Chipotle Mexican Grill (CMG) is betting big on protein. The fast-casual chain announced its first dedicated High Protein Menu launching Dec. 23. The company's target is a dietary trend that has been dominating American eating habits for the past three years. High-protein diets have become the foremost nutritional focus nationwide. Around 70% of Americans now prioritize protein intake, with over one-third increasing their consumption over the past year.

This pivot will also help the company capture the growing demographic of GLP-1 drug users who require protein-dense, smaller portions. Will this lead to a windfall for the company, or will CMG stock continue sliding down? Let's take a look.

Chipotle Can Capture New Demographics With Strategic Pricing

Chipotle's new menu features a Single Chicken Taco starting at $3.50, making high-protein options accessible at multiple price points. The High Protein Cup, essentially a side of Adobo Chicken, allows customers to add substantial protein to any existing order for a nominal fee. This can boost margins without requiring new transactions as more customers choose the add-on.

This flexibility appeals to both budget-conscious consumers and premium buyers who want to maximize their protein intake. Chipotle has collaborated with influencers like Josh Hart on a 95-gram protein burrito to spread the word among demographics who are conscious about fitness.

Furthermore, the “meat cup” strategy is a direct response to the rise of GLP-1 weight-loss medications. Users of these drugs often require smaller, protein-dense portions to prevent muscle loss while managing reduced appetites. By offering these streamlined options, Chipotle is positioning itself as a convenient partner for a demographic that might otherwise avoid its traditional 1,000-calorie burritos. If successful, this pivot could diversify Chipotle's customer base and improve transaction frequency, which has been under pressure as traffic slowed earlier this year.

Can Protein Turn Things Around for Chipotle?

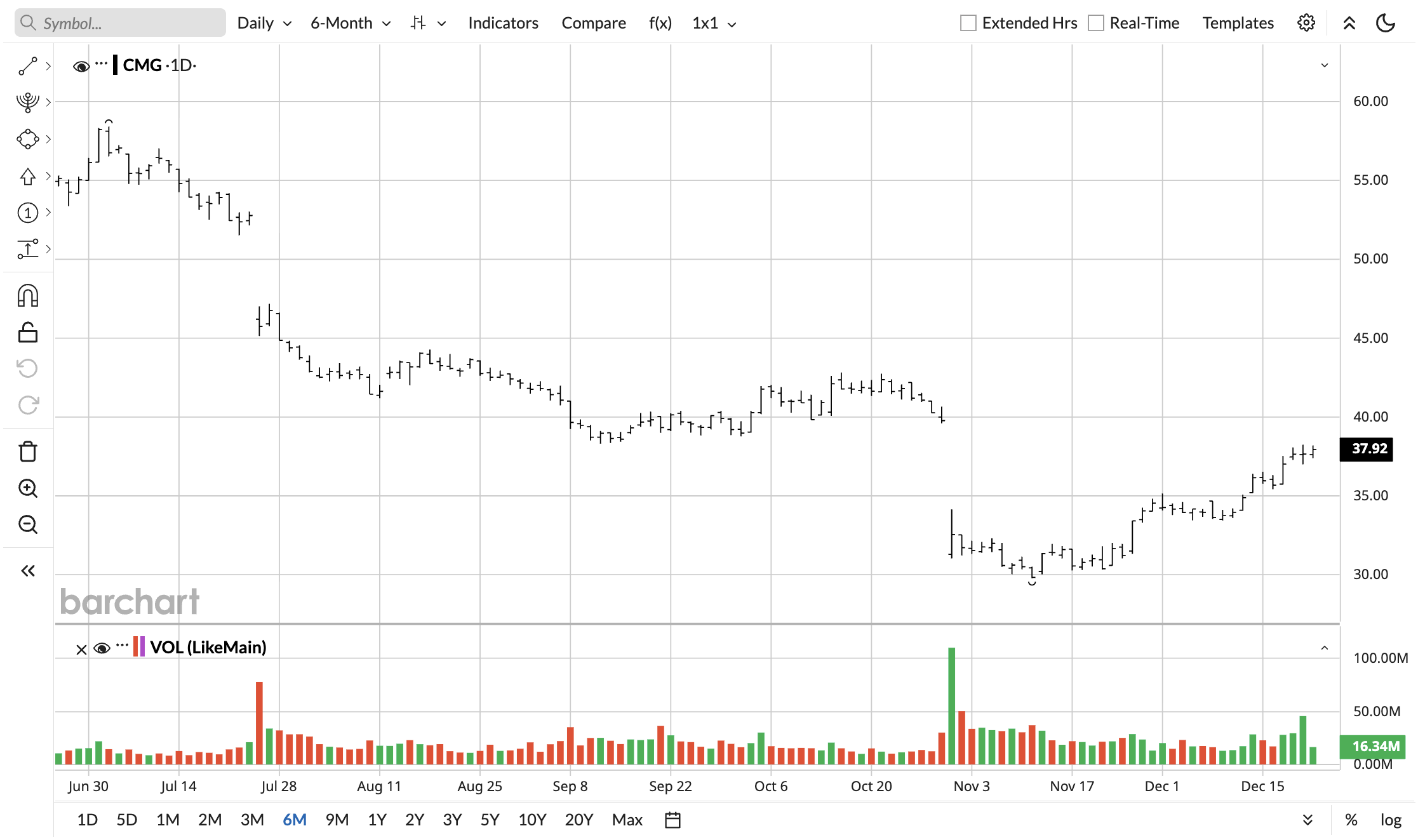

CMG stock is down 38% in the past year and was in an even worse position around November, though there has been a 27% recovery from its trough.

It'll be an uphill battle for Chipotle to sustain this recovery rally without a major improvement in the company's financials. There have been a series of downward outlook revisions that shifted the outlook from mid-single-digit growth to a low-single-digit drop in same-store sales for the full year.

It's not exactly a “Chipotle problem” and more of a nationwide affordability issue, as lower-income groups have been squeezed out of restaurants. Even middle-class folks are having trouble justifying the cost of eating out. Thus, Chipotle's going to have to fight for a larger portion of a plateauing restaurant industry if it wishes to grow.

Chipotle's protein-centric items come with higher price points and integrate well into the company's own infrastructure. This means the company can increase margins and boost sales without a large investment. Analysts think this can lead to Q1 2026 same-store sales getting a bump.

Only time will tell if this bump will be large enough to translate into a major rally for CMG stock.

Should You Buy CMG Stock Now?

CMG stock has been on a downtrend since early 2024, and multiple recovery rallies since then ended up being head fakes. Sales and earnings are currently going through a rough phase, and they are only expected to start accelerating meaningfully around 2027. Meanwhile, you are paying nearly 33 times 2025 expected earnings for a stock that is expected to report 3.57% EPS growth for the year.

Sales growth is expected to be 5.3%, and you're paying over 4 times the midpoint of 2025 expected sales. Both figures are still quite high and don't scream a discount. CMG stock only looks attractive when you take 2027 and 2028 estimates into account, but a lot can change by then.

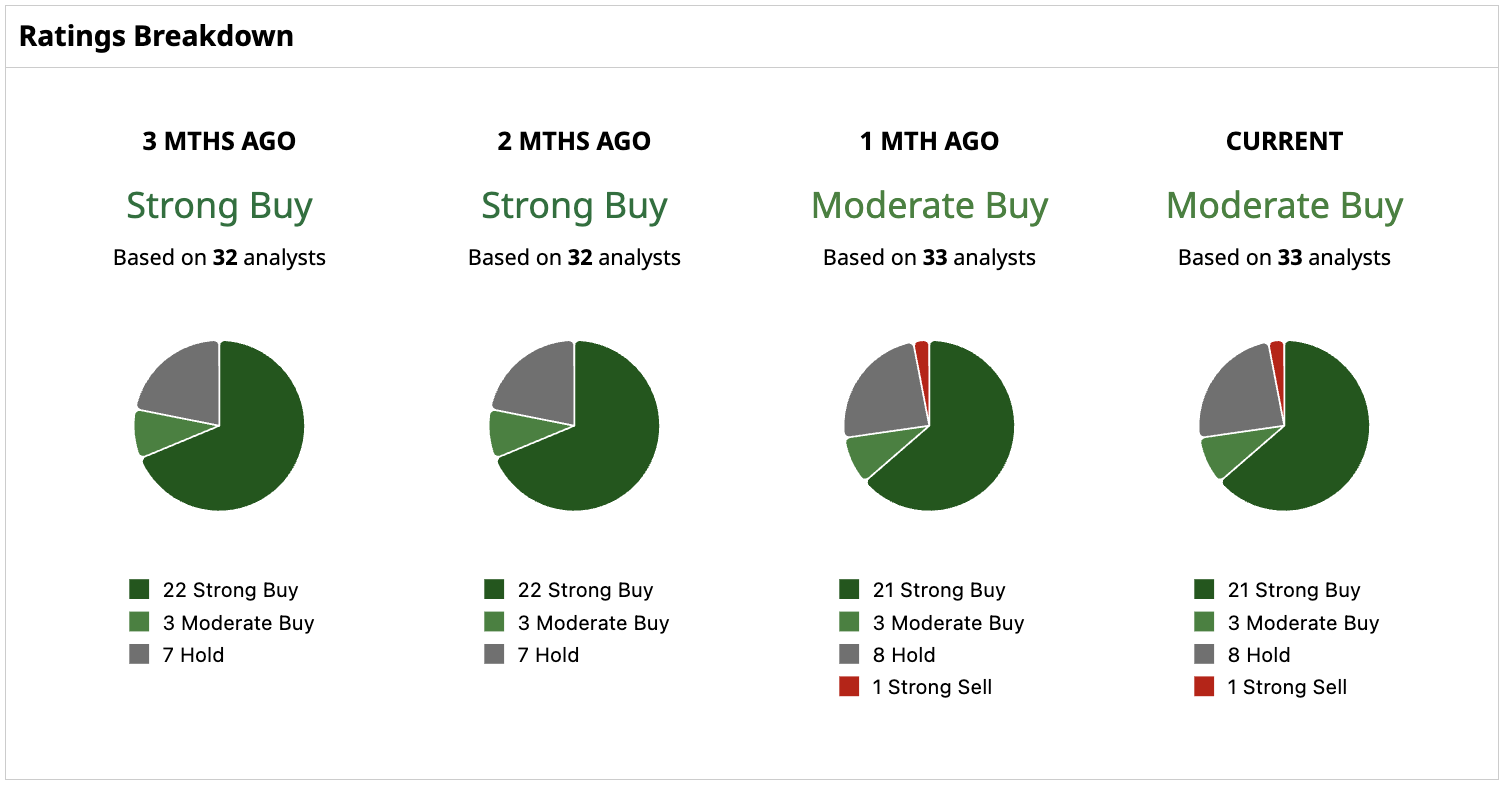

Analysts have also gotten slightly more pessimistic.

I believe the best strategy now is to hold and see if Q4 results lead to a substantial reversal. I wouldn't buy the dip in the stock just yet if you don't already own any.

On the date of publication, Omor Ibne Ehsan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Wall Street Did the Math, and January 2026 Could Be a Prime Time to Buy Nvidia Stock

- This Software Stock Looks ‘Washed Out’ but Analysts Think 2026 Could Be Its Turnaround Year. Why?

- This Dividend Stock Just Scored an FDA Win. Should You Buy Shares Now?

- Top 100 Stocks to Buy: AMC Entertainment Partially Exited Hycroft Mining Earlier This Month. There’s Good News and Bad News for AMC Shareholders.