Automaker Ford Motor Company (F) just delivered a troubling signal for the electric vehicle (EV) industry. The company reported a 0.9% drop in U.S. unit sales for November, and while its internal-combustion lineup grew 2.2%, that strength couldn’t come close to offsetting a stunning 61% crash in all-electric sales, a decline that accelerates the slump already seen in October.

Ford’s leadership had already anticipated this fallout, with the expiration of the $7,500 federal EV tax credit in October pushing many consumers away from EVs and creating a shock in demand, at least for now. Further, Ford’s latest EV numbers weren’t just disappointing, they were a blaring warning siren for the entire EV ecosystem.

A collapse this steep reinforces concerns that EV momentum is slowing just as competition heats up. And while Ford dominates the headlines now, the reverberations could also hit EV leader Tesla (TSLA) the hardest, especially as Tesla already navigates pressure in key global markets. So, with sentiment turning cautious and demand signals looking shaky, it’s worth taking a closer look at TSLA stock now.

About Tesla Stock

Founded in 2003 by a group of engineers determined to prove that electric vehicles could outperform gas-powered cars, Tesla has transformed itself from a scrappy Silicon Valley startup into one of the world’s most influential companies. Under CEO Elon Musk, the brand reshaped the auto industry with high-performance EVs and a bold vision for the future.

Today, Tesla’s ambitions reach far beyond cars, spanning autonomous driving, artificial intelligence (AI)-powered robotics, and energy infrastructure, including grid-scale battery technology. With a market capitalization hovering around $1.4 trillion, Tesla sits firmly among the elite “Magnificent Seven” group.

And while its EV lineup still drives most of the brand recognition, much of Tesla’s long-term story is tied to big bets on the Cybercab autonomous robotaxi and the Optimus humanoid robot. Investors see these as potential blockbuster products, ones that could eventually generate more revenue than Tesla’s entire automotive business. Musk has even suggested they could help make Tesla the most valuable company in the world someday.

Yet despite all the buzz, Tesla’s momentum has noticeably cooled this year. A mix of intensifying competition, a slowing core EV market, and a growing investor preference for long-term AI and robotics bets have weighed on sentiment. Macroeconomic pressures from tariffs and a potential economic slowdown, as well as pricing battles across global markets, have added further stress.

Also, the company is under the spotlight due to scrutiny over Musk’s massive $1 trillion compensation package. All of this has translated into a relatively muted stock performance in 2025. Tesla shares are up just 10.52% year-to-date (YTD), trailing far behind the broader S&P 500 Index ($SPX) 16.46% return during the same stretch. In fact, TSLA stock is currently the weakest performer in the Magnificent Seven group in 2025.

Tesla’s Q3 Earnings Snapshot

Tesla’s fiscal 2025 third-quarter results, released in late October, delivered a mixed but intriguing update for investors. The headline number was revenue, which climbed 12% year-over-year (YOY) to $28.1 billion, easily topping Wall Street’s $26.6 billion estimate. Notably, this was the first quarter of the year in which Tesla posted sales growth over 2024. A big boost came from U.S. customers rushing to grab the $7,500 federal EV tax credit before it expired, creating a last-minute demand surge that helped lift overall sales.

That rush helped Tesla’s core automotive segment bounce back, with revenue rising 6% YOY to $21.2 billion. The energy business, however, stole the spotlight once again. Tesla’s energy-storage division delivered a 44% annual revenue jump to $3.4 billion, fueled by the rapid adoption of its advanced battery systems. This segment has now repeatedly posted double-digit gains, reinforcing its role as one of Tesla’s fastest-growing and most resilient businesses.

But underneath the strong top line results, the margin picture told a tougher story. Tesla continued to slash prices to keep pace with fierce global competition, and profitability took the hit. Gross margin slid to 18%, down from 19.8% last year, while operating margin tumbled 501 basis points to 5.8%. Adjusted EPS dropped 31% YOY to $0.50, coming in about 10.5% below analyst expectations, underscoring the pressure Tesla is under to defend market share.

Looking ahead, Tesla is doubling down on its most ambitious projects. The company is targeting 2026 for “volume production” of the long-awaited Cybercab robotaxi, its heavy-duty Semi truck, and the next-generation Megapack 3 energy-storage system. At the same time, Tesla is ramping up the first manufacturing lines for its Optimus humanoid robot, a sign that the company’s long-promised shift from automaker to robotics and AI powerhouse is getting closer to reality.

What Could Ford’s EV Sales Crash Mean for Tesla?

Ford’s 61% plunge in EV sales isn’t just a Ford problem. It’s a flashing red warning for other industry players, including Tesla. When a major automaker sees electric demand collapse immediately after the expiration of the $7,500 federal tax credit, it suggests that a meaningful share of EV buyers remain highly price-sensitive and their purchasing decisions can shift overnight when incentives disappear.

In early October, Tesla reported record deliveries of 497,099 vehicles in the third quarter on total production of 447,450 vehicles. That surge was largely driven by a last-minute rush from U.S. buyers trying to secure the same federal tax credit before it ended. In other words, Q3’s strength was boosted by a temporary tailwind that won’t be available in the coming quarters.

And even with record deliveries, the financials revealed cracks. Profitability weakened as aggressive price cuts, rising competition, and a softer global EV backdrop squeezed margins. That leaves Tesla exposed if industry-wide demand continues to cool, especially with rivals rolling out cheaper EVs and hybrids at scale. With these pressures mounting, it might be wise for investors to keep a close eye on Tesla now, as the post-incentive landscape could look very different from the surge seen in Q3.

How Are Analysts Viewing Tesla Stock?

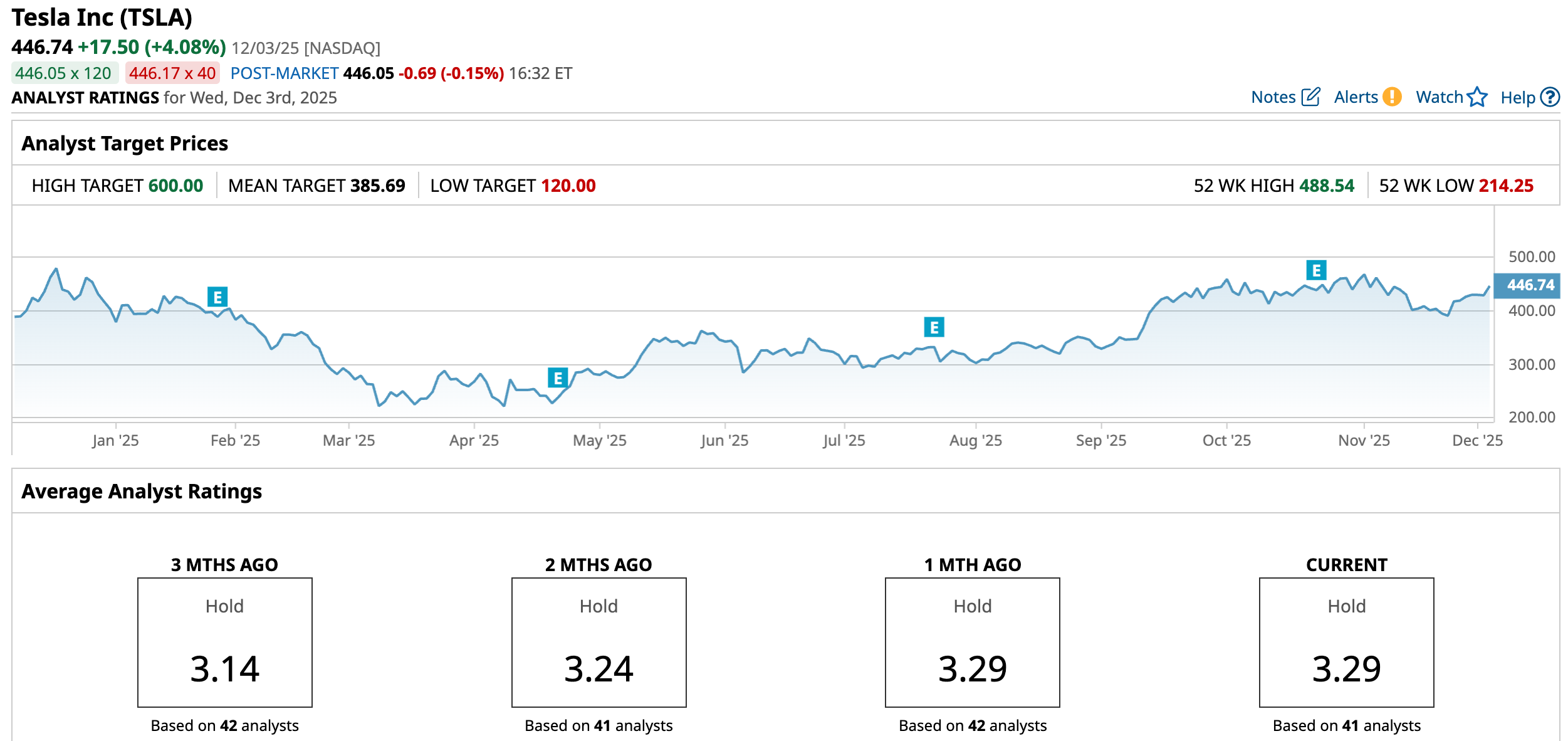

Even Wall Street seems unsure about where Tesla goes next. The stock carries a consensus “Hold” rating, highlighting the division among analysts. Of the 41 analysts covering TSLA, 14 are firmly in the “Strong Buy” camp, two call it a “Moderate Buy,” 16 prefer to wait on the sidelines with a “Hold,” and nine have gone as far as issuing a “Strong Sell.”

Tesla already trades above its average price target of $385.69. Even so, the upside isn’t off the table. The most bullish analysts on Wall Street see a path to $600, which would mean roughly 34% upside from current levels if Tesla can deliver on its ambitious roadmap.

On the date of publication, Anushka Mukherji did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Is the Wheel the Best Options Strategy for Income? Here’s How to Trade Options Like Warren Buffett

- Ford Just Reported an Absolute Collapse in Its EV Sales. That Could Be a Key Warning for Tesla Stock.

- Cathie Wood Is Selling Palantir Stock. Should You?

- Netflix Stock Breaks Below 20-Day Moving Average Amid Selloff. Should You Buy the Dip?