BigBear.ai (BBAI) landed a strategic partnership last week that could expand its presence in the defense and homeland security markets. The company announced an integration deal with C Speed, a radar technology specialist backed by NewSpring Holdings.

This deal combines BigBear's ConductorOS AI platform with C Speed's LightWave Radar system to create autonomous threat detection capabilities for military and border security applications. The partnership enables real-time AI-driven threat detection at the sensor level and addresses a critical national security requirement.

C Speed's radars are already deployed across multiple Department of Homeland Security and Department of Defense missions, which provides BigBear with access to established government customers. The integrated solution should accelerate threat response times through AI-powered sensor fusion and autonomous mode switching between airborne, ground, and maritime threats.

The partnership represents a strategic shift toward embedding AI capabilities directly into defense hardware rather than offering standalone software solutions, which creates stickier customer relationships and recurring revenue streams in the high-margin government contracting space.

How Did BigBear.ai Perform in Q3 of 2025?

In Q3 of 2025, BigBear.ai reported revenue of $33.1 million, down from $41.5 million in the year-ago period. The top-line decline was tied to lower volume on Army programs. Moreover, gross margins narrowed from 25.9% to 22.4% over the last 12 months as certain higher-margin contracts from the previous year did not repeat.

The company posted an adjusted EBITDA loss of $9.4 million, compared with a profit of $900,000 in the year-ago quarter. This deterioration stemmed from increased selling, general, and administrative expenses, which rose to $25.3 million from $17.5 million.

Management attributed the spending increase to $4.3 million in additional labor costs to support growth initiatives, $2 million in nonrecurring strategic expenses, and $1.4 million in marketing investments.

Despite operating losses, BigBear reported net income of $2.5 million for the quarter, driven by a $26 million gain from remeasuring the convertible features of its outstanding notes. This accounting adjustment masks underlying operational challenges and should not be viewed as indicative of business performance.

BigBear.ai forecasts revenue between $125 million and $140 million in 2025, compared to $158.24 million in 2024. Notably, the government shutdown, which ended last month, could impact revenue in Q4.

BigBear improved its liquidity by raising $337 million in Q3 through an equity offering at an average gross price of $5.18 per share. It ended Q3 with $715 million in total liquidity, which includes $457 million in cash.

The capital raise enables BigBear to pursue its acquisition of Ask Sage, a generative AI platform that serves 16,000 government teams across 27 agencies. Ask Sage grew its annual recurring revenue sixfold over the past year and is tracking toward $25 million in ARR for 2025. The platform holds FedRAMP High accreditation and supports more than 30 frontier AI models for Department of Defense and national security customers.

Is BBAI Stock Undervalued Right Now?

Valued at a market cap of $2.73 billion, BBAI stock has more than doubled in the past year and is up over 800% in the last three years. Analysts tracking the AI stock forecast revenue to increase from $133.7 million in 2025 to $164 million in 2027. However, BBAI is projected to remain unprofitable, reporting a net loss per share of $0.03 in 2026 and $0.07 in 2025.

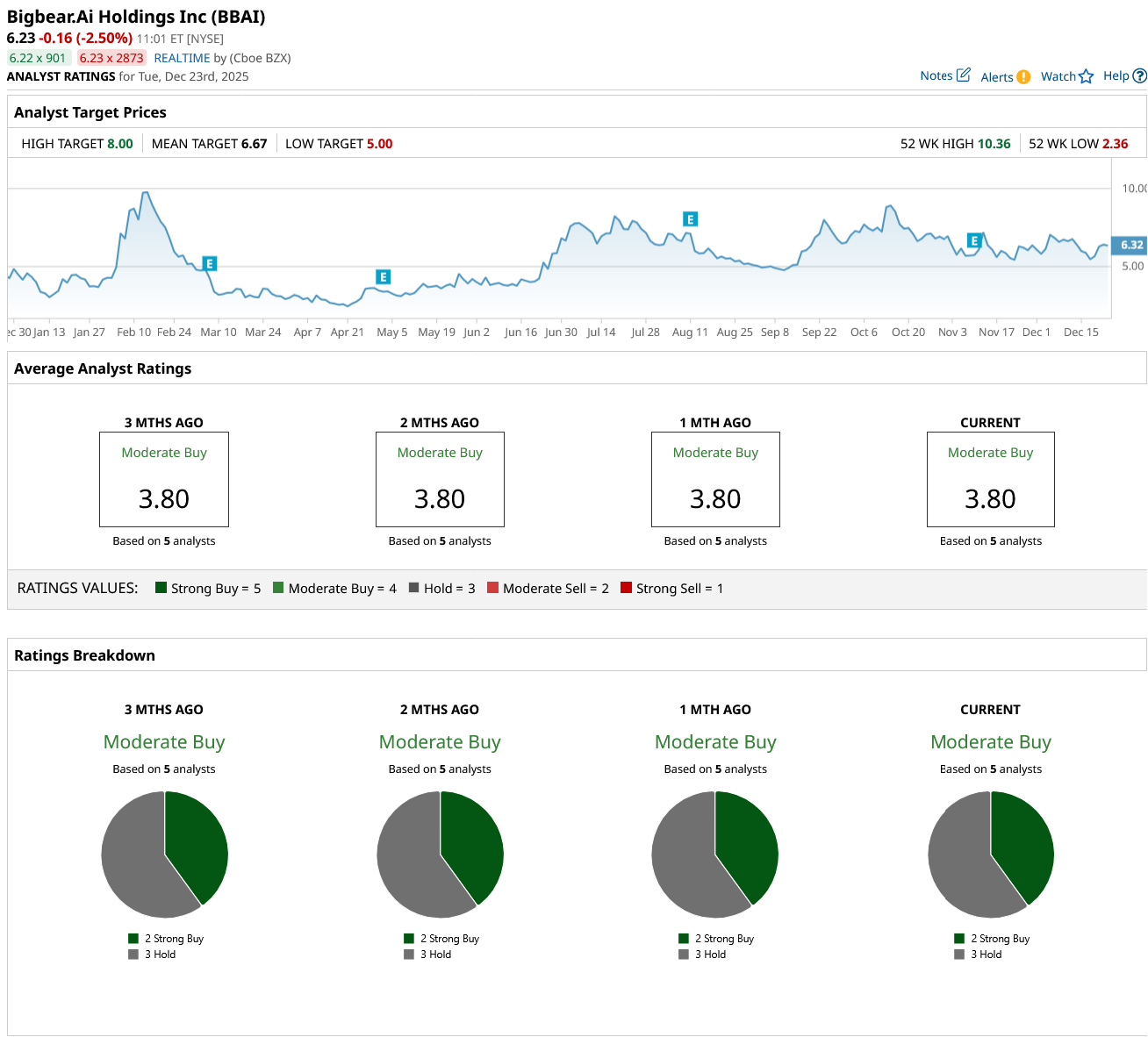

Out of the five analysts covering BBAI stock, two recommend “Strong Buy,” and three recommend “Hold.” The average BBAI stock price target is $6.67, above the current price of $6.23.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Wall Street Did the Math, and January 2026 Could Be a Prime Time to Buy Nvidia Stock

- This Software Stock Looks ‘Washed Out’ but Analysts Think 2026 Could Be Its Turnaround Year. Why?

- This Dividend Stock Just Scored an FDA Win. Should You Buy Shares Now?

- Top 100 Stocks to Buy: AMC Entertainment Partially Exited Hycroft Mining Earlier This Month. There’s Good News and Bad News for AMC Shareholders.