Earnings results often indicate what direction a company will take in the months ahead. With Q3 behind us, let’s have a look at Shopify (NASDAQ: SHOP) and its peers.

While e-commerce has been around for over two decades and enjoyed meaningful growth, its overall penetration of retail still remains low. Only around $1 in every $5 spent on retail purchases comes from digital orders, leaving over 80% of the retail market still ripe for online disruption. It is these large swathes of the retail where e-commerce has not yet taken hold that drives the demand for various e-commerce software solutions.

The 5 e-commerce software stocks we track reported a satisfactory Q3. As a group, revenues beat analysts’ consensus estimates by 1.4% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 6.9% since the latest earnings results.

Best Q3: Shopify (NASDAQ: SHOP)

Starting with just three people selling snowboards online in 2004, Shopify (NYSE: SHOP) provides a comprehensive platform that enables merchants of all sizes to create, manage and grow their businesses across multiple sales channels.

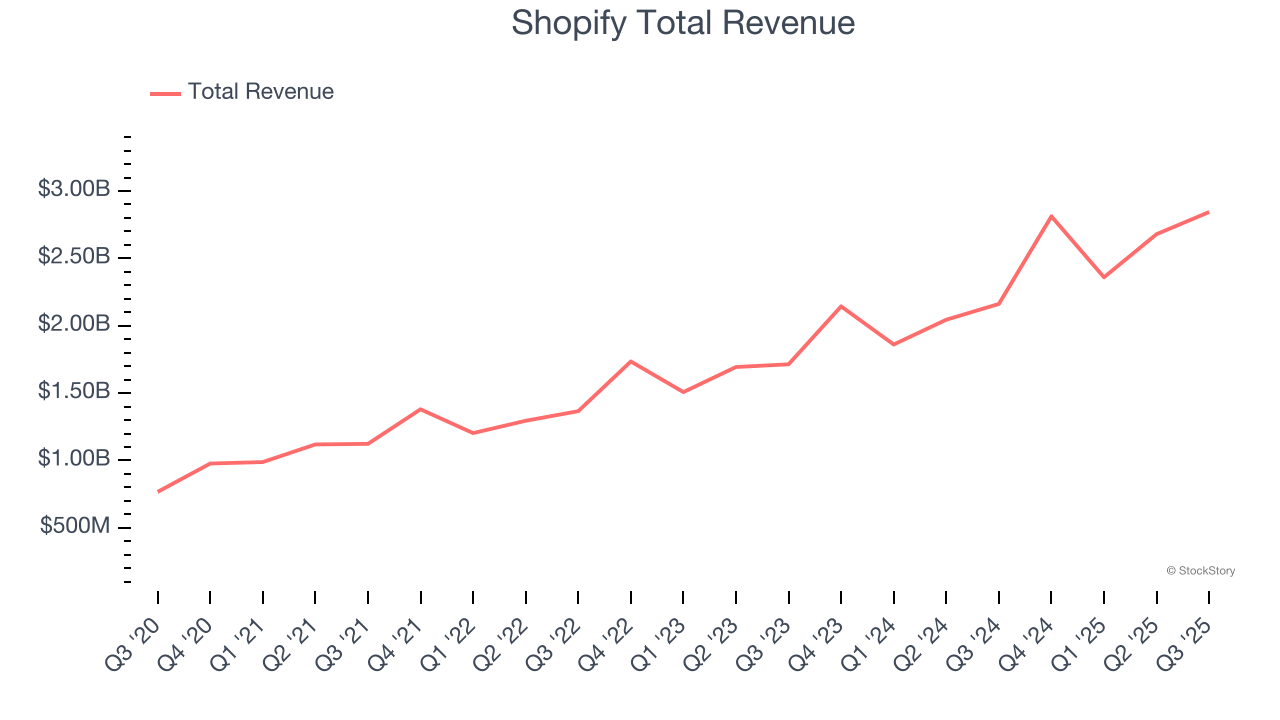

Shopify reported revenues of $2.84 billion, up 31.5% year on year. This print exceeded analysts’ expectations by 3.1%. Overall, it was a very strong quarter for the company with an impressive beat of analysts’ total payment volume estimates and a solid beat of analysts’ EBITDA estimates.

Shopify scored the biggest analyst estimates beat and fastest revenue growth of the whole group. Investor expectations, however, were likely higher than Wall Street’s published projections, leaving some wishing for even better results (analysts’ consensus estimates are those published by big banks and advisory firms, not the investors who make buy and sell decisions). The stock is down 6.7% since reporting and currently trades at $159.78.

GoDaddy (NYSE: GDDY)

Known for its memorable Super Bowl commercials that put it on the map, GoDaddy (NYSE: GDDY) is a domain registrar and web services provider that helps entrepreneurs establish an online presence through domain registration, website building, hosting, and e-commerce tools.

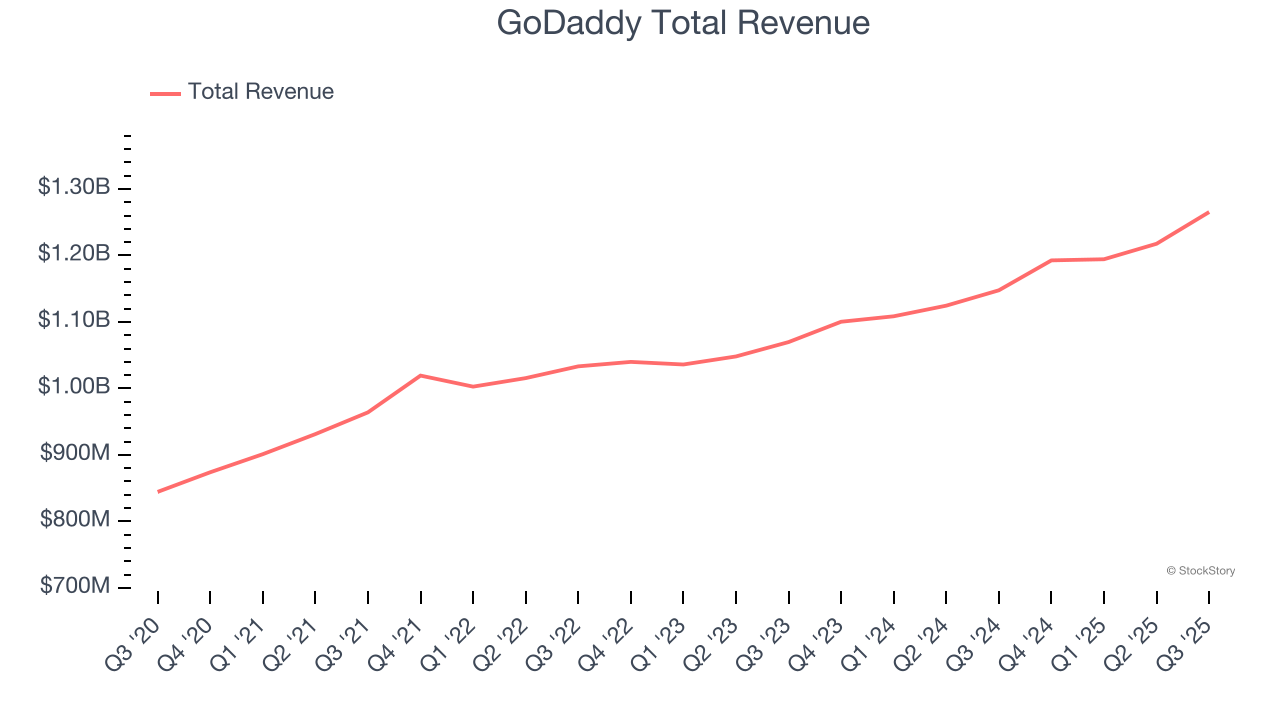

GoDaddy reported revenues of $1.27 billion, up 10.3% year on year, outperforming analysts’ expectations by 2.7%. The business had a satisfactory quarter with an impressive beat of analysts’ EBITDA estimates but revenue guidance for next quarter slightly missing analysts’ expectations.

However, the results were likely priced into the stock as it’s traded sideways since reporting. Shares currently sit at $126.78.

Is now the time to buy GoDaddy? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: Wix (NASDAQ: WIX)

Powering over 263 million registered users worldwide with its AI-driven tools, Wix (NASDAQ: WIX) provides a cloud-based platform that helps individuals and businesses create and manage professional websites without requiring coding skills.

Wix reported revenues of $505.2 million, up 13.6% year on year, exceeding analysts’ expectations by 0.6%. Still, it was a slower quarter as it posted a significant miss of analysts’ EBITDA estimates and revenue guidance for next quarter meeting analysts’ expectations.

As expected, the stock is down 26.3% since the results and currently trades at $93.46.

Read our full analysis of Wix’s results here.

Commerce (NASDAQ: CMRC)

As a founding member of the MACH Alliance advocating for modern tech standards, Commerce (NASDAQ: CMRC) provides a SaaS platform that enables businesses to build and manage online stores, connect with marketplaces, and integrate with point-of-sale systems.

Commerce reported revenues of $86.03 million, up 2.8% year on year. This print met analysts’ expectations. Aside from that, it was a mixed quarter as it also recorded a solid beat of analysts’ EBITDA estimates but revenue guidance for next quarter meeting analysts’ expectations.

Commerce achieved the highest full-year guidance raise but had the weakest performance against analyst estimates and weakest performance against analyst estimates among its peers. The stock is down 3.3% since reporting and currently trades at $4.52.

Read our full, actionable report on Commerce here, it’s free for active Edge members.

VeriSign (NASDAQ: VRSN)

As the silent guardian of the internet's roadmap, VeriSign (NASDAQ: VRSN) operates the authoritative registry for .com and .net domain names, enabling websites to be found reliably when users type web addresses.

VeriSign reported revenues of $419.1 million, up 7.3% year on year. This result surpassed analysts’ expectations by 0.5%. However, it was a mixed quarter as it underperformed in some other aspects of the business.

The stock is up 1.8% since reporting and currently trades at $255.07.

Read our full, actionable report on VeriSign here, it’s free for active Edge members.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.