Airbnb (ABNB) desperately needs to right the ship — and that opportunity may come this Thursday when the homestay marketplace releases its fourth-quarter earnings report. Since the beginning of January, ABNB stock is down roughly 11% while over the past 52 weeks, the security dipped more than 10%. As such, ABNB dubiously earned the label of 24% Weak Sell from the Barchart Technical Opinion indicator.

Of course, the thing about Sell ratings is that eventually, they could transition back to Buy ratings. If you look at Barchart’s own Top Trade Alerts, you’ll see that neither label sticks indefinitely. With constant gyration between pessimism and optimism, a Sell signal could be a contrarian indicator lurking in disguise.

The obvious question is, how do we determine this? We have a series of extensive first-order analytics that can help narrow the education gap.

First, let’s consider options flow, a screener that focuses exclusively on big block transactions likely placed by institutional investors. Monday’s sentiment fell to $146,100 below parity. However, it’s my opinion that you must look at this indicator in totality. In particular, during the first three trading sessions of this month, cumulative net trade sentiment stood at nearly $2.13 million.

Also significant, the biggest trades in those sessions appeared to be debit-based calls. That means ABNB stock has to rise and meet profitability thresholds to actually be profitable (or at least break even on the debit expenditure).

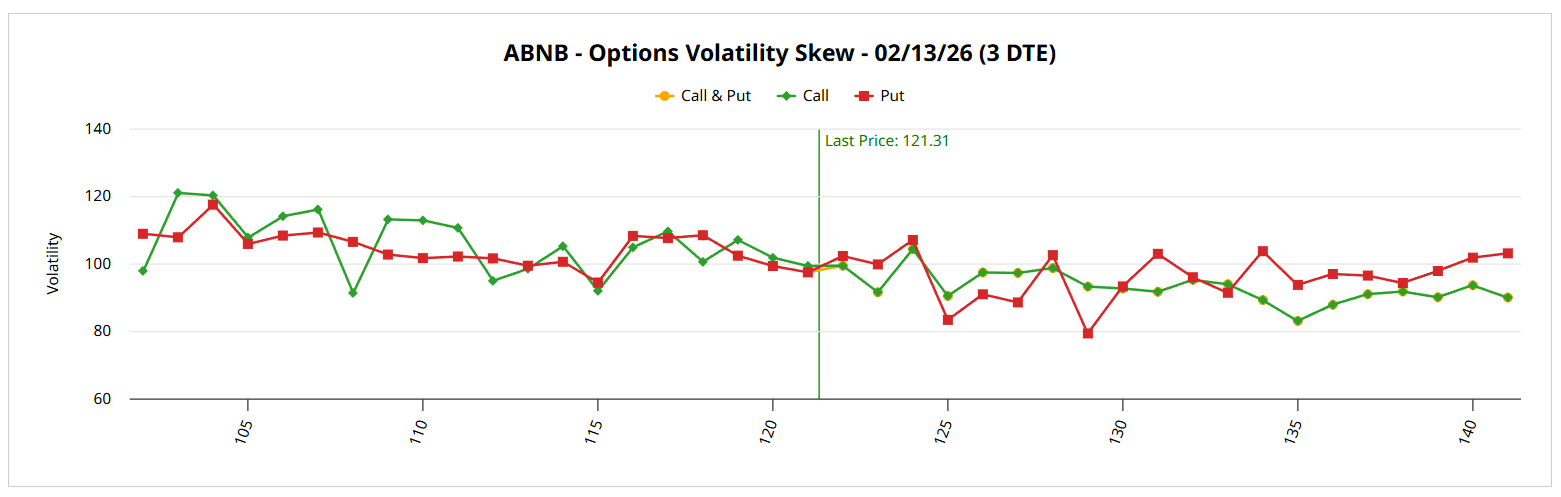

However, the biggest arguably comes from information by omission, specifically from the volatility skew. This indicator, which identifies implied volatility — or a stock’s potential kinetic output — across the strike price spectrum of a given options chain, reveals no real prioritization of either bullish or bearish hedging by the smart money (for the Feb. 13 expiration date).

How is that information by omission? Because ABNB stock is down about 11% year-to-date amid a challenging economic environment so the natural tendency among institutional investors — who are absolutely incentivized to protect their portfolio against sharp volatility — is to be vigilant against downside risk.

Instead, we’re hearing crickets. Of course, I can’t be absolutely sure that that is what the sentiment is. However, the evidence does seem to align in the manner of leaning toward optimism.

Establishing the Trading Parameters of ABNB Stock

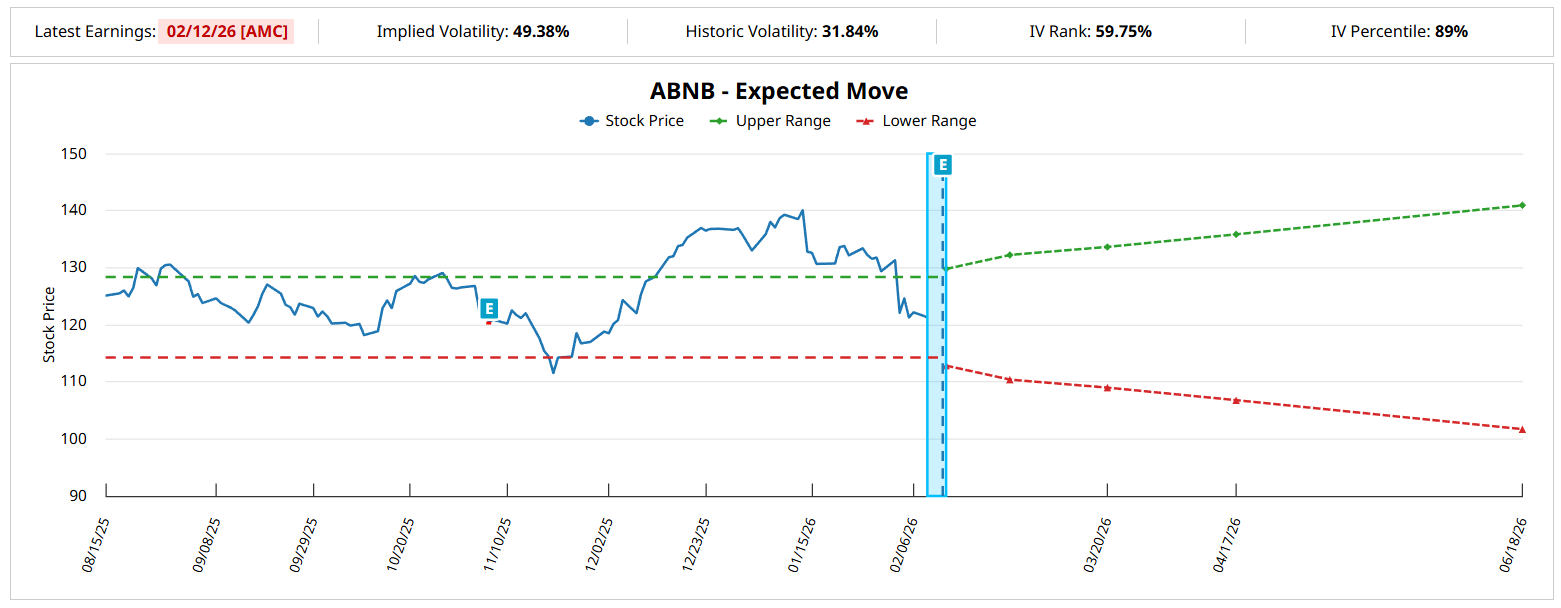

While we now have a general understanding of smart money sentiments toward ABNB stock, we’re still at a loss as to how this may actually translate into price outcomes. For that, we may turn to the Black-Scholes-derived Expected Move calculator. Wall Street’s standard mechanism for pricing options reveals that for the Feb. 13 expiration date, ABNB may land between $112.85 and $129.77.

Where does this dispersion come from? Black-Scholes assumes a world where stock market returns are lognormally distributed. Under this framework, the above range represents where ABNB stock may symmetrically fall one standard deviation away from spot (while accounting for volatility and days to expiration).

Effectively, the model is saying that in 68% of cases, we would expect ABNB to trade within the prescribed range — and honestly, it’s a great assumption. After all, it would take an extraordinary catalyst for any security to move beyond one standard deviation. Further, the volatility skew states that neither bullishness nor bearishness is being optimized. That’s another clue that we can trust Black-Scholes (because it’s reflecting the reality of the volatility skew).

At this point, though, we have reached the limit of first-order analyses. We have talked about options flow, volatility skew (which reflects persistent unusual options activity) and Black-Scholes. As such, we have the trading parameters of ABNB stock for this Friday (after earnings), which should range between about $113 and $130.

To answer the burning question — where in the dispersion is ABNB stock likely to land? — requires methodologies that you, the reader, must ultimately determine. Talking about volatility skew and Black-Scholes is not controversial because the underlying assumptions are shared by consensus.

To dive further requires conditioning these assumptions by another epistemological layer, which itself is an assumption. And because this assumption is not shared, it is controversial. Therefore, the analysis must end here.

Targeting a Bull Call Spread for Airbnb

Now, just because the analytical portion has ended does not mean that we can’t extract practical value from the data that we have collected. We can reasonably deduce directly and through omission that the net expression among smart money traders is unusually modest hedging with the option for upside convexity.

With that in mind, I’m tempted by the ultra-aggressive 127/130 bull call spread expiring Feb. 13. It’s effectively a binary bet that Airbnb will deliver a positive earnings report — and we’re largely hinging this trade on the hidden message behind volatility skew.

Essentially, heightened put activity should be the dominant theme for ABNB stock considering its poor performance. That it’s not — and the fact that calls appear rather pricey — implies that traders are hoping for positive tidings. Of course, it’s a binary opportunity because if Airbnb misses expectations, ABNB could tumble. Still, if the glass-half-full premise appears plausible to you, the aforementioned bull spread could be worth consideration.

On the date of publication, Josh Enomoto did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Airbnb’s (ABNB) Upcoming Earnings Present a ‘Binary’ Opportunity

- Nasdaq, Inc. Stock Is Off Its Highs, Despite Strong Results - Short Put Plays Work Here

- These Low IV Stocks May Be Setting Up for an Explosive Move

- Apple's FCF Margins Surge and Its Target Value Rises - What's the Best AAPL Stock Play?