Data security company Varonis Systems (NASDAQ: VRNS) fell short of the market’s revenue expectations in Q3 CY2025, but sales rose 9.1% year on year to $161.6 million. Next quarter’s revenue guidance of $168 million underwhelmed, coming in 1.2% below analysts’ estimates. Its non-GAAP profit of $0.06 per share was in line with analysts’ consensus estimates.

Is now the time to buy Varonis Systems? Find out by accessing our full research report, it’s free for active Edge members.

Varonis Systems (VRNS) Q3 CY2025 Highlights:

- Revenue: $161.6 million vs analyst estimates of $166.1 million (9.1% year-on-year growth, 2.7% miss)

- Adjusted EPS: $0.06 vs analyst estimates of $0.05 (in line)

- Adjusted Operating Income: $161 million vs analyst estimates of $2.59 million (99.6% margin, significant beat)

- Revenue Guidance for Q4 CY2025 is $168 million at the midpoint, below analyst estimates of $170.1 million

- Management lowered its full-year Adjusted EPS guidance to $0.13 at the midpoint, a 26.5% decrease

- Operating Margin: -22.2%, down from -16% in the same quarter last year

- Free Cash Flow Margin: 17.9%, up from 11.4% in the previous quarter

- Market Capitalization: $7.02 billion

Yaki Faitelson, Varonis CEO, said, “We continued to see healthy demand for our SaaS platform, which now represents 76% of total company ARR. This adoption is driven by the automated outcomes that it provides as well as customer interest in deploying AI initiatives and securing data in the cloud. At the same time, in the final weeks of the quarter, we experienced lower renewals in the Federal vertical and in our non-Federal on-prem subscription business, which led to a shortfall relative to our expectations.”

Company Overview

Beginning with protecting Windows file shares in 2005 and evolving into a comprehensive security platform, Varonis Systems (NASDAQ: VRNS) provides data security software that helps organizations protect sensitive information, detect threats, and comply with privacy regulations.

Revenue Growth

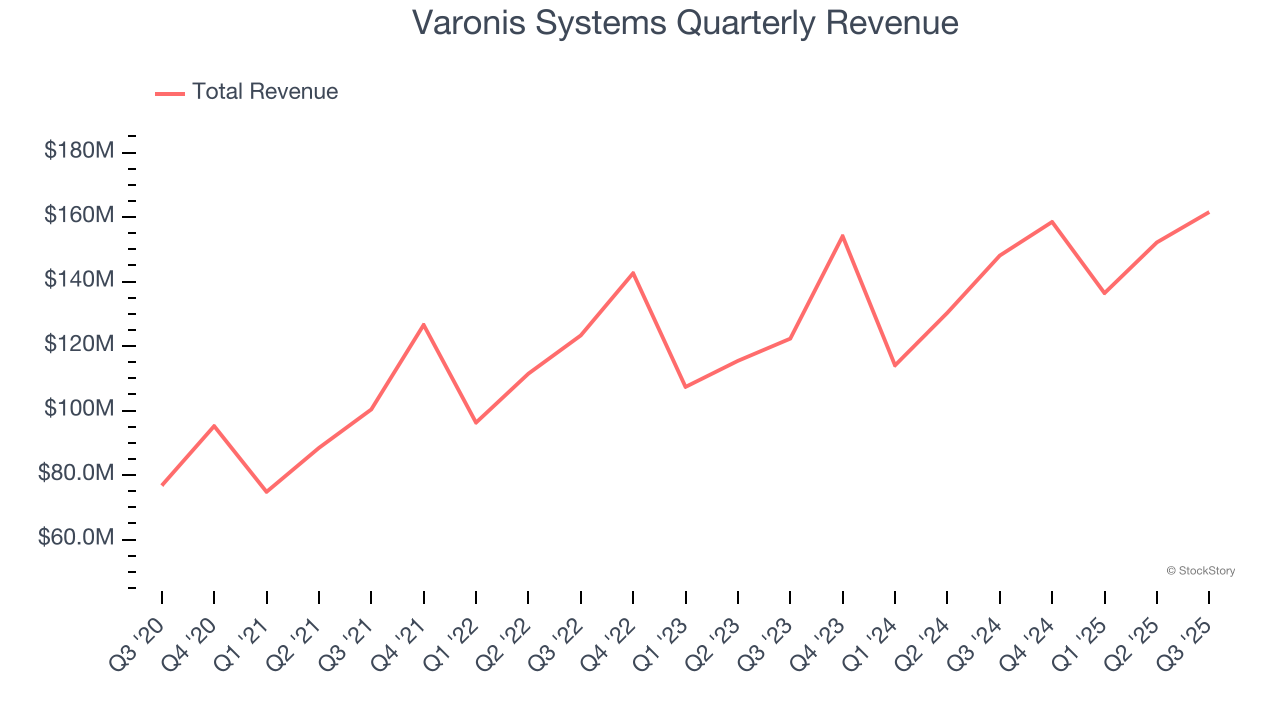

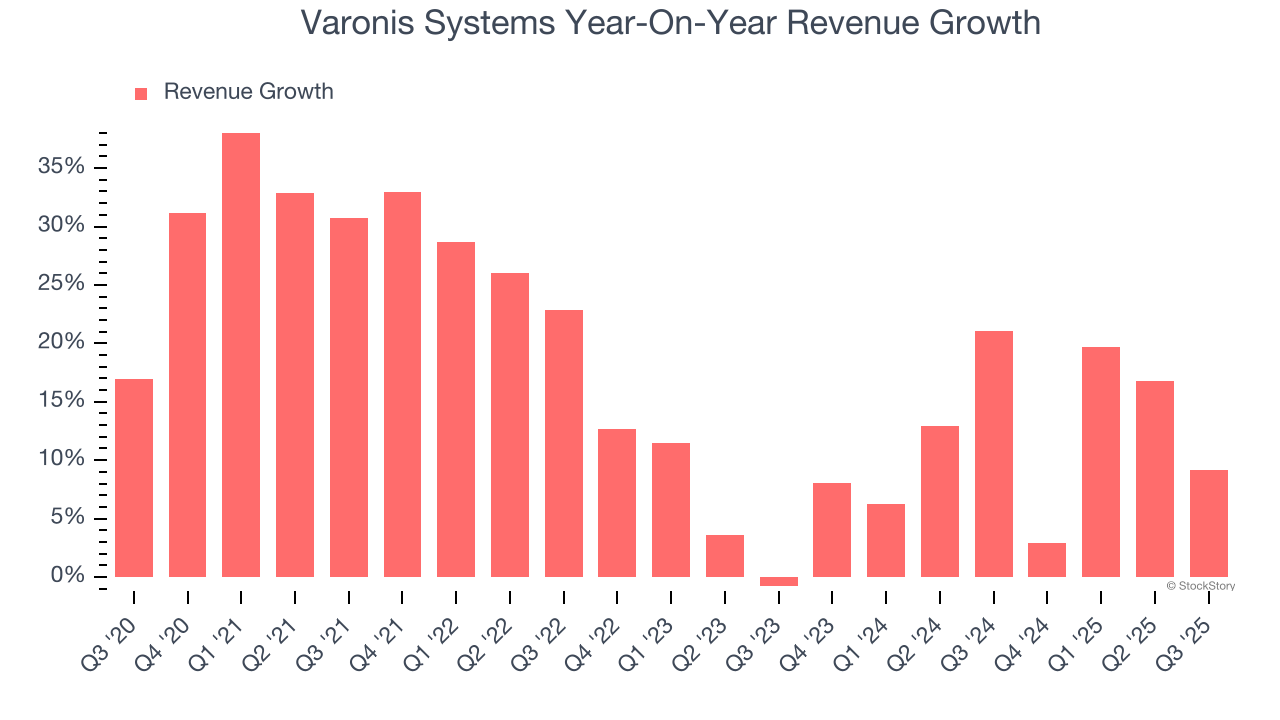

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Thankfully, Varonis Systems’s 17.6% annualized revenue growth over the last five years was decent. Its growth was slightly above the average software company and shows its offerings resonate with customers.

Long-term growth is the most important, but within software, a half-decade historical view may miss new innovations or demand cycles. Varonis Systems’s recent performance shows its demand has slowed as its annualized revenue growth of 11.7% over the last two years was below its five-year trend.

This quarter, Varonis Systems’s revenue grew by 9.1% year on year to $161.6 million, missing Wall Street’s estimates. Company management is currently guiding for a 6% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 15.5% over the next 12 months, an improvement versus the last two years. This projection is above the sector average and indicates its newer products and services will catalyze better top-line performance.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Customer Acquisition Efficiency

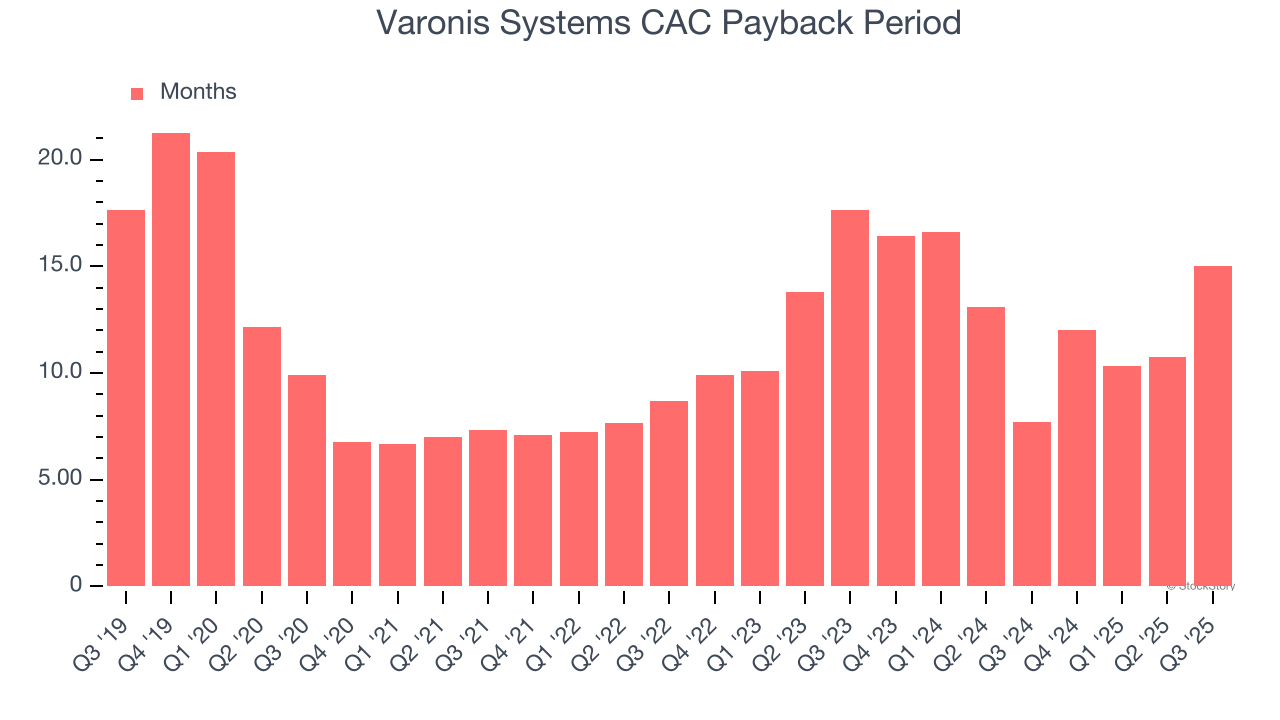

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

Varonis Systems is extremely efficient at acquiring new customers, and its CAC payback period checked in at 15 months this quarter. The company’s rapid recovery of its customer acquisition costs means it can attempt to spur growth by increasing its sales and marketing investments.

Key Takeaways from Varonis Systems’s Q3 Results

Revenue in the quarter missed, which is a bad way to start an earnings report. Full-year revenue guidance slightly missed as well, and the company lowered its full-year adjusted EPS guidance. Overall, this was a pretty bad quarter. The stock traded down 28.6% to $45 immediately after reporting.

Varonis Systems’s earnings report left more to be desired. Let’s look forward to see if this quarter has created an opportunity to buy the stock. We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.