Looking back on custody bank stocks’ Q3 earnings, we examine this quarter’s best and worst performers, including Affiliated Managers Group (NYSE: AMG) and its peers.

Custody banks safeguard financial assets and provide services like settlement, accounting, and regulatory compliance for institutional investors. Growth opportunities stem from increasing global assets under custody, demand for data analytics, and blockchain technology adoption for settlement efficiency. Challenges include fee pressure from large clients, substantial technology investment requirements, and competition from both traditional players and fintech firms entering the space.

The 16 custody bank stocks we track reported a strong Q3. As a group, revenues beat analysts’ consensus estimates by 5%.

Thankfully, share prices of the companies have been resilient as they are up 6.5% on average since the latest earnings results.

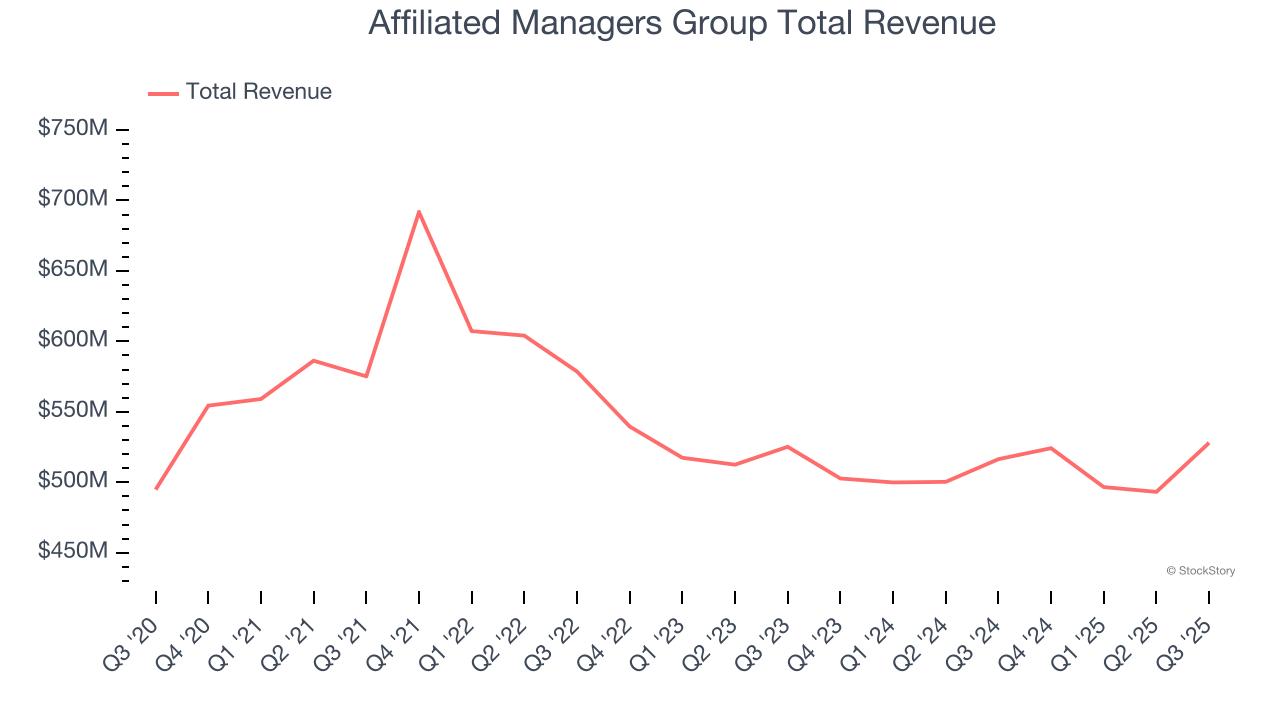

Affiliated Managers Group (NYSE: AMG)

Using a partnership approach that preserves entrepreneurial culture at its portfolio companies, Affiliated Managers Group (NYSE: AMG) is an investment firm that acquires stakes in boutique asset management companies while allowing them to maintain operational independence.

Affiliated Managers Group reported revenues of $528 million, up 2.2% year on year. This print fell short of analysts’ expectations by 1.4%. Overall, it was a mixed quarter for the company with a solid beat of analysts’ AUM estimates but a slight miss of analysts’ revenue estimates.

Affiliated Managers Group delivered the slowest revenue growth of the whole group. Interestingly, the stock is up 17.3% since reporting and currently trades at $279.03.

Read our full report on Affiliated Managers Group here, it’s free for active Edge members.

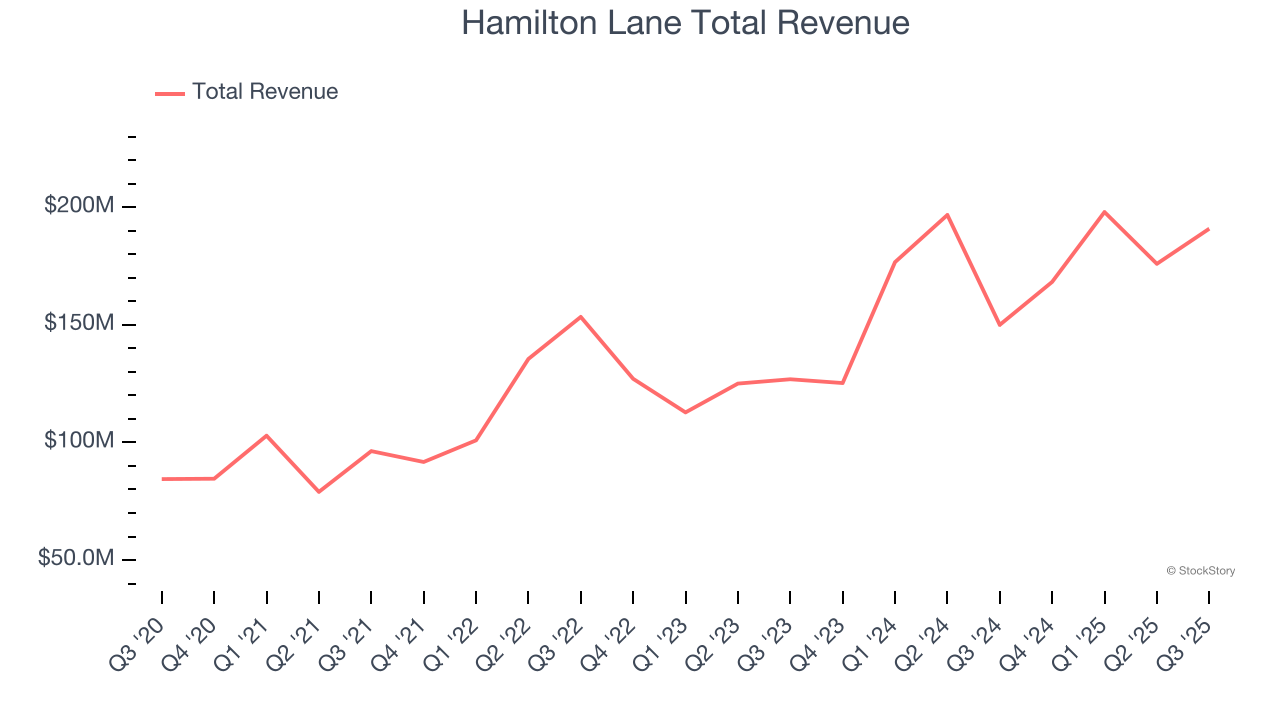

Best Q3: Hamilton Lane (NASDAQ: HLNE)

With over $100 billion in assets under management and supervision, Hamilton Lane (NASDAQ: HLNE) is an investment management firm that specializes in private markets, offering advisory services and fund solutions to institutional and private wealth investors.

Hamilton Lane reported revenues of $190.9 million, up 27.3% year on year, outperforming analysts’ expectations by 12.8%. The business had an incredible quarter with a beat of analysts’ EPS estimates and an impressive beat of analysts’ revenue estimates.

The market seems happy with the results as the stock is up 17% since reporting. It currently trades at $134.43.

Is now the time to buy Hamilton Lane? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: P10 (NYSE: PX)

Operating as a bridge between institutional investors and hard-to-access private market opportunities, P10 (NYSE: PX) is an alternative asset management firm that provides access to private equity, venture capital, impact investing, and private credit opportunities in the middle and lower middle markets.

P10 reported revenues of $75.93 million, up 2.3% year on year, falling short of analysts’ expectations by 4.5%. It was a slower quarter as it posted a significant miss of analysts’ EBITDA and management fees estimates.

P10 delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 5.6% since the results and currently trades at $9.99.

Read our full analysis of P10’s results here.

WisdomTree (NYSE: WT)

Originally founded as a financial media company before pivoting to ETF management in 2006, WisdomTree (NYSE: WT) is a financial services company that creates and manages exchange-traded funds (ETFs) and other investment products for individual and institutional investors.

WisdomTree reported revenues of $125.6 million, up 14.7% year on year. This print surpassed analysts’ expectations by 2.2%. It was a very strong quarter as it also recorded an impressive beat of analysts’ EBITDA estimates and an impressive beat of analysts’ yield estimates.

The stock is up 8.8% since reporting and currently trades at $12.60.

Read our full, actionable report on WisdomTree here, it’s free for active Edge members.

Federated Hermes (NYSE: FHI)

With roots dating back to 1955 and a pioneering role in money market funds, Federated Hermes (NYSE: FHI) is an investment management firm that offers a wide range of funds and strategies for institutional and individual investors.

Federated Hermes reported revenues of $469.4 million, up 14.9% year on year. This number topped analysts’ expectations by 5.5%. Overall, it was a stunning quarter as it also put up a beat of analysts’ EPS estimates and an impressive beat of analysts’ revenue estimates.

The stock is up 11.3% since reporting and currently trades at $52.64.

Read our full, actionable report on Federated Hermes here, it’s free for active Edge members.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.