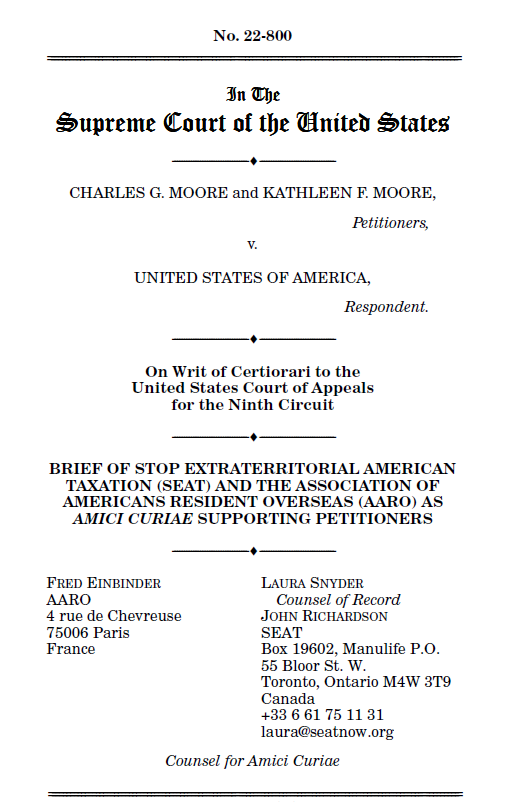

WASHINGTON - Sept. 6, 2023 - PRLog -- Paris, France: The Association of Americans Residents Overseas (AARO) announced today that AARO and Stop Extraterritorial American Taxation (SEAT) joined to file an amicus curiae brief with the U.S. Supreme Court in relation to Charles G. Moore, et al. v. United States (Docket No. 22-800).

The case concerns Charles and Kathleen Moore, who live in Washington State. In 2006, they invested in 13% of an Indian corporation, KisanKraft, created to import, manufacture, and distribute affordable farming equipment in India. The Moores never realized earnings from the investment.

In 2017, the Moores discovered they owed nearly $15,000 in U.S. income tax based on unrealized earnings of KisanKraft going back to 2006. The Moores took their case to court arguing that, because the tax was imposed on accumulated foreign earnings, it was unconstitutional under the 16th Amendment. The district court rejected their challenge and, in June 2022, the Ninth Circuit Court of Appeals affirmed that rejection. In its decision, the Ninth Circuit held that whether income is realized is not a determinative factor regarding the validity of the transition tax.

The Moores filed a petition for a writ of certiorari with the Supreme Court. In June, 2023, the Supreme Court agreed to hear the case and is expected to hold arguments in December, 2023.

The amicus curiae brief is important for overseas Americans as it provides the opportunity for AARO and SEAT to familiarize the Court and a broad audience of the onerous and discriminatory burdens placed on Americans abroad by citizenship based taxation and the hardships that flow from it, such as the transition tax at issue in Moore.

See this short video in which the Moores explain their predicament.

The amicus curiae brief can be seen here.

____________________

About the Association of American Residents Overseas (AARO)

The Association of Americans Resident Overseas (AARO) is an international, nonpartisan association with members from over 40 States living in 36 countries that seeks fair treatment for Americans abroad by advocating the issues that negatively affect their lives. AARO also informs its members of their rights and responsibilities as Americans.

www.aaro.org

AARO, 4 rue de Chevreuse, 75006 Paris, France

Photos: (Click photo to enlarge)

Source: Association of Americans Resident Overseas

Read Full Story - AARO Files Amicus Curiae Brief with U.S. Supreme Court in Moore Tax Case | More news from this source

Press release distribution by PRLog