Anyone who has traded Nvidia (NVDA) stock in the past knows it goes hand in hand with the word “overvalued.” Every time someone talks about buying the stock, the obvious answer is that it is overvalued. For a company that has achieved so much over the past decade, expecting it to be undervalued is futile. Yet this is precisely what’s happening right now, according to Bernstein analyst Stacy Rasgon.

Rasgon has argued that Nvidia is trading at a discount considering its historical valuations and AI investments. Despite upward earnings revisions, the stock returns have stayed muted, suggesting the upside is yet to come. Whenever investors have taken entry at such discounted levels, they have done extremely well over the next year, making 2026 an interesting year for fresh Nvidia investors.

About Nvidia Stock

Nvidia Corporation is an American technology company, known mainly for its GPUs that previously served the gaming industry and are now mainly used in AI applications. The company is led by Jensen Huang and headquartered in Santa Clara, California.

One reason for Bernstein's bullishness on the stock is how it has performed relative to the PHLX Semiconductor Sector Index ($SOX). SOX is up 40% in the last year, but Nvidia has only gained 34%. This suggests peers have done well during this period, despite Nvidia being considered the leader of the pack.

The analysts also noted an intriguing stat regarding Nvidia. The company’s stock is trading at a 13% discount to the SOX index. Over the last ten years, there were only thirteen days when the stock traded at a bigger discount than this. Bernstein analysts clearly believe they have unearthed a unique valuation stat, and it is difficult to argue against it, considering how rarely such a scenario happens.

Due to the above, the stock offers a great entry point. Anyone who has bought NVDA at such levels has enjoyed average one-year returns of more than 150%, with no occurrence of a negative drawdown, according to the analyst. The forward P/E of 25x is also in line with Nasdaq’s ($NASX) forward P/E of 25.1x. All this suggests Nvidia is set to do well in 2026.

Nvidia Beats Earnings Estimates

Nvidia’s earnings on Nov. 19 hardly moved the stock price. That didn’t mean the performance wasn’t impressive, though. The firm reported a 62% year-over-year (YoY) growth in revenue, bringing in $57 billion during the quarter. Data center revenue accounts for $51.2 billion of this amount. Going forward, the company continues to forecast incredible demand for its products, with about $500 billion in revenue visibility from Blackwell and Rubin chips. During the quarter, two-thirds of the Blackwell revenue came from the GB300 GPU.

The management also talked about new partnerships on the earnings call. Partnerships with HUMAIN and AWS expanded in scope during the quarter, with up to 150,000 AI accelerators likely to be deployed. In the second half of 2026, the company is expected to ramp up the Rubin platform, which should give increased performance relative to Blackwell.

What Analysts Are Saying About NVDA Stock

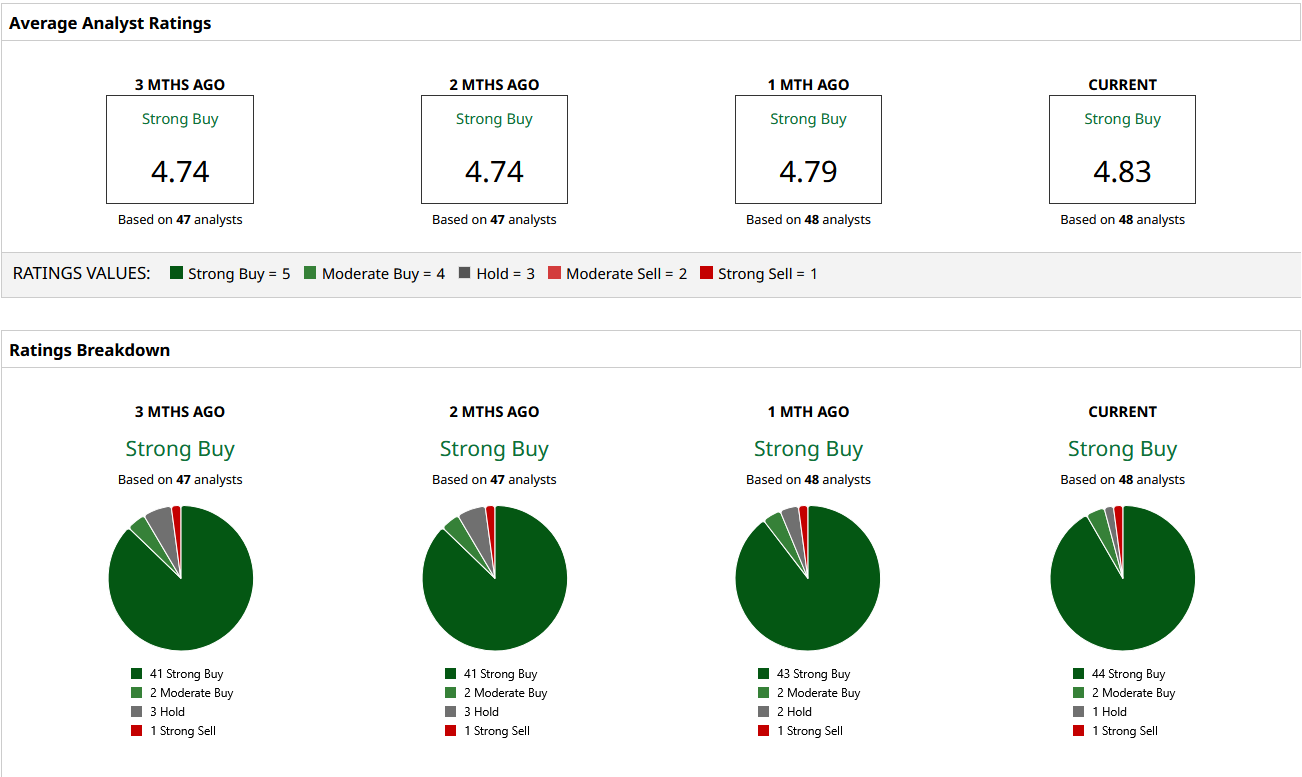

Wall Street loves Nvidia, and the consensus rating reflects that. The stock has 44 “Strong Buy” ratings from the 48 analysts that cover it. A solitary “Strong Sell” rating does stand out, but it is hardly surprising for a stock that is usually dubbed overvalued.

The consensus price target also indicates decent upside for NVDA stock. The highest target price of $352 could see the stock roughly double from here. Even the mean target price of $256 suggests a further 36% upside. 2026 could indeed be an exciting year for Nvidia investors.

On the date of publication, Jabran Kundi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Broadcom (AVGO) Stock Options Are Signaling Pensiveness. Here’s Why the Fear Might Be Unwarranted.

- Occidental Petroleum Stock Has Tanked - But It May Hike Its Dividend - Time to Buy?

- Wall Street Did the Math, and January 2026 Could Be a Prime Time to Buy Nvidia Stock

- This Software Stock Looks ‘Washed Out’ but Analysts Think 2026 Could Be Its Turnaround Year. Why?