The Travelers Companies, Inc. (TRV) is one of America’s leading insurers, specializing in property and casualty coverage for individuals, businesses, and organizations. The company operates across personal, business, and specialty insurance segments, combining deep underwriting expertise with a strong emphasis on risk management and innovative insurance solutions.

Headquartered in New York City, Travelers offers a broad and diversified portfolio of products across the U.S. and select international markets, reinforcing its reputation as a reliable industry heavyweight. With a market capitalization of $65.1 billion, the company remains a key player in the global insurance landscape. The insurance company is set to report its fiscal 2025 fourth-quarter earnings before the market opens on Wednesday, Jan. 21, 2026.

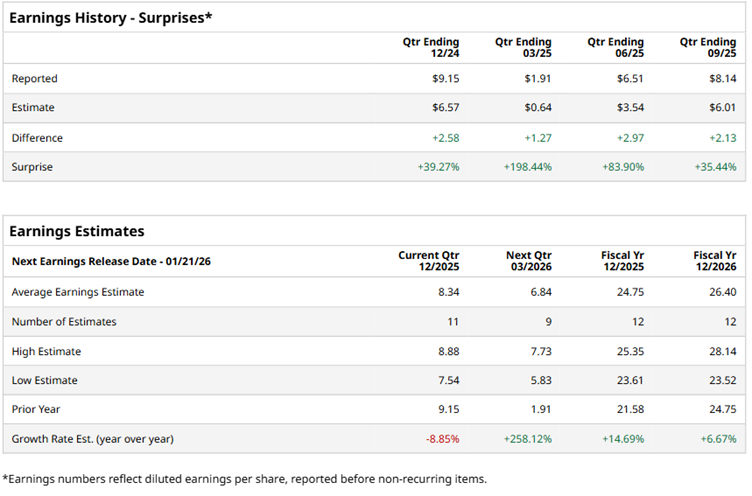

Expectations are muted heading into the report, with analysts forecasting Travelers Companies’ profit to decline 8.9% year over year to $8.34 per share. Even so, the insurer has earned the benefit of the doubt, delivering earnings beats in each of the past four quarters. More importantly, the longer-term picture points to renewed momentum, as Wall Street projects EPS growth of 14.7% in fiscal 2025 to $24.75, followed by a further 6.7% increase in fiscal 2026 to $26.40, signaling solid earnings rebound beyond the near-term softness.

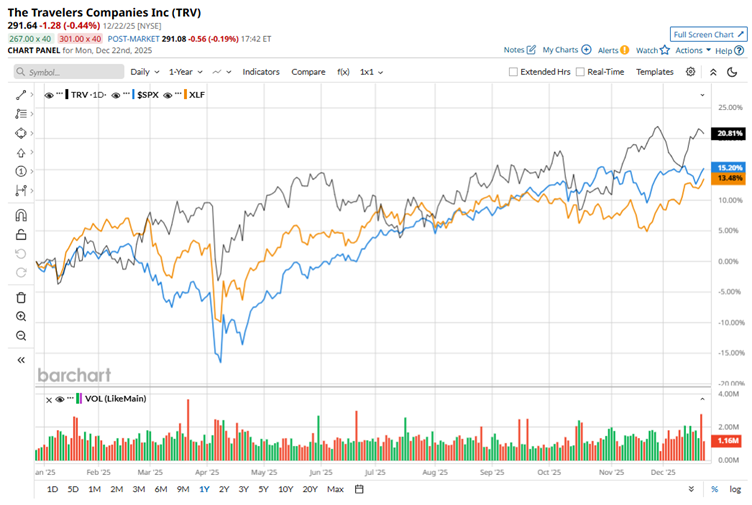

TRV has been a clear standout over the past year, with shares rallying a robust 21.1% over the last 52 weeks. That performance comfortably tops the broader market, as the S&P 500 Index ($SPX) advanced 16% over the same period, while the Financial Select Sector SPDR Fund (XLF) lagged further behind with a 14% gain.

On Oct. 16, Travelers turned in an eye-catching fiscal 2025 third-quarter earnings report that sailed past Wall Street expectations across the board. Net revenue rose 4.7% year over year to $12.47 billion, coming in ahead of the Street’s $12.34 billion forecast. Profitability was the clear standout, with core earnings jumping 55.4% to $8.14, handily beating estimates of $6.01.

The earnings surge was powered by exceptionally strong underwriting results and higher investment income. Pre-tax underwriting income reached $1.4 billion, more than double the prior-year quarter, as the company benefited from lower catastrophe losses alongside improved underlying underwriting performance, a combination that highlighted Travelers’ operational discipline and earnings leverage in favorable conditions.

Wall Street remains cautiously constructive on TRV, with the stock earning an overall “Moderate Buy” consensus. Sentiment is clearly mixed but leans positive. Nine of the 27 analysts covering TRV rate it a “Strong Buy,” one sees it as a “Moderate Buy,” while the bulk of 15 analysts maintain a “Hold.” Bearish views are limited, with just one “Moderate Sell” and one “Strong Sell.” The average price target of $300.27 implies roughly 3% upside from the current level.

On the date of publication, Anushka Mukherjee did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart