GoDaddy Inc. (GDDY) is a leading internet services company that specializes in domain name registration, web hosting, and a suite of cloud-based products designed to help individuals and small to medium-sized businesses establish and grow their online presence. Headquartered in Tempe, Arizona, GoDaddy operates globally, offering services such as website building, e-commerce tools, managed WordPress hosting, and security solutions. The company has a market cap of approximately $13.3 billion.

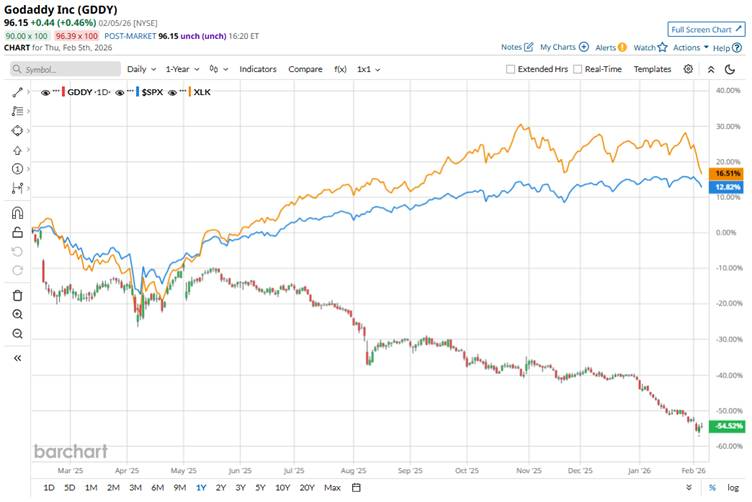

Shares of GoDaddy have lagged behind the broader market. Over the past 52 weeks, GDDY has dipped 54.2%, while the broader S&P 500 Index ($SPX) has gained 12.2%. Moreover, the stock has slipped 22.5% on a year-to-date (YTD) basis, compared to SPX’s marginal decline.

Looking closer, GDDY has also underperformed the State Street Technology Select Sector SPDR ETF’s (XLK) return of 15.8% over the past 52 weeks and a 5.8% slump on a YTD basis.

GoDaddy stock is facing downward pressure due to concerns regarding growth, and a choppy macroeconomic environment. Also, there are concerns about intense competition and technology shifts, especially around generative AI, where rivals are seen as moving faster than GoDaddy, feeding a narrative that the company might lag in innovation.

For the fiscal year 2025, analysts expect GoDaddy’s EPS to grow 19.2% year-over-year to $5.78. The company’s earnings surprise history is mixed. It beat the consensus estimates in two of the last four quarters while missing on two other occasions.

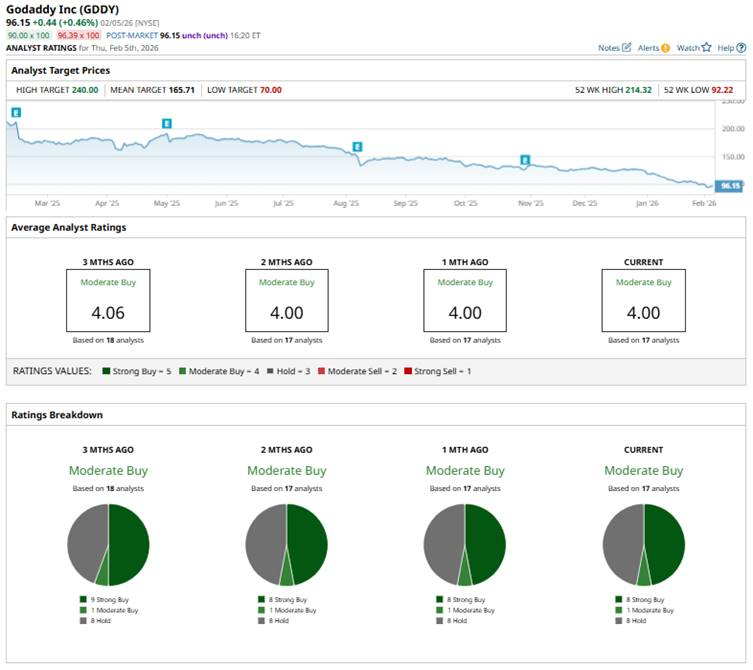

Among the 17 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on eight “Strong Buys,” one “Moderate Buy” rating, and eight “Holds.”

This configuration is slightly less bullish compared to three months ago, when there were nine “Strong Buy” ratings.

On Jan. 15, Morgan Stanley analyst Elizabeth Porter reiterated an “Equal-Weight” rating on GoDaddy but cut the price target to $145 from $159.

The stock’s mean price target of $165.71 indicates an upside of 72.3%. The Street-high price target of $240 implies a potential upside of 149.6% from the current price levels.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart