- AerCap (AER) is trading at a new all-time high and has strong technical momentum.

- Shares are up 52% over the past year.

- AER maintains a 100% “Buy” technical opinion from Barchart.

- Wall Street is bullish, with multiple “Buy” ratings and long-term price targets up to $290.

Today’s Featured Stock

Valued at $27.2 billion, AerCap (AER) is an integrated global aviation company with a leading market position in aircraft and engine leasing, trading, and parts sales. It also provides aircraft management services and performs aircraft and engine maintenance, repair and overhaul services and aircraft disassembly through its certified repair stations.

What I’m Watching

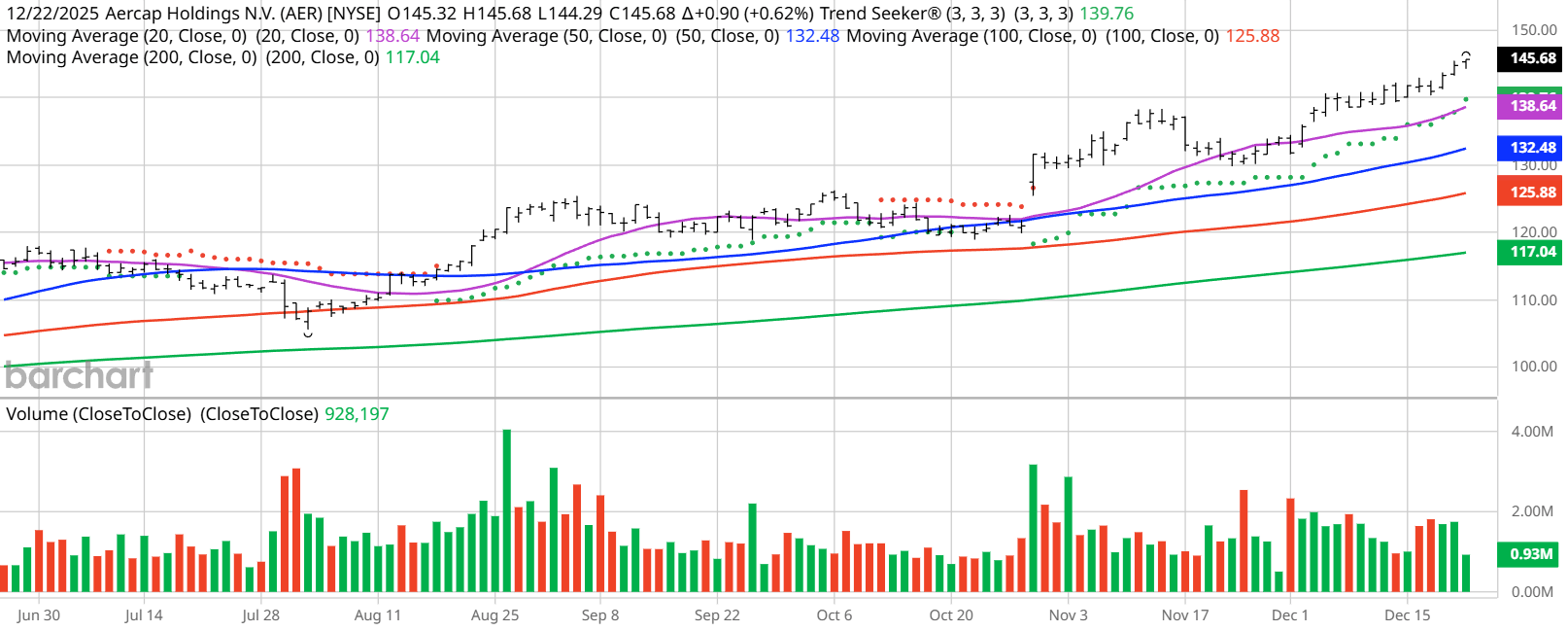

I found today’s Chart of the Day by using Barchart’s powerful screening functions to sort for stocks with the highest technical buy signals; superior current momentum in both strength and direction; and a Trend Seeker “buy” signal. I then used Barchart’s Flipcharts feature to review the charts for consistent price appreciation. AER checks those boxes. Since the Trend Seeker signaled a new “Buy” on Oct. 30, the stock has gained 11.37%.

Barchart Technical Indicators for AerCap

Editor’s Note: The technical indicators below are updated live during the session every 20 minutes and can therefore change each day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com website when you read this report. These technical indicators form the Barchart Opinion on a particular stock.

AerCap hit an all-time high of $146.55 on Dec. 23.

- AER has a Weighted Alpha of +56.90.

- AerCap has a 100% “Buy” opinion from Barchart.

- The stock gained 52.69% over the past year.

- AER has its Trend Seeker “Buy” signal intact.

- The stock recently traded at $145.22 with a 50-day moving average of $132.93.

- AerCap made 17 new highs and gained 10.22% in the last month.

- Relative Strength Index (RSI) is at 70.48.

- There’s a technical support level around $144.75.

Don’t Forget the Fundamentals

- $27.2 billion market capitalization.

- 9.79x trailing price-earnings ratio.

- 0.74% dividend yield.

- Revenue is expected to grow 4.15% this year but decrease slightly by 0.24% next year.

- Earnings are estimated to increase 22.08% this year and an additional 0.55% next year.

Analysts and Investor Sentiment on AerCap

Wall Street analysts like this stock and so do individual investors.

- Wall Street analysts tracked by Barchart have given 9 “Strong Buy” and 1 “Hold” opinion on the stock.

- Value Line gives the stock its “Highest” rating with 3-5-year price targets between $195-$290.

- CFRA’s MarketScope Advisor rates it a “Buy” with a price target of $150.

- Morningstar thinks with the stock’s recent runup, it’s 11% overvalued.

- 886 investors following the stock on Motley Fool think it will beat the market, while 95 think it won’t.

- 13,890 investors are monitoring the stock on Seeking Alpha, which rates the stock a “Strong Buy.”

- Short interest is low at 1.79% of the float.

The Bottom Line on AerCap

Wall Street analysts and individual investors agree on this stock. I like the low price-earnings ratio and the low short interest. As always, have a predetermined stop loss in case things go south.

Additional disclosure: The Barchart Chart of the Day highlights stocks that are experiencing exceptional current price appreciation. They are not intended to be buy recommendations as these stocks are extremely volatile and speculative. Should you decide to add one of these stocks to your investment portfolio it is highly suggested you follow a predetermined diversification and moving stop loss discipline that is consistent with your personal investment risk tolerance.

On the date of publication, Jim Van Meerten did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Virgin Galactic Stock Is Challenging This Key Resistance Level as Trump Goes All In on Space

- Should You Buy FJET Stock After the Starfighters Space IPO?

- As Silver Prices Hit New Record Highs, Should You Buy Hycroft Mining Stock?

- Sidus Space Just Scored a Major Golden Dome Win. Should You Buy SIDU Stock Here?