Consumer products behemoth Proctor & Gamble (NYSE: PG) reported Q3 CY2025 results exceeding the market’s revenue expectations, with sales up 3% year on year to $22.39 billion. Its non-GAAP profit of $1.99 per share was 4.9% above analysts’ consensus estimates.

Is now the time to buy Procter & Gamble? Find out by accessing our full research report, it’s free for active Edge members.

Procter & Gamble (PG) Q3 CY2025 Highlights:

- Revenue: $22.39 billion vs analyst estimates of $22.17 billion (3% year-on-year growth, 1% beat)

- Adjusted EPS: $1.99 vs analyst estimates of $1.90 (4.9% beat)

- Adjusted EBITDA: $6.74 billion vs analyst estimates of $6.50 billion (30.1% margin, 3.6% beat)

- Management reiterated its full-year Adjusted EPS guidance of $6.96 at the midpoint

- Operating Margin: 26.2%, down from 27.8% in the same quarter last year

- Free Cash Flow Margin: 21.9%, up from 15.2% in the same quarter last year

- Organic Revenue rose 2% year on year

- Market Capitalization: $356.2 billion

“Our organic sales growth, earnings and cash results in the first quarter reflect strong execution of our integrated strategy,” said Jon Moeller, Chairman of the Board, President and Chief Executive Officer.

Company Overview

Founded by candle maker William Procter and soap maker James Gamble, Proctor & Gamble (NYSE: PG) is a consumer products behemoth whose product portfolio spans everything from facial tissues to laundry detergent to feminine care to men’s grooming.

Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $84.93 billion in revenue over the past 12 months, Procter & Gamble is one of the most widely recognized consumer staples companies. Its influence over consumers gives it negotiating leverage with distributors, enabling it to pick and choose where it sells its products (a luxury many don’t have). However, its scale is a double-edged sword because it’s harder to find incremental growth when your existing brands have penetrated most of the market. To accelerate sales, Procter & Gamble likely needs to optimize its pricing or lean into new products and international expansion.

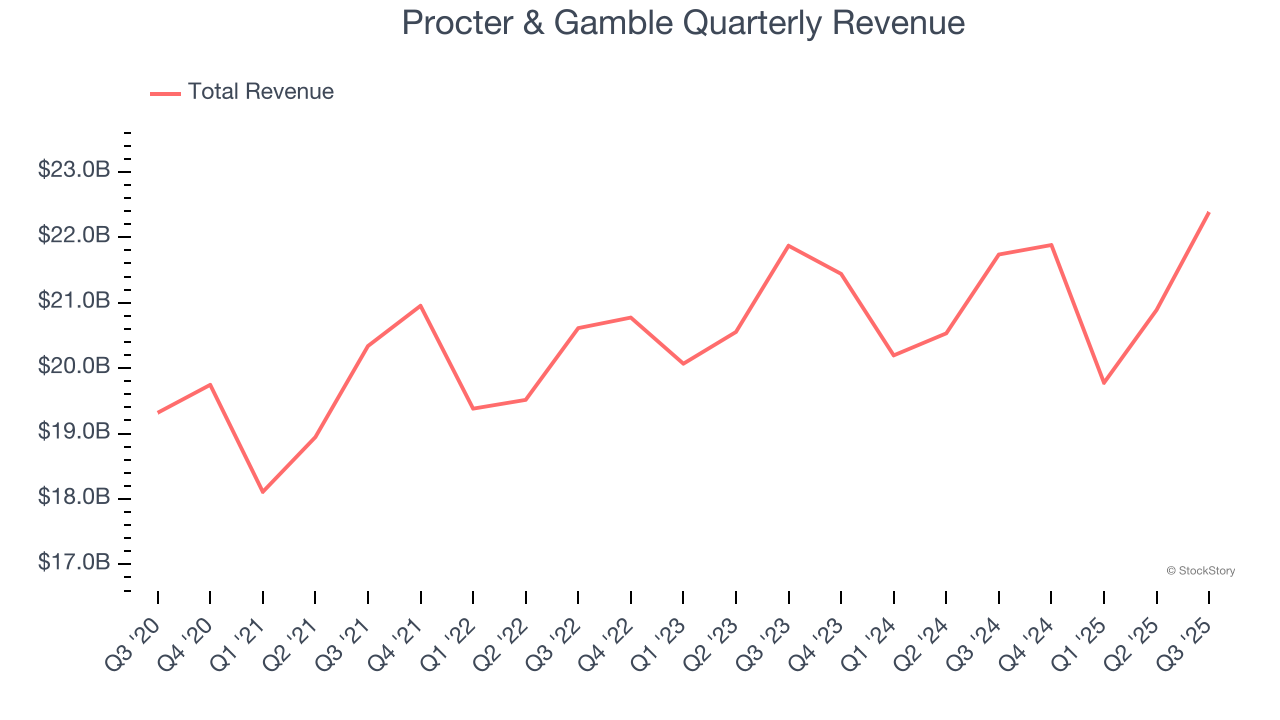

As you can see below, Procter & Gamble’s sales grew at a sluggish 1.8% compounded annual growth rate over the last three years. This shows it failed to generate demand in any major way and is a rough starting point for our analysis.

This quarter, Procter & Gamble reported modest year-on-year revenue growth of 3% but beat Wall Street’s estimates by 1%.

Looking ahead, sell-side analysts expect revenue to grow 3.2% over the next 12 months, similar to its three-year rate. Although this projection implies its newer products will spur better top-line performance, it is still below the sector average.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Organic Revenue Growth

When analyzing revenue growth, we care most about organic revenue growth. This metric captures a business’s performance excluding one-time events such as mergers, acquisitions, and divestitures as well as foreign currency fluctuations.

The demand for Procter & Gamble’s products has been stable over the last eight quarters but fell behind the broader sector. On average, the company has posted feeble year-on-year organic revenue growth of 2.3%.

In the latest quarter, Procter & Gamble’s organic sales rose by 2% year on year. This performance was more or less in line with its historical levels.

Key Takeaways from Procter & Gamble’s Q3 Results

It was encouraging to see Procter & Gamble beat analysts’ EBITDA expectations this quarter. We were also happy its revenue narrowly outperformed Wall Street’s estimates. Overall, this print had some key positives. The stock traded up 2.5% to $156.06 immediately following the results.

Big picture, is Procter & Gamble a buy here and now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.