With a market cap of $262.3 billion, American Express Company (AXP) is an integrated global payments company offering credit cards, charge cards, banking, payment, financing, and related services to consumers and businesses worldwide. Operating across multiple regions and business segments, it also provides merchant services, fraud prevention, expense management solutions, and premium travel and lifestyle offerings.

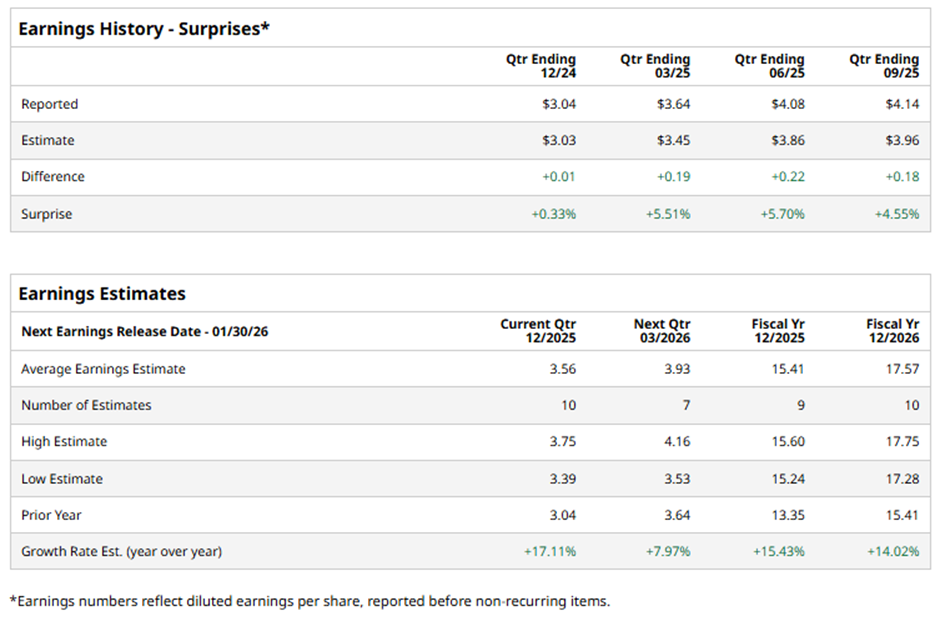

The New York-based company is set to announce its fiscal Q4 2025 results on Friday, Jan. 30. Ahead of this event, analysts forecast AXP to report a profit of $3.56 per share, an increase of 17.1% from $3.04 per share in the year-ago quarter. It has surpassed Wall Street's earnings estimates in the last four quarters.

For fiscal 2025, analysts expect the credit card issuer and global payments company to report an EPS of $15.41, up 15.4% from $13.35 in fiscal 2024.

Shares of American Express have soared 27.5% over the past 52 weeks, outpacing both the S&P 500 Index's ($SPX) nearly 16% increase and the Financial Select Sector SPDR Fund's (XLF) 14% return over the same period.

Shares of American Express climbed 7.3% on Oct. 17 after the company reported strong Q3 2025 results, with revenue rising 11% year-over-year to a record $18.43 billion and EPS jumping 19% to $4.14, well above expectations. Investor sentiment was further boosted by accelerated Card Member spending growth and strong early demand for the refreshed U.S. Platinum Cards, with new account acquisitions doubling versus pre-refresh levels. Additionally, the company raised its full-year 2025 guidance to revenue growth of 9% - 10% and EPS of $15.20 - $15.50.

Analysts' consensus view on AXP stock is cautiously optimistic, with a "Moderate Buy" rating overall. Among 29 analysts covering the stock, eight recommend "Strong Buy," two have a "Moderate Buy," 18 "Holds," and one suggests "Strong Sell." As of writing, it is trading above the average analyst price target of $365.84.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart