This mega-cap giant, once recognized for stability rather than speed, is gradually rewriting its growth story. Walmart (WMT) is one of the world's largest retailers, with a broad network of physical stores and digital platforms that provide everyday necessities, groceries, general products, electronics, clothing, and household goods.

Valued at $915 billion, Walmart is on the verge of joining the $1 trillion market cap club. With e-commerce gaining traction and a tech-powered operating model taking hold, can Walmart reignite meaningful growth in 2026?

Positioning for 2026

In the third quarter, consolidated revenue increased by more than 6%, accounting for more than $10 billion in sales, while adjusted operating income improved by 8%. Management identified continuing market share gains, disciplined cost control, and the benefits of Walmart's omnichannel approach as significant factors. Importantly, the company boosted its full-year sales and operating income estimate, indicating that it expects to maintain pace into 2026.

E-commerce is one of Walmart's most important growth drivers. Global e-commerce sales increased by 27%, marking the eighth consecutive quarter of growth above 20%. Pickup, delivery, and advertising drove 28% of e-commerce growth in the U.S. Walmart U.S. reported comparable sales growth of 4.5%, boosted by increased traffic both in-store and online. Walmart continued to rely on price rollbacks and its “everyday low pricing” strategy to reaffirm value, as highlighted by initiatives like its Thanksgiving Meal Basket, which aims to keep staples affordable. International operations delivered over 11% sales growth, led by Flipkart, China, and Walmex.

Walmart's membership income increased 17%, driven by robust worldwide growth and double-digit gains from Walmart+ in the U.S. Net member additions in the quarter were the highest on record, emphasizing the growing importance of recurring, higher-margin income streams. The company is diversifying its earnings mix. Global advertising income increased by 53%, with Walmart Connect in the U.S. gaining 33%, excluding VIZIO. Advertising and membership fees accounted for nearly one-third of consolidated adjusted operating income in the quarter.

These higher-margin streams serve to mitigate pressure from merchandise mix and support Walmart's goal of growing earnings faster than sales. Adjusted profits rose by 6.9% to $0.62 per share.

Walmart's cash flow remains strong. The company generated $8.8 billion in free cash flow, which allowed it to reinvest while also returning capital to shareholders. Walmart returned around $13 billion in dividends and share repurchases. Walmart ended the quarter with $10.6 billion in cash and cash equivalents and a total debt of $53.1 billion.

With sustained e-commerce growth, increased overseas contributions, rising advertising and membership income, and disciplined execution, Walmart appears to be well positioned to continue its growth trajectory into 2026. Analysts estimate Walmart's earnings to rise by 5% in 2026 and another 12.9% in 2027.

What Analysts Think of WMT Stock

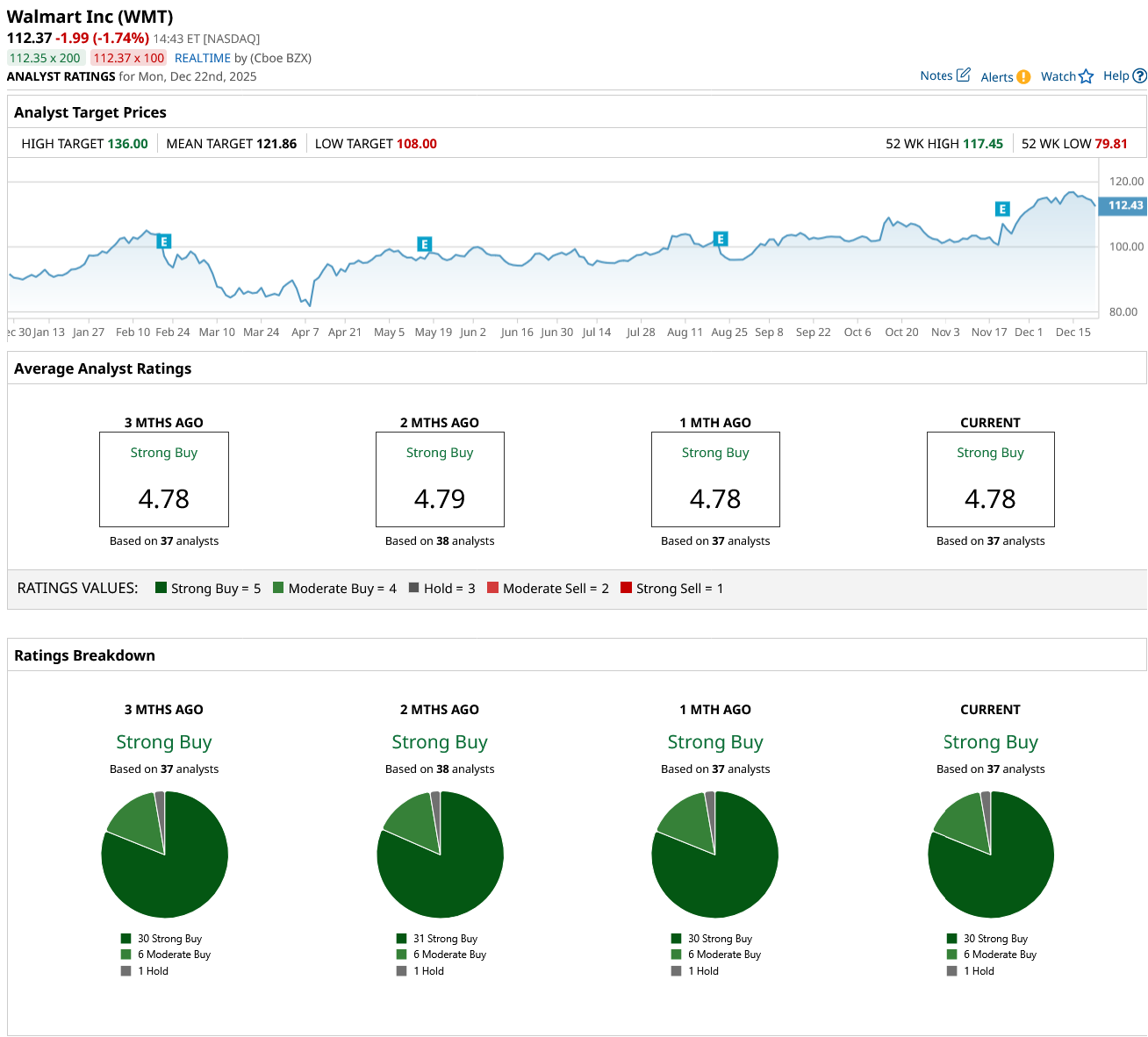

Overall, Wall Street rates WMT stock a “Strong Buy.” Out of the 37 analysts covering WMT stock, 30 have a “Strong Buy” recommendation, six rate it a “Moderate Buy,” and one suggests it’s a “Hold.” Its average price target of $121.86 suggests an upside potential of 6.8% from current levels. However, its Street-high estimate of $136 implies a potential upside of about 19% in the next 12 months.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart