Broadcom (AVGO) heads into its Dec. 11 fiscal Q4 earnings report with momentum few semiconductor companies can match. The company delivered record-breaking performance in the first three quarters of 2025, powered by explosive AI demand, accelerating XPU wins, VMware growth, and industry-leading profitability.

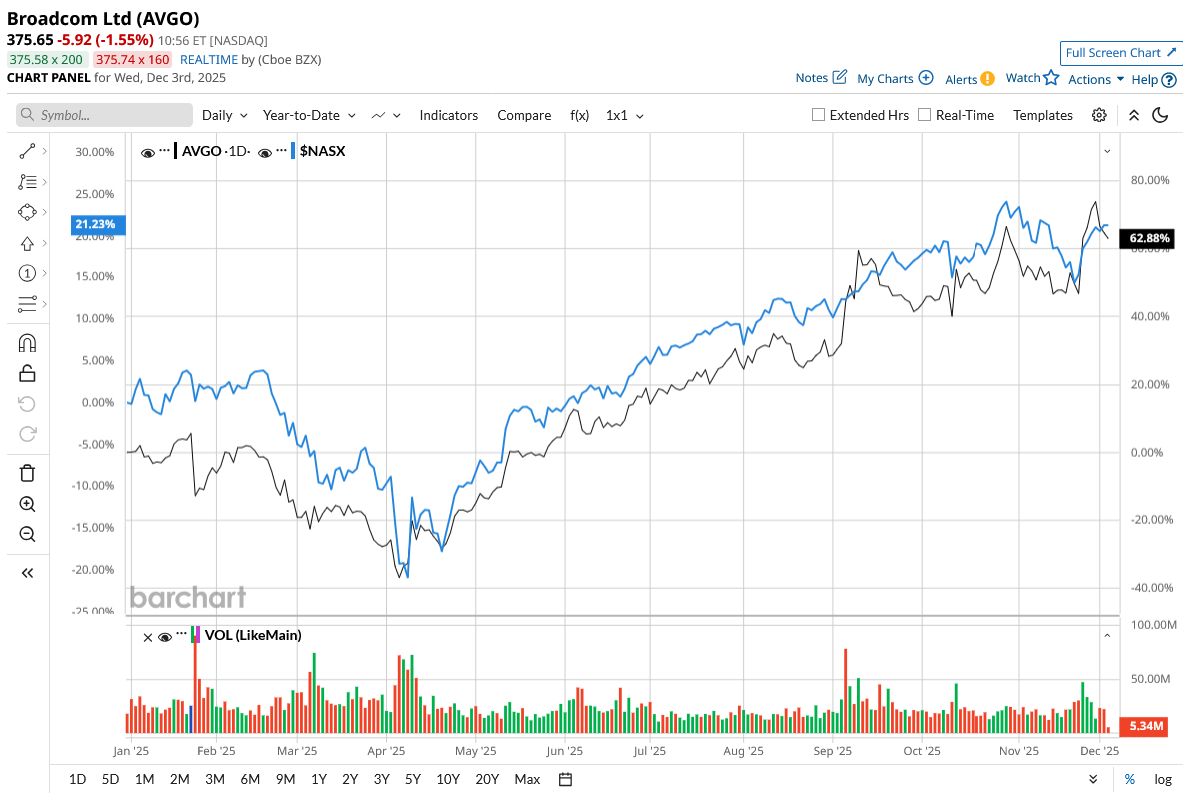

After climbing 64.5% YTD, the stock is once again in the spotlight, with the Street predicting around 40% upside. Is AVGO a buy before earnings?

AI Semiconductors: The Engine Behind Broadcom’s Explosive Growth

Valued at $1.8 trillion, Broadcom builds semiconductors (networking, connectivity, storage, and broadband) and also owns major infrastructure software used by large companies worldwide. Broadcom reported a record $16 billion in fiscal Q3 revenue, representing 22% year-over-year (YoY) growth, driven overwhelmingly by better-than-expected performance in AI semiconductors and continued strength in VMware.

Broadcom’s semiconductor segment delivered $9.2 billion in Q3 revenue, representing 26% YoY growth, with AI semiconductor revenue reaching $5.2 billion, up 63% YoY. This marks Broadcom’s 10th consecutive quarter of robust AI growth.

Broadcom’s infrastructure software division, anchored by the VMware acquisition, delivered $6.8 billion in Q3 revenue, up 17% YoY with a massive 93% gross margin. The company ended Q3 with an extraordinary $110 billion consolidated backlog, reflecting exceptionally high bookings as AI infrastructure spending accelerates across the hyperscale landscape. This backlog effectively locks in multi-year revenue and supports Broadcom's long-term expansion.

During the Q3 Q&A, analysts asked what was in Broadcom's large $110 billion backlog and how much of it was related to AI. CEO Hock Tan highlighted that semiconductors account for at least half of the overall backlog, with the majority being AI, with software continuing to increase steadily and non-AI semiconductors rising at relatively modest double-digit percentages.

A Fourth XPU Customer Changes the Growth Trajectory for 2026

A key highlight of the quarter was the sustained growth of Broadcom's XPU business, which accounted for 65% of total AI revenue. Broadcom is seeing steady volume increases from its existing three hyperscale customers, but the major catalyst for 2026 is the addition of a fourth customer, one that moved from a “prospect” to a fully qualified XPU customer after placing over $10 billion in orders for XPU-based AI racks. While the name of this customer still remains a mystery, most analysts speculate it to be Anthropic or OpenAI. Management noted that this customer is already driving substantial demand and will begin shipping “pretty strongly” at the start of 2026.

Tan noted that the fourth addition has significantly altered Broadcom's internal forecasts for fiscal 2026, resulting in a stronger growth curve than the 50% to 60% range he previously indicated. In the quarter, Broadcom also confirmed that Hock Tan will continue as CEO through at least 2030, ensuring leadership stability at a time when the company is entering its most important growth phase.

Management's Q4 outlook paves the way for another strong quarter. Revenue is predicted to climb by 24% YoY to $17.4 billion. Semiconductor revenue is predicted to reach $10.7 billion, up 30%, with AI semiconductor revenue rising to $6.2 billion, a strong 66% YoY growth. Infrastructure software revenue is expected to reach $6.7 billion, up 15%.

While the company did not provide forecasts for the full fiscal year, Wall Street expects revenue and earnings to grow by 22.8% and 38.5%, respectively, in fiscal 2025. For fiscal 2026, the addition of a fourth XPU customer creates a materially stronger 2026 outlook than previously anticipated by the company. The Q3 performance indicated that AVGO remains well-positioned for long-term growth in both semiconductors and software, with 2026 shaping up to be another year of rapid momentum. Analysts see a 38% increase in earnings in fiscal 2026. Valued at 40x forward earnings, AVGO stock is trading at a premium, reflecting its long-term prospects in AI.

What Does Wall Street Say About AVGO Stock?

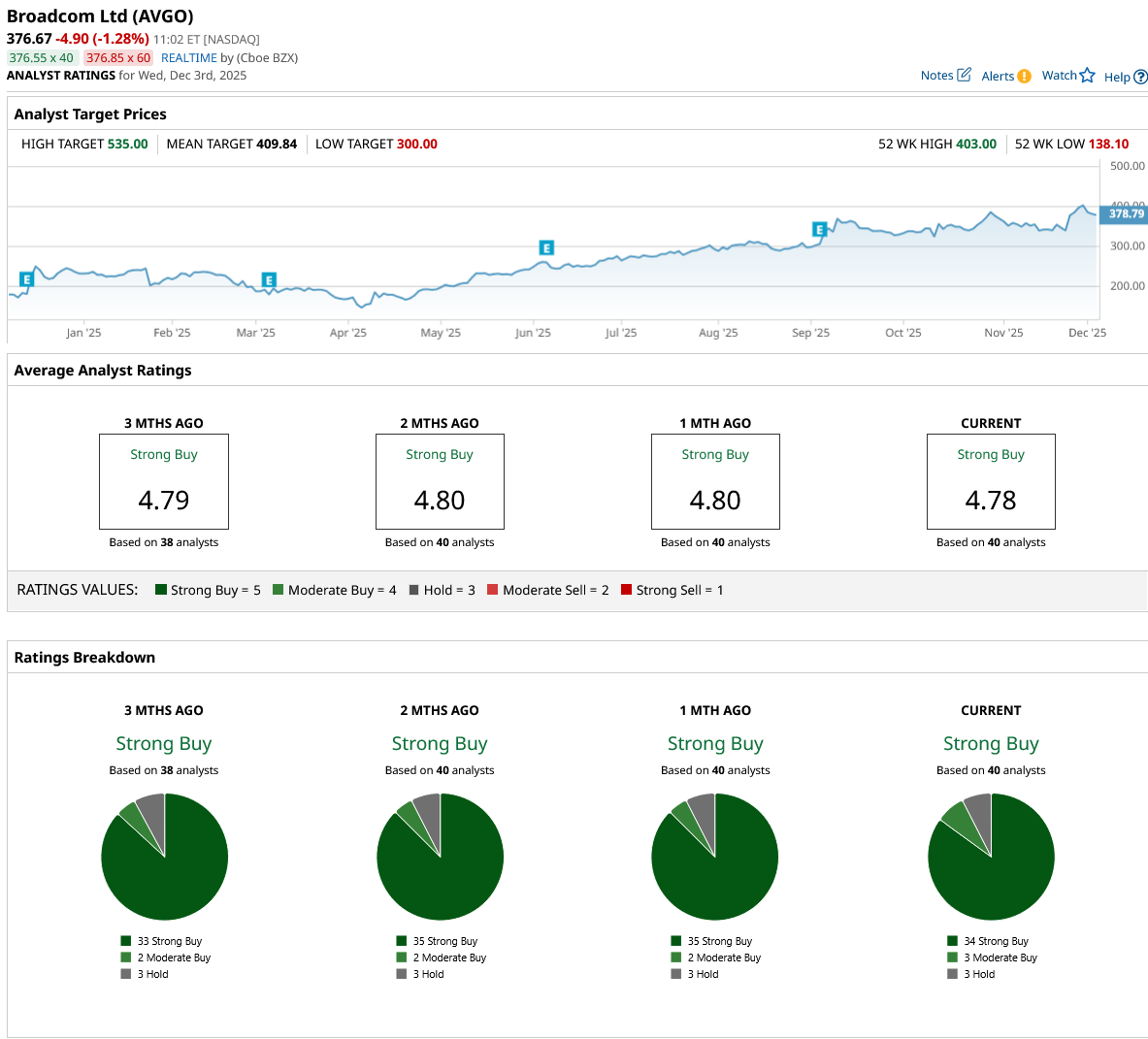

Wall Street remains strongly bullish about AVGO stock. Out of the 40 analysts in coverage, 34 rate it a “Strong Buy,” three say it is a “Moderate Buy,” and three recommend a “Hold.”

Despite the record run this year, analysts expect the stock could still climb another 43% from current levels based on the high price estimate of $535. Meanwhile, the mean target price of $406.59 suggests a potential upside of 8% from current levels.

Is AVGO a Buy Before Dec. 11?

Broadcom entered Q4 with accelerating AI tailwinds, strengthening demand for custom XPUs, significant new XPU orders worth over $10 billion, a massive $110 billion backlog, and strong execution in VMware and infrastructure software. For long-term investors seeking exposure to AI infrastructure, advanced networking, and enterprise software, AVGO continues to look like a compelling growth stock to own now.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Cathie Wood Is Buying Up Google Stock at Record Highs. Should You?

- MicroStrategy Is Turning to a U.S. Dollar Reserve Amid Bitcoin Volatility. Should You Buy, Sell, or Hold MSTR Stock Here?

- This ‘Strong Buy’ AI Stock Could Jump 56% —Time to Buy?

- Microsoft May Be an AI Tech Giant, But It Is Also One of the Safest Stocks to Own Now, According to Wall Street