Rush Street Interactive has been on fire lately. In the past six months alone, the company’s stock price has rocketed 92.3%, reaching $21.81 per share. This was partly thanks to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is now the time to buy Rush Street Interactive, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Why Is Rush Street Interactive Not Exciting?

Despite the momentum, we're cautious about Rush Street Interactive. Here is one reason why RSI doesn't excite us and a stock we'd rather own.

Weak Operating Margin Could Cause Trouble

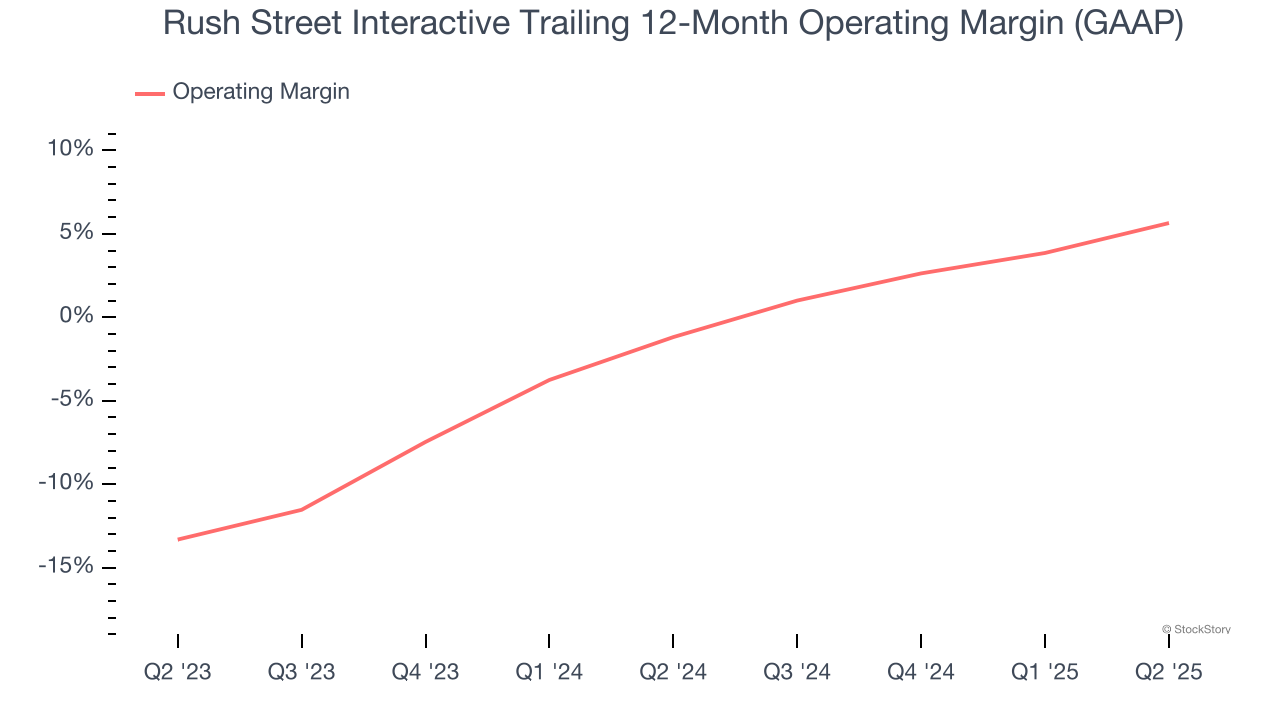

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Rush Street Interactive’s operating margin has been trending up over the last 12 months and averaged 2.6% over the last two years. The company’s higher efficiency is a breath of fresh air, but its suboptimal cost structure means it still sports lousy profitability for a consumer discretionary business.

Final Judgment

Rush Street Interactive isn’t a terrible business, but it doesn’t pass our quality test. Following the recent rally, the stock trades at 58.5× forward P/E (or $21.81 per share). This valuation tells us a lot of optimism is priced in - we think there are better opportunities elsewhere. We’d recommend looking at the Amazon and PayPal of Latin America.

Stocks We Like More Than Rush Street Interactive

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.