As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q2. Today, we are looking at footwear stocks, starting with Wolverine Worldwide (NYSE: WWW).

Before the advent of the internet, styles changed, but consumers mainly bought shoes by visiting local brick-and-mortar shoe, department, and specialty stores. Today, not only do styles change more frequently as fads travel through social media and the internet but consumers are also shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some footwear companies have made concerted efforts to adapt while those who are slower to move may fall behind.

The 8 footwear stocks we track reported a satisfactory Q2. As a group, revenues beat analysts’ consensus estimates by 2.3% while next quarter’s revenue guidance was 34% below.

In light of this news, share prices of the companies have held steady as they are up 4.8% on average since the latest earnings results.

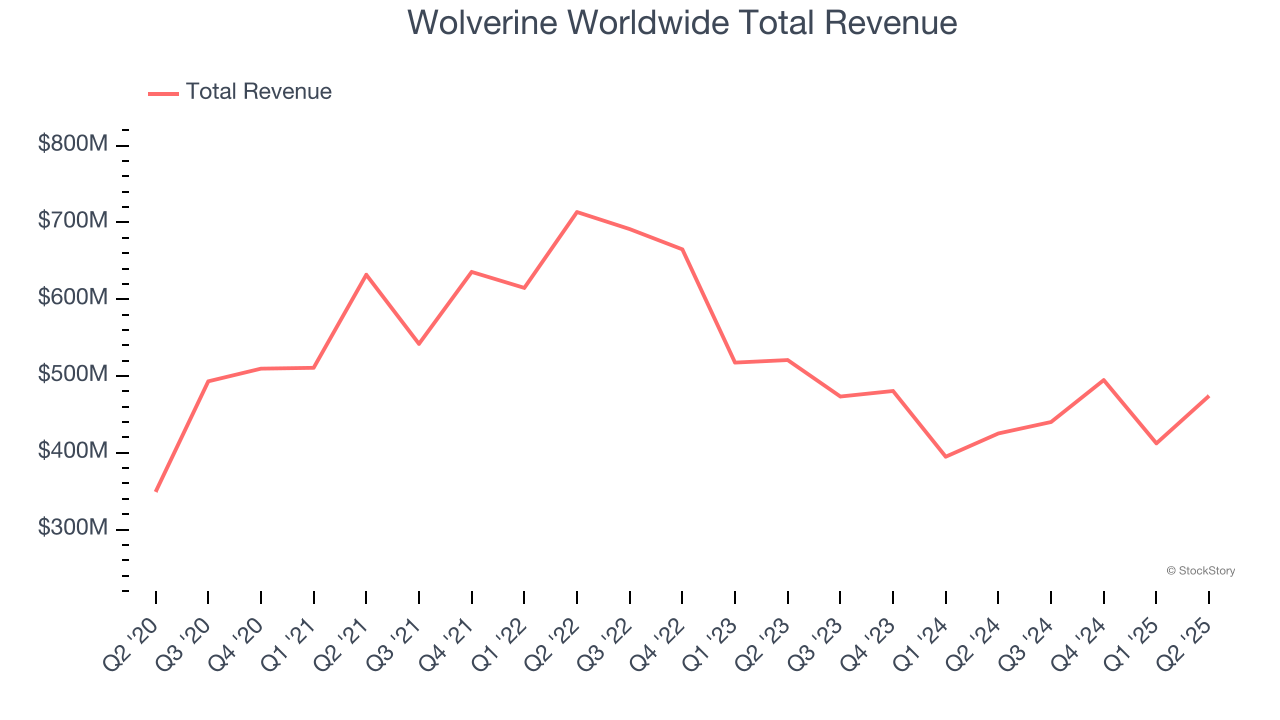

Wolverine Worldwide (NYSE: WWW)

Founded in 1883, Wolverine Worldwide (NYSE: WWW) is a global footwear company with a diverse portfolio of brands including Merrell, Hush Puppies, and Saucony.

Wolverine Worldwide reported revenues of $474.2 million, up 11.5% year on year. This print exceeded analysts’ expectations by 5.1%. Overall, it was an exceptional quarter for the company with a beat of analysts’ EPS and EBITDA estimates.

"Our second quarter results exceeded our expectations, which led to the strongest revenue growth we've seen in several years. This growth, coupled with another quarter of record gross margin, helped more than double our earnings per share year-over-year," said Chris Hufnagel, President and Chief Executive Officer of Wolverine Worldwide.

Interestingly, the stock is up 23.8% since reporting and currently trades at $29.10.

Is now the time to buy Wolverine Worldwide? Access our full analysis of the earnings results here, it’s free.

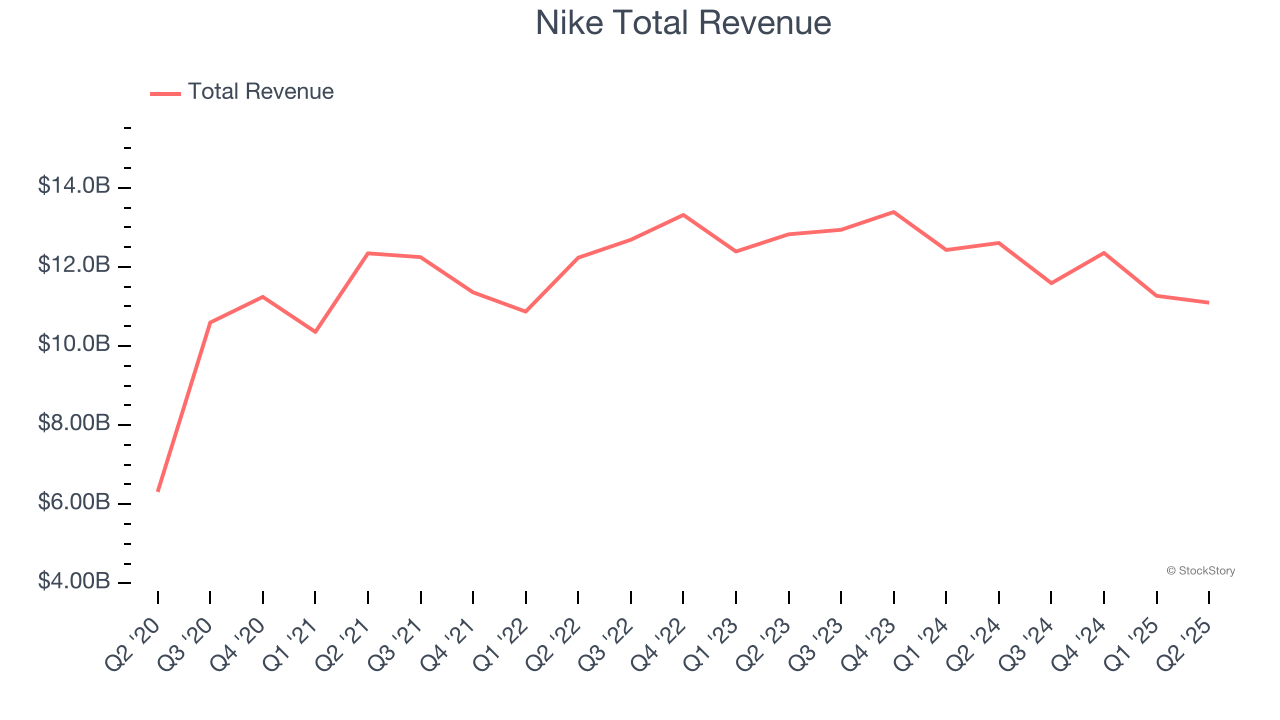

Best Q2: Nike (NYSE: NKE)

Originally selling Japanese Onitsuka Tiger sneakers as Blue Ribbon Sports, Nike (NYSE: NKE) is a global titan in athletic footwear, apparel, equipment, and accessories.

Nike reported revenues of $11.1 billion, down 12% year on year, outperforming analysts’ expectations by 3.4%. The business had an exceptional quarter with a solid beat of analysts’ constant currency revenue estimates and an impressive beat of analysts’ EBITDA estimates.

The market seems happy with the results as the stock is up 14.3% since reporting. It currently trades at $71.49.

Is now the time to buy Nike? Access our full analysis of the earnings results here, it’s free.

Slowest Q2: Caleres (NYSE: CAL)

The owner of Dr. Scholl's, Caleres (NYSE: CAL) is a footwear company offering a range of styles.

Caleres reported revenues of $658.5 million, down 3.6% year on year, in line with analysts’ expectations. It was a disappointing quarter as it posted a significant miss of analysts’ adjusted operating income estimates.

As expected, the stock is down 4.6% since the results and currently trades at $14.27.

Read our full analysis of Caleres’s results here.

Crocs (NASDAQ: CROX)

Founded in 2002, Crocs (NASDAQ: CROX) sells casual footwear and is known for its iconic clog shoe.

Crocs reported revenues of $1.15 billion, up 3.4% year on year. This result was in line with analysts’ expectations. More broadly, it was a mixed quarter as it also recorded a decent beat of analysts’ adjusted operating income estimates but a slight miss of analysts’ constant currency revenue estimates.

The stock is down 26.7% since reporting and currently trades at $77.15.

Read our full, actionable report on Crocs here, it’s free.

Skechers (NYSE: SKX)

Synonymous with "dad shoe", Skechers (NYSE: SKX) is a footwear company renowned for its comfortable, stylish, and affordable shoes for all ages.

Skechers reported revenues of $2.44 billion, up 13.1% year on year. This print beat analysts’ expectations by 3.7%. Overall, it was an exceptional quarter as it also logged a beat of analysts’ EPS estimates.

The stock is flat since reporting and currently trades at $63.17.

Read our full, actionable report on Skechers here, it’s free.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.