Since May 2025, Franklin Resources has been in a holding pattern, posting a small return of 0.7% while floating around $22.36. The stock also fell short of the S&P 500’s 13.1% gain during that period.

Is there a buying opportunity in Franklin Resources, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free for active Edge members.

Why Do We Think Franklin Resources Will Underperform?

We're swiping left on Franklin Resources for now. Here are three reasons why BEN doesn't excite us and a stock we'd rather own.

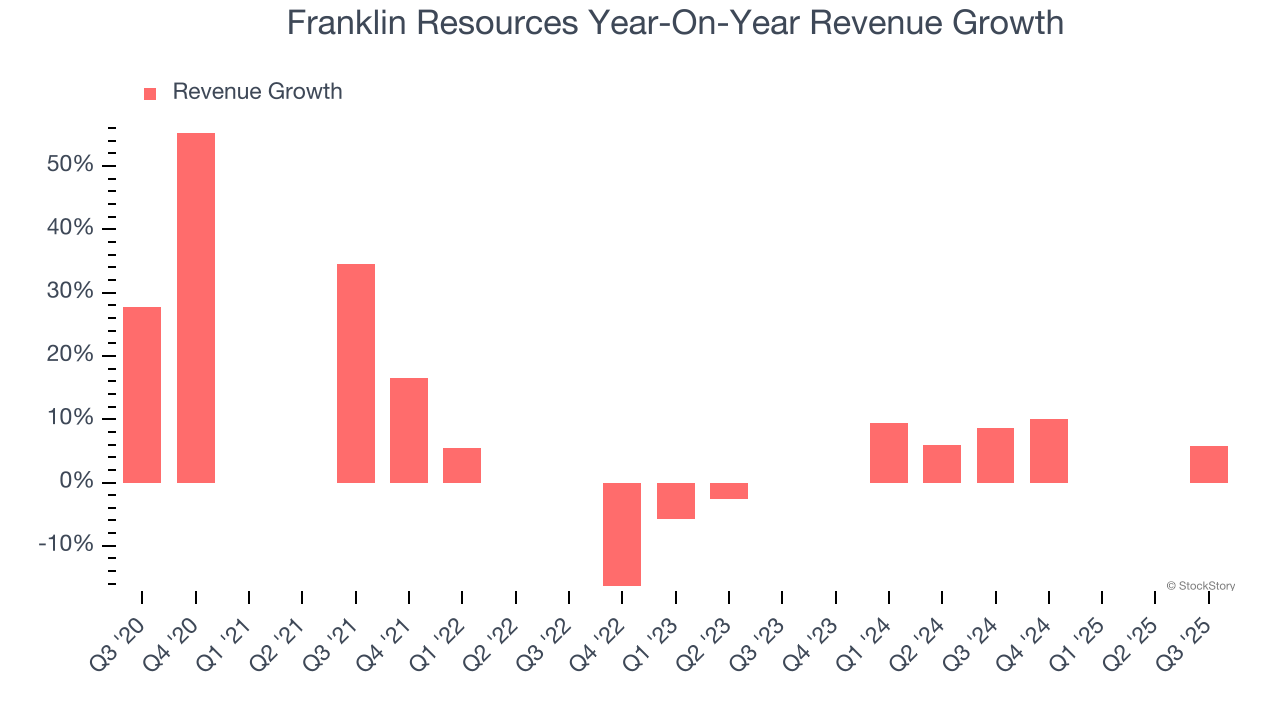

1. Lackluster Revenue Growth

Long-term growth is the most important, but within financials, a stretched historical view may miss recent interest rate changes and market returns. Franklin Resources’s recent performance shows its demand has slowed as its annualized revenue growth of 4.8% over the last two years was below its five-year trend.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

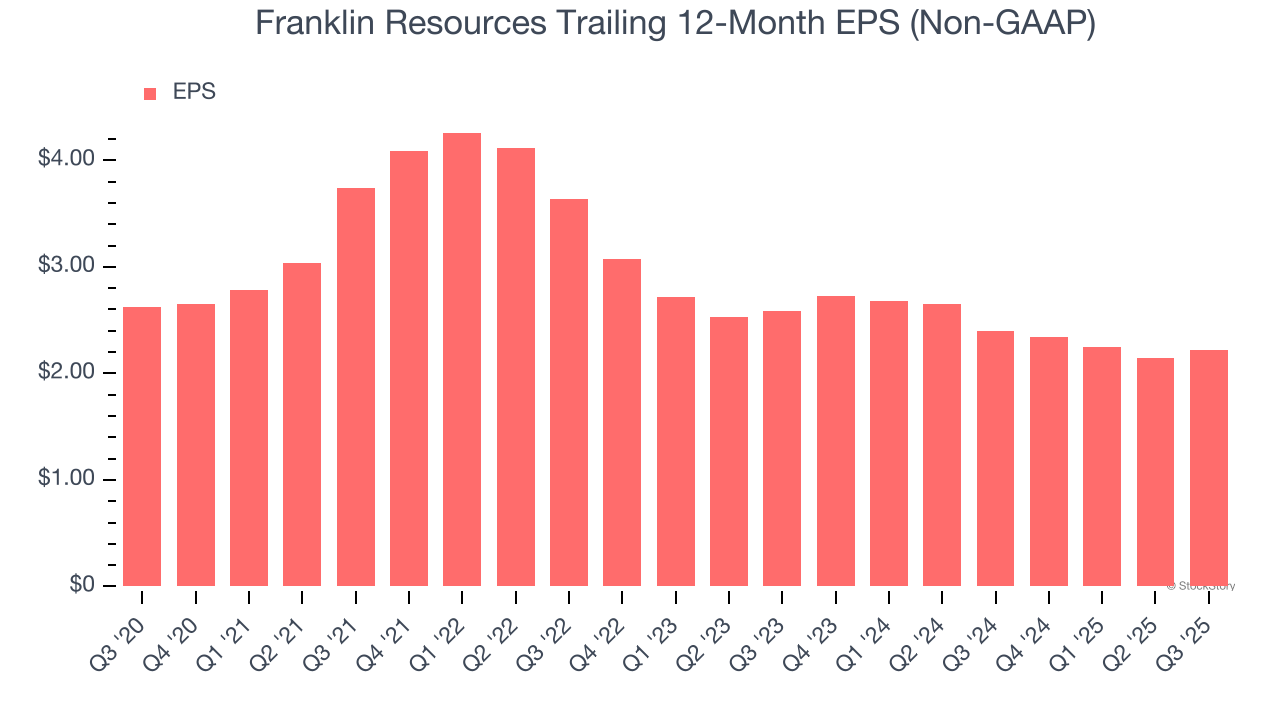

2. EPS Trending Down

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for Franklin Resources, its EPS declined by 3.3% annually over the last five years while its revenue grew by 11.6%. This tells us the company became less profitable on a per-share basis as it expanded.

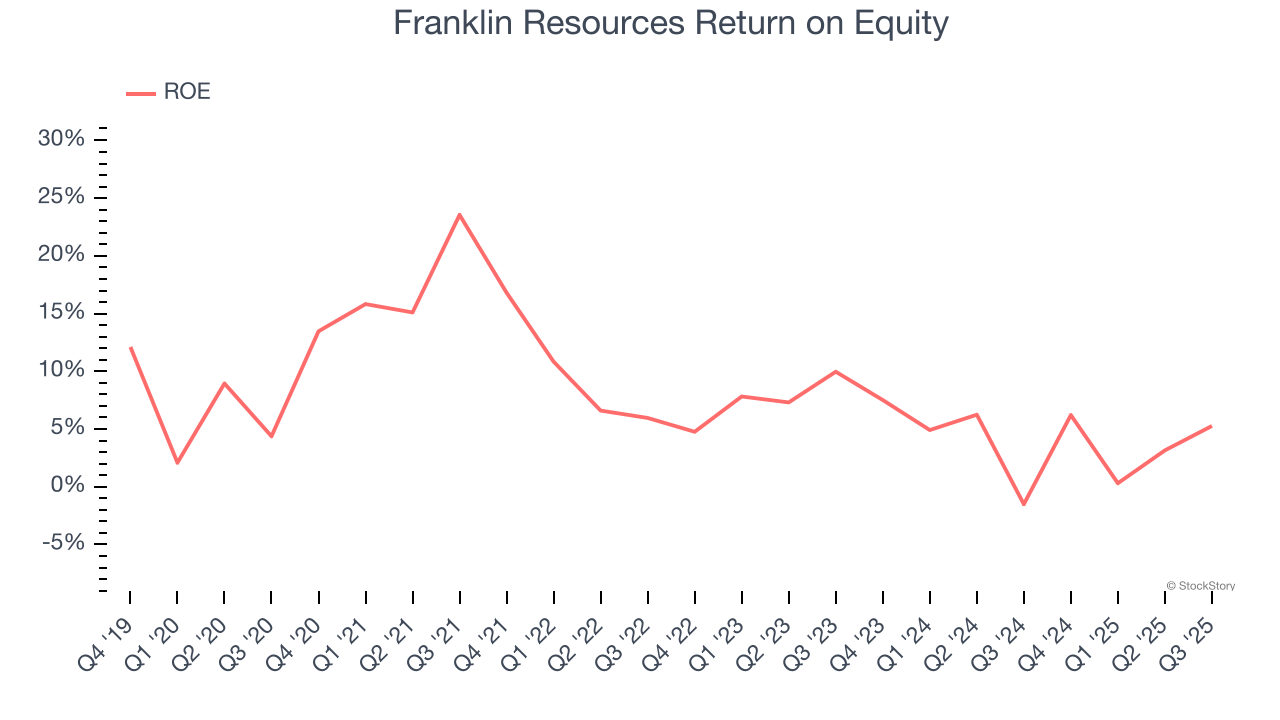

3. Previous Growth Initiatives Haven’t Impressed

Return on equity (ROE) reveals the profit generated per dollar of shareholder equity, which represents a key source of bank funding. Banks maintaining elevated ROE levels tend to accelerate wealth creation for shareholders via earnings retention, buybacks, and distributions.

Over the last five years, Franklin Resources has averaged an ROE of 8.5%, uninspiring for a company operating in a sector where the average shakes out around 10%.

Final Judgment

Franklin Resources doesn’t pass our quality test. With its shares underperforming the market lately, the stock trades at 8.6× forward P/E (or $22.36 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are more exciting stocks to buy at the moment. Let us point you toward an all-weather company that owns household favorite Taco Bell.

Stocks We Would Buy Instead of Franklin Resources

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.