Abbott Laboratories (ABT), the global healthcare titan, announced on Dec. 22 that the U.S. Food and Drug Administration (FDA) has approved its Volt™ PFA System for treating atrial fibrillation (AFib). Abbott will soon begin commercial PFA procedures in the U.S. and continue expanding European sites, building on Volt’s CE Mark approval earlier this year and accelerating global market penetration.

AFib presents a rapidly growing clinical and economic burden. Around 12 million Americans aged over 65 currently live with AFib, and this population is expected to double over the next 20 years. Patients face a fivefold higher stroke risk, underscoring the urgency for scalable, effective treatment solutions.

FDA approval will meaningfully strengthen Abbott’s cardiovascular portfolio and open access to a fast-expanding AFib market serving millions of elderly patients. Commercialization across the U.S. and European Union would lift procedure volumes, drive recurring revenues, and support margin expansion.

However, this regulatory catalyst now prompts a closer look at whether Abbott’s shares offer an attractive entry point.

About Abbott Stock

Headquartered in North Chicago, Illinois, Abbott operates as a global healthcare leader across cardiovascular care, diabetes management, diagnostics, nutrition, and neuromodulation. Commanding a market cap of approximately $218.1 billion, its operations span more than 160 countries.

The stock has gained nearly 10.35% year-to-date (YTD), reflecting confidence in its long-term growth story. However, sentiment softened recently, with Abbott shares declining 8.15% over the past three months.

Valuation metrics show ABT stock trading at 24.36 times forward adjusted earnings and 4.87 times sales, a clear premium to industry averages that reflects investor confidence in its earnings durability and long-term growth visibility.

Also, Abbott announced that its board of directors has increased the company's quarterly common dividend to $0.63 per share, an increase of 6.8%. The cash dividend is payable on Feb. 13, 2026, to shareholders of record at the close of business on Jan. 15, 2026. This marks Abbott's 54th consecutive year of dividend growth.

A Closer Look at Abbott’s Q3 Earnings

On Oct. 15, Abbott reported its Q3 fiscal 2025 results, wherein the top and bottom lines both came in line with Wall Street’s estimates. Revenue rose 6.9% year-over-year (YOY) to $11.37 billion, aligning with Wall Street expectations. Newly launched products generated nearly half a billion dollars in sales and contributed over 100 basis points to organic growth.

Profitability also improved. Adjusted net earnings increased 7.5% YOY to $2.3 billion, while adjusted EPS rose 7.4% to $1.30. Management credited double-digit growth in medical devices, particularly diabetes care and electrophysiology, highlighting solid execution in Abbott’s highest-margin growth segments.

Coming to the balance sheet, Abbott ended the quarter with $7.5 billion in cash and cash equivalents. Current assets increased to $24.8 billion, up from $23.6 billion on Dec. 31, 2024, providing ample liquidity to fund innovation, dividends, acquisitions, and clinical investments.

Looking ahead, Abbott’s management has reaffirmed its full-year 2025 outlook, projecting organic sales growth of 7.5%–8.0% excluding COVID-19 testing. And, the company maintains the midpoint of its adjusted diluted EPS guidance and has narrowed the range to $5.12–$5.18, implying double-digit earnings growth.

Management highlighted a strong product pipeline, easing diagnostic-related headwinds, and continued investment in clinical trials as key growth drivers.

Analysts broadly support the trajectory. They expect fiscal 2025 Q4 EPS to rise 11.9% YOY to $1.50. They forecast the full-year fiscal 2025 bottom line growing 10.3% to $5.15, followed by a further 9.9% rise to $5.66 in fiscal year 2026.

What Do Analysts Expect for Abbott Stock?

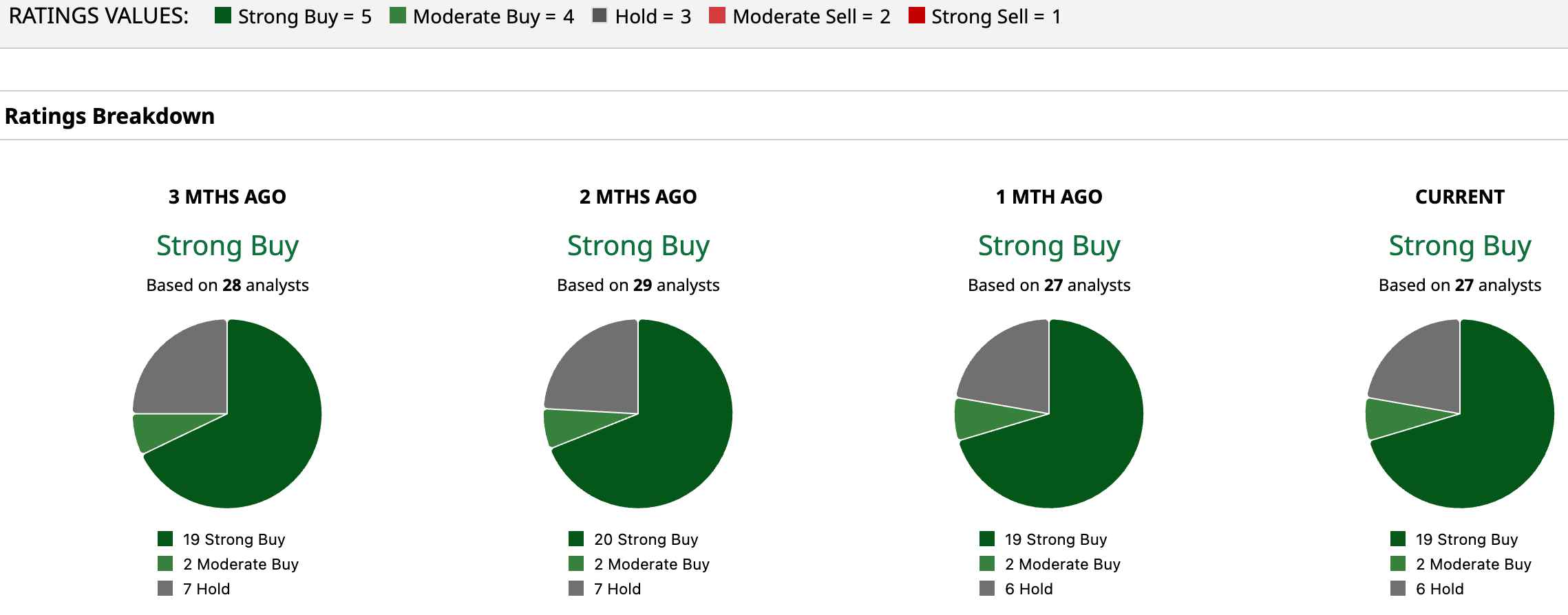

Wall Street’s outlook on ABT remains firmly optimistic, anchored in consistent execution and visible growth drivers. Abbott carries a “Strong Buy” consensus rating, with 19 of 27 analysts recommending “Strong Buy,” two suggesting “Moderate Buy,” and six advising “Hold.”

The stock’s average price target of $146.69 implies upside of 17.8%, while the Street-high target of $162 suggests potential upside of 30% from current levels.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Wall Street Did the Math, and January 2026 Could Be a Prime Time to Buy Nvidia Stock

- This Software Stock Looks ‘Washed Out’ but Analysts Think 2026 Could Be Its Turnaround Year. Why?

- This Dividend Stock Just Scored an FDA Win. Should You Buy Shares Now?

- Top 100 Stocks to Buy: AMC Entertainment Partially Exited Hycroft Mining Earlier This Month. There’s Good News and Bad News for AMC Shareholders.