Let’s dig into the relative performance of Dutch Bros (NYSE: BROS) and its peers as we unravel the now-completed Q2 traditional fast food earnings season.

Traditional fast-food restaurants are renowned for their speed and convenience, boasting menus filled with familiar and budget-friendly items. Their reputations for on-the-go consumption make them favored destinations for individuals and families needing a quick meal. This class of restaurants, however, is fighting the perception that their meals are unhealthy and made with inferior ingredients, a battle that's especially relevant today given the consumers increasing focus on health and wellness.

The 13 traditional fast food stocks we track reported a satisfactory Q2. As a group, revenues beat analysts’ consensus estimates by 0.8%.

While some traditional fast food stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 2.9% since the latest earnings results.

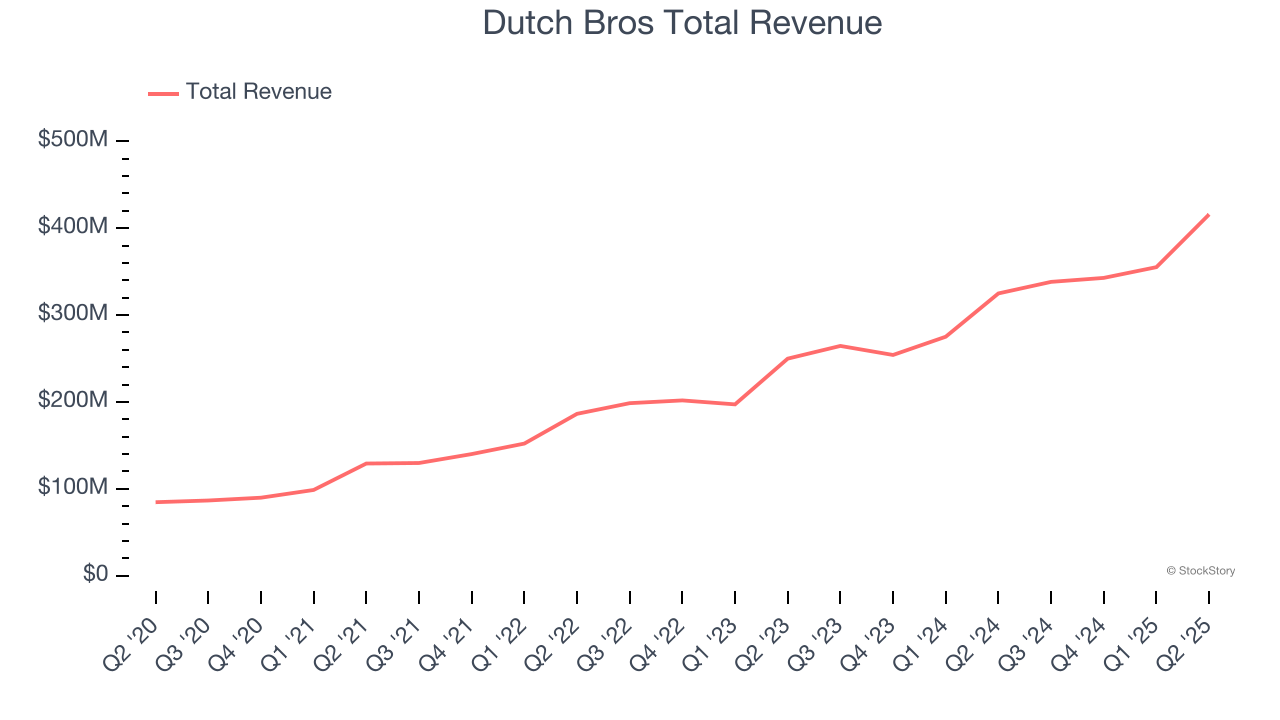

Best Q2: Dutch Bros (NYSE: BROS)

Started in 1992 by two brothers as a single pushcart, Dutch Bros (NYSE: BROS) is a dynamic coffee chain that’s captured the hearts of coffee enthusiasts across the United States.

Dutch Bros reported revenues of $415.8 million, up 28% year on year. This print exceeded analysts’ expectations by 3.1%. Overall, it was a stunning quarter for the company with an impressive beat of analysts’ EBITDA and same-store sales estimates.

Dutch Bros scored the biggest analyst estimates beat and fastest revenue growth of the whole group. Investor expectations, however, were likely higher than Wall Street’s published projections, leaving some wishing for even better results (analysts’ consensus estimates are those published by big banks and advisory firms, not the investors who make buy and sell decisions). The stock is down 4% since reporting and currently trades at $55.50.

Is now the time to buy Dutch Bros? Access our full analysis of the earnings results here, it’s free.

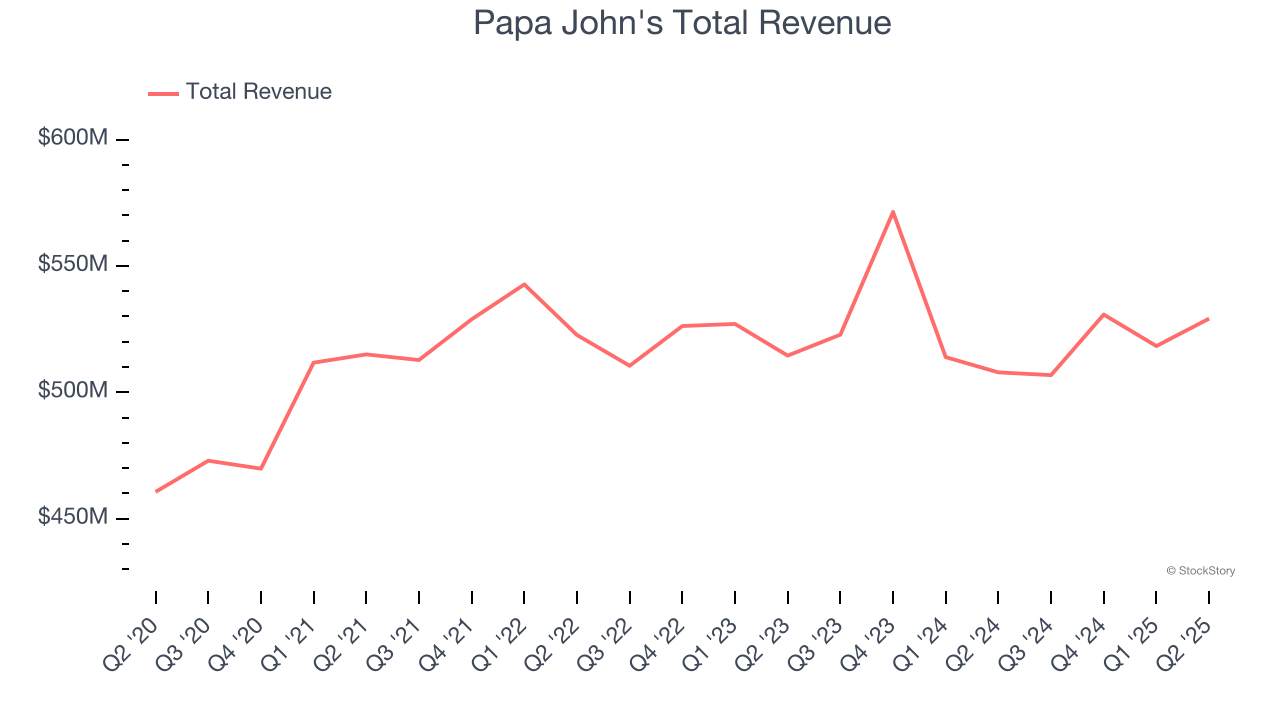

Papa John's (NASDAQ: PZZA)

Founded by the eclectic John “Papa John” Schnatter, Papa John’s (NASDAQ: PZZA) is a globally recognized pizza delivery and carryout chain known for “better ingredients” and “better pizza”.

Papa John's reported revenues of $529.2 million, up 4.2% year on year, outperforming analysts’ expectations by 2.7%. The business had a very strong quarter with a solid beat of analysts’ same-store sales and EPS estimates.

The market seems happy with the results as the stock is up 14.5% since reporting. It currently trades at $46.41.

Is now the time to buy Papa John's? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Jack in the Box (NASDAQ: JACK)

Delighting customers since its inception in 1951, Jack in the Box (NASDAQ: JACK) is a distinctive fast-food chain known for its bold flavors, innovative menu items, and quirky marketing.

Jack in the Box reported revenues of $333 million, down 9.8% year on year, falling short of analysts’ expectations by 2.1%. It was a softer quarter as it posted a miss of analysts’ EBITDA estimates and a miss of analysts’ same-store sales estimates.

Jack in the Box delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 2.3% since the results and currently trades at $18.49.

Read our full analysis of Jack in the Box’s results here.

Starbucks (NASDAQ: SBUX)

Started by three friends in Seattle’s historic Pike Place Market, Starbucks (NASDAQ: SBUX) is a globally-renowned coffeehouse chain that offers a wide selection of high-quality coffee, beverages, and food items.

Starbucks reported revenues of $9.46 billion, up 3.8% year on year. This number topped analysts’ expectations by 1.7%. Aside from that, it was a slower quarter as it recorded a significant miss of analysts’ EBITDA and EPS estimates.

The stock is down 7.8% since reporting and currently trades at $85.74.

Read our full, actionable report on Starbucks here, it’s free.

Restaurant Brands (NYSE: QSR)

Formed through a strategic merger, Restaurant Brands International (NYSE: QSR) is a multinational corporation that owns three iconic fast-food chains: Burger King, Tim Hortons, and Popeyes.

Restaurant Brands reported revenues of $2.41 billion, up 15.9% year on year. This result surpassed analysts’ expectations by 2.9%. Overall, it was a strong quarter as it also recorded same-store sales in line with analysts’ estimates.

The stock is down 6.2% since reporting and currently trades at $64.35.

Read our full, actionable report on Restaurant Brands here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.