Quantum computing stocks have been skyrocketing since 2024, thanks to the unstoppable excitement around artificial intelligence (AI) spilling into next-generation technologies like quantum computing. Investors are clearly captivated by the idea of computers that can solve mind-bending problems far beyond today’s capabilities, unlocking breakthroughs in drug discovery, materials science, and financial modeling.

Among the standout pure-play quantum computing names, IonQ (IONQ) continues to make waves. The company is rapidly stacking up strategic partnerships and government contracts that strengthen its long-term growth story. And now its latest move centers around quantum medicine. On Dec. 1, IonQ announced a new investment partnership with the Center for Commercialization of Regenerative Medicine (CCRM) to bring hybrid quantum and quantum-AI technologies into medicine in order to speed up the development of next-generation therapeutics. The focus includes optimizing bioprocessing, improving disease-modeling workflows, and using quantum-enhanced simulations to advance the design and manufacturing of cutting-edge therapies. Initial projects are set to kick off in Canada and Sweden next year. So, given this latest development, is now the perfect time to scoop up IONQ stock?

About IonQ Stock

At the forefront of the quantum race, IonQ holds over 20 years of academic research that helped pioneer trapped-ion quantum computing. Unlike other quantum approaches, IonQ uses ionized atoms as its qubits, a method that naturally delivers longer, more accurate computations with far fewer errors. And that edge is already attracting some of the world’s biggest tech and pharma players.

IonQ’s Forte and Forte Enterprise systems are driving major performance improvements for partners like Amazon (AMZN), AstraZeneca (AZN), and Nvidia (NVDA). With an ambitious goal of scaling its systems to two million qubits by 2030, IonQ aims to solve the toughest problems, from breakthrough drug discovery to national defense capabilities.

From jaw-dropping highs to sharp pullbacks, IonQ’s stock has certainly delivered a roller-coaster ride. Over the past three years, shares have ballooned by a staggering 951.8%, fueled by the surge in enthusiasm for quantum computing. However, this year, volatility has set in amid a long runway for real-world quantum applications, rising competition, and persistent net losses.

So, even after sliding about 44.6% from its October peak of $84.64, IonQ’s long-term momentum remains compelling. Currently valued at a market capitalization of about $16.4 billion, its stock is still up 46.38% over the past year, comfortably outpacing the broader S&P 500 Index ($SPX), which has returned around a modest 12.9% during the same stretch. And so far in 2025, IONQ has climbed 12.35%.

A Look Inside IonQ’s Q3 Performance

IonQ delivered a standout performance in its fiscal 2025 third-quarter earnings report on Nov. 5, solidly beating Wall Street expectations. Revenue soared to $39.9 million, marking a stunning 222% year-over-year (YOY) increase and surpassing the $26.9 million consensus estimate. Impressively, the number also exceeded the high end of management’s revenue guidance by 37%, signaling powerful and accelerating momentum.

This growth reflects surging demand for quantum computing contracts, strategic partnerships, and real-world commercial applications. IonQ continues to position itself as a leader in moving quantum technology from the research stage into scalable revenue generation. Riding this wave of progress, management raised its full-year 2025 revenue forecast to $106 million and $110 million, which represents over 150% annual growth.

Losses, however, remain sizable as IonQ invests aggressively in technology advancement, global expansion, and acquisitions such as Oxford Ionics and Vector Atomic. The company reported a GAAP loss of $3.58 per share, compared to $0.24 in the year-ago quarter. On an adjusted basis, the loss widened to $0.17 per share, versus $0.11 last year, though it still came in better than Wall Street’s projected $0.20 loss.

A key highlight of the quarter was a major scientific breakthrough. IonQ achieved a world-record 99.99% two-qubit gate fidelity, becoming the first company to reach the precision required to scale toward full fault-tolerant quantum computing, a milestone that places it at the forefront of the quantum race.

With $1.5 billion in cash, cash equivalents, and investments as of Sept. 30, and $3.5 billion pro forma after a $2 billion equity raise completed on Oct. 14, IonQ has the financial strength to push boundaries and pursue its bold growth ambitions with speed and confidence.

What Do Analysts Think About IonQ Stock?

In early November, Cantor Fitzgerald turned even more bullish on IonQ, lifting its price target from $60 to $70 while reiterating its “Overweight” rating. The investment firm says IonQ is still in the “very early innings” of commercializing its breakthrough quantum technology, a phase where the biggest growth leaps can happen.

Looking ahead, Cantor believes IonQ has the potential to command 30% of the entire quantum hardware, software, and services market by 2035. Cantor highlighted increasing traction across IonQ’s key focus areas, including quantum computing, quantum networking, and quantum security. With progress building on multiple fronts, the firm sees strong justification for raising its bullish targets.

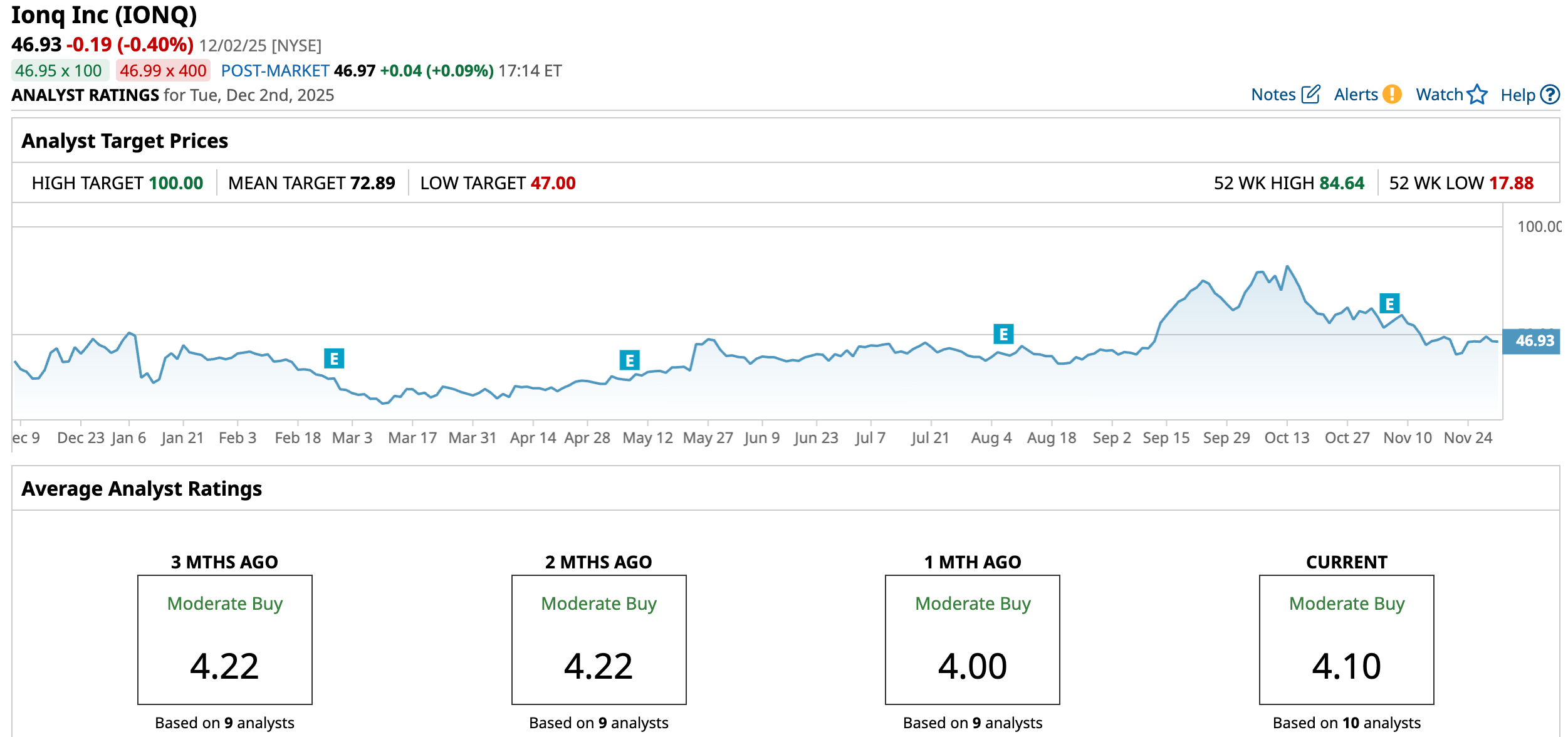

Despite this year's volatility, Wall Street remains strongly supportive of IonQ. Of the 10 analysts covering the stock, five rate it a “Strong Buy,” one calls it a “Moderate Buy,” and the remaining four recommend “Hold.” That gives the stock a consensus “Moderate Buy” rating overall, but with a clear tilt toward optimism.

Analysts also see plenty of upside ahead. The average price target sits at $72.89, pointing to a potential 55.3% gain from current levels. And the most optimistic forecast, a bold $100, suggests the stock could climb as much as 113.1%.

On the date of publication, Anushka Mukherji did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart