 billion, an increase of 16% YoY. Its product sales grew by 23% as software form factors now account for 44% of trailing 12-month product sales.

The shift toward software firewalls has accelerated due to the proliferation of cloud workloads and the demand for protected multi-cloud environments. Palo Alto holds roughly 50% market share in third-party cloud firewalls with no significant competition outside individual cloud service providers.

Operating margins expanded 140 basis points to 30.2%, marking the second consecutive quarter above 30% and demonstrating improving operational leverage. Management expects to maintain at least 37% adjusted free cash flow margins in fiscal 2026, even after integrating pending acquisitions, with a path to 40% plus margins by fiscal 2028.

The company announced a $3.35 billion acquisition of Chronosphere, an observability platform that management believes addresses a gap in the AI infrastructure stack. Chronosphere has reached over $160 million in annual recurring revenue with triple-digit growth by solving observability challenges at a fraction of typical vendor costs. The platform already serves two of the top five frontier AI model providers, which indicates technical credibility at extreme scale.

Management raised its fiscal 2030 ARR target for next-generation security from $15 billion to $20 billion. The increase reflects confidence in core business momentum across SASE, which surpassed $1.3 billion in ARR and grew 34%, and XSIAM, which now serves approximately 470 customers with an average ARR exceeding $1 million per customer.

Palo Alto Networks introduced several new products, including AgentiX, which brings autonomous AI agents to security operations, and expanded its quantum-safe security offerings through a partnership with IBM (IBM).

Management expects quantum computing to drive a multi-year enterprise infrastructure upgrade cycle as organizations prepare for post-quantum cryptography requirements by 2029.

Is PANW Stock Undervalued?

PANW stock has returned over 540% to shareholders over the past decade. According to consensus estimates, the cybersecurity giant is forecast to increase revenue from $9.22 billion in fiscal 2025 (ended in July) to $16.98 billion in fiscal 2030. In this period, free cash flow is forecast to grow from $3.7 billion to $8.45 billion.

Currently, PANW trades at a forward FCF multiple of 31x, which is above its 10-year average of 23.5x. If the tech stock is priced at 25x forward FCF, it could gain 62% within the next three years.

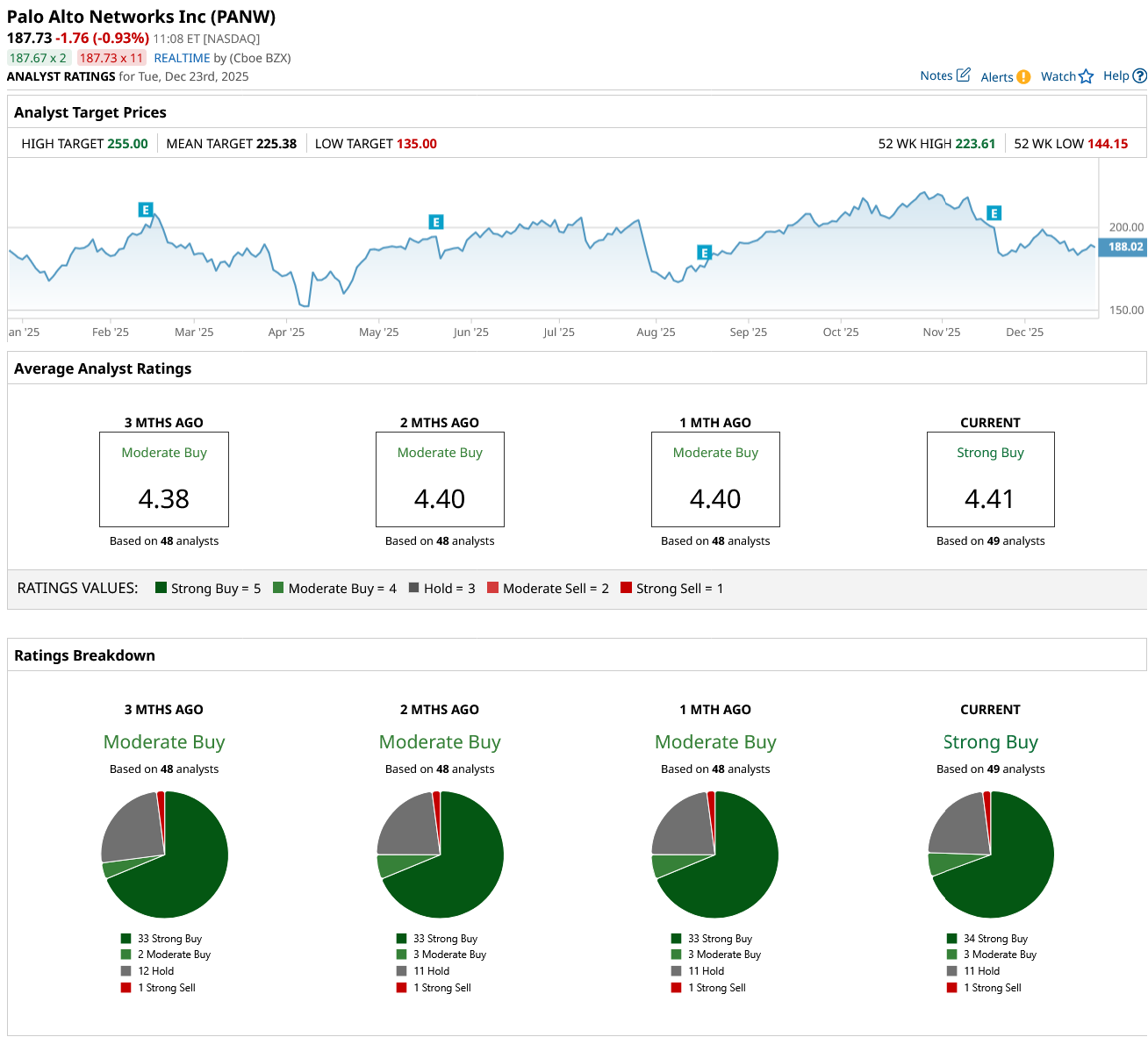

Out of the 49 analysts covering PANW stock, 34 recommend “Strong Buy,” three recommend “Moderate Buy,” 11 recommend “Hold,” and one recommends “Strong Sell.” The average PANW stock price target is $225.38, above the current price of $188.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Wall Street Did the Math, and January 2026 Could Be a Prime Time to Buy Nvidia Stock

- This Software Stock Looks ‘Washed Out’ but Analysts Think 2026 Could Be Its Turnaround Year. Why?

- This Dividend Stock Just Scored an FDA Win. Should You Buy Shares Now?

- Top 100 Stocks to Buy: AMC Entertainment Partially Exited Hycroft Mining Earlier This Month. There’s Good News and Bad News for AMC Shareholders.