Financial data provider FactSet (NYSE: FDS) reported Q4 CY2025 results exceeding the market’s revenue expectations, with sales up 6.9% year on year to $607.6 million. The company expects the full year’s revenue to be around $2.44 billion, close to analysts’ estimates. Its non-GAAP profit of $4.51 per share was 3.5% above analysts’ consensus estimates.

Is now the time to buy FactSet? Find out by accessing our full research report, it’s free for active Edge members.

FactSet (FDS) Q4 CY2025 Highlights:

- Revenue: $607.6 million vs analyst estimates of $600 million (6.9% year-on-year growth, 1.3% beat)

- Pre-tax Profit: $190.1 million (31.3% margin)

- Adjusted EPS: $4.51 vs analyst estimates of $4.36 (3.5% beat)

- The company reconfirmed its revenue guidance for the full year of $2.44 billion at the midpoint

- Management reiterated its full-year Adjusted EPS guidance of $17.25 at the midpoint

- Market Capitalization: $11.08 billion

Company Overview

Founded in 1978 when financial data was still primarily delivered through paper reports, FactSet (NYSE: FDS) provides financial data, analytics, and technology solutions that investment professionals use to research, analyze, and manage their portfolios.

Revenue Growth

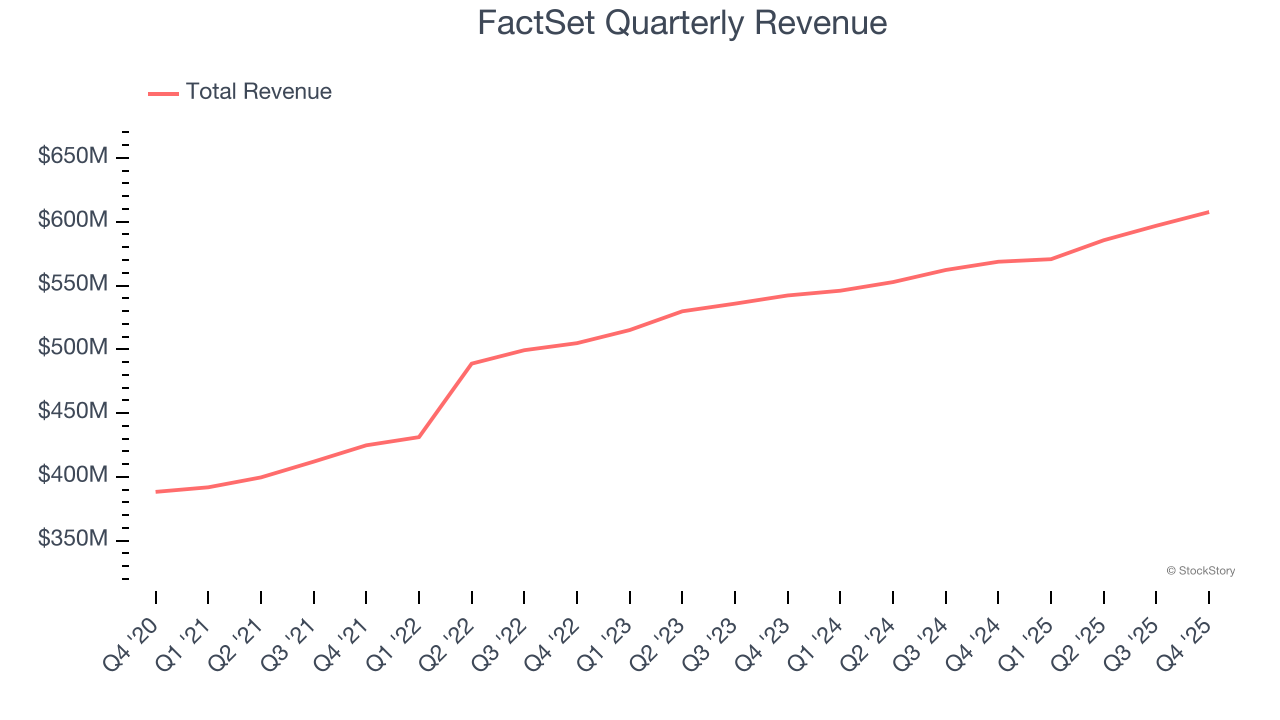

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Luckily, FactSet’s revenue grew at a decent 9.3% compounded annual growth rate over the last five years. Its growth was slightly above the average financials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. FactSet’s recent performance shows its demand has slowed as its annualized revenue growth of 5.5% over the last two years was below its five-year trend.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, FactSet reported year-on-year revenue growth of 6.9%, and its $607.6 million of revenue exceeded Wall Street’s estimates by 1.3%.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

Key Takeaways from FactSet’s Q4 Results

We enjoyed seeing FactSet beat analysts’ EBITDA expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its full-year EPS guidance slightly missed. Zooming out, we think this was a mixed quarter. The stock remained flat at $297.75 immediately following the results.

Big picture, is FactSet a buy here and now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.